The Hermitage fraud became an international cause célèbre after the death in custody of Browder’s lawyer, Sergei Magnitsky. Keystone High-profile Kremlin critic and investor Bill Browder has threatened Credit Suisse and UBS with legal action for breaching US sanctions if they unfreeze accounts belonging to three Russian clients accused of a huge tax fraud against his investment company. The two Swiss banks hold assets worth more than $24 million (CHF21.8 million),...

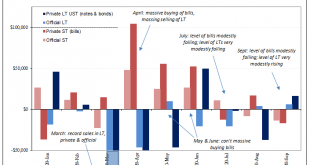

Read More »Just Who Is, And Who Is Not, Selling T-Bills

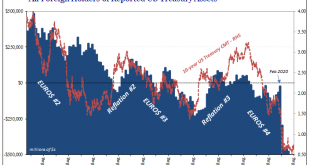

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral. Best collateral means OTR, and for standard practice this had always meant Treasury bills (as well as, noted yesterday, bonds and notes just auctioned off). According to...

Read More »Ramon Ray’s Entrepreneurial Communities

“Small business” is just a government classification. Entrepreneurial businesses serving well-defined communities via creative specialization exhibit enormous economic productivity, energy and dynamism. Such businesses can not be defined quantitatively as small, medium or large. They’re defined by their qualitative impact on their customers’ lives. Entrepreneurial businesses care differently, and care more. Big businesses must pay attention to size and scale, to...

Read More »French blockchain firms offer tracing for Swiss watches

The online purchase of a second-hand luxury watch is becoming ever more popular. Andrew Poplavsky The market for second-hand luxury watches is booming. But for the average consumer, it is not easy to tell a fake from the genuine article and determine the real value of a particular timepiece. Certificates based on blockchain technology could provide more transparency. Watch fans who want to get the new diving watch by Rolex had better be patient. The official...

Read More »Life as an expat in Swiss cities: the good news and the less good news

From tip-top transport in Basel to housing headaches in Geneva, foreign residents share what they love and loathe about the four Swiss cities featured in the Expat City Ranking 2020. Of the 66 cities in the latest list, published by InterNations on Thursday, Basel rates highest (24th), ahead of Lausanne (28th), Zurich (37th) and Geneva (48th). The Expat City Ranking 2020 The Expat City Ranking is based on the annual Expat Insider survey by InterNations, a global...

Read More »Treasury Auctions Are Anything But Sorry Because They’ve Never Been Sorry About Solly

Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on auctions as the sole...

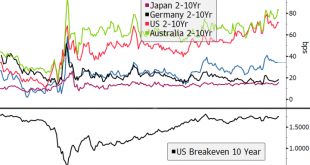

Read More »Dollar Consolidates Ahead of Thanksgiving Holiday

The divergence in developed markets yield curves continues; the dollar is consolidating ahead of the US holiday FOMC minutes will be released; weekly jobless claims data will be released a day early; October personal income and spending will be reported; Banco de Mexico releases its quarterly inflation report UK Chancellor Sunak’s spending review will lay out his plans for next year; South Africa reported higher than expected October CPI Japan’s Cabinet Office...

Read More »2021 Would Be a Great Time to Audit the Fed

Gone are the days of the Federal Reserve hiding in the shadows. Now it’s a woke central bank fighting for climate and racial justice. Progressives must not fall for this but instead team up with the populist right to audit the Fed and demand transparency. Let the healing begin! If it is going to be President Joe Biden a couple months from now, then there will be all the more incentive for antiestablishment Democrats to join forces with populist Republicans. What...

Read More »FX Daily, November 27: Dollar Offered Ahead of the Weekend

Swiss Franc The Euro has risen by 0.19% to 1.0814 EUR/CHF and USD/CHF, November 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are finishing the week on a firm tone, while the US dollar remains heavy. In the Asia Pacific, only Australia and India did not end the week on a firm note. The MSCI Asia Pacific completed its fourth consecutive weekly gain, for around a 13% gain. Europe’s Dow Jones Stoxx...

Read More »Die staatlichen Corona- und Klimamaßnahmen können wissenschaftlich nicht begründet werden

[Dieser Beitrag wurde unter dem Titel „Umwelt- und Katastrophen-Meme im Dienste des Interventionismus“ auf der Jahreskonferenz 2020 des Ludwig von Mises Instituts Deutschland vorgetragen.[1] Das Thema der Konferenz lautete „Wie der Markt Umwelt und Ressourcen schützt“. Den Videobeitrag finden Sie hier.] Mit meinem Beitrag betrachtete ich den Aspekt, dass der staatliche Interventionismus, also der zwangsweise Eingriff des Staates in den ansonsten freiwilligen...

Read More » SNB & CHF

SNB & CHF