Credit Suisse is preparing to sell parts of its Swiss domestic bank as it attempts to close a capital hole of around CHF4.5 billion, according to people briefed on the discussions. With less than two weeks until the lender is due to present plans for a radical strategic revamp, executives are also in the final stages of plotting a heavy round of job cuts, which could affect up to 6,000 of the group’s 50,000 global employees. Ulrich Körner was installed as Credit...

Read More »Relai Partners Checkout.com to Enable Instant Bitcoin Purchases

Swiss Bitcoin investment app Relai has partnered with global payments provider Checkout.com to enable its users to buy the cryptocurrency via Visa, Mastercard and Apple Pay in real time through its self-custodial wallet. The partnership with Checkout.com is expected to allow users to have constant access to instant liquidity while also ensuring that they have full say over what happens to their assets. Founded in 2020, Relai currently serves over 40 countries in...

Read More »Market Currents: Fed Confusion

The Federal Reserve seems confused about its role in inflation and unemployment. Alhambra’s Steve Brennan and Joe Calhoun discuss it. [embedded content] [embedded content] Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Inflation is about money and that means and has meant eurodollar, not the Federal Reserve.

It may seem like semantics or splitting hairs. Who cares how or why consumer prices have accelerated? History, however, shows there's a nontrivial at times massive difference between the two. So, let's diagram and examine the history to see if we can find something useful out of it. Spoiler: we can. Eurodollar University's Money & Macro Analysis Twitter: https://twitter.com/JeffSnider_AIP https://www.eurodollar.university https://www.marketsinsiderpro.com...

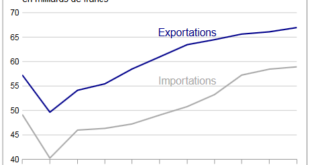

Read More »Swiss Trade Balance 3nd quarter 2022: foreign trade remains in rise

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »The yen isn’t Japan’s problem, it is everyone’s problem. Because this crash isn’t the Fed.

Japan's yen like China's yuan is being pummeled by the dollar. Most people are led to believe the dollar is rising because of the Fed and its rate hikes. No sir. In fact, in just three charts we can easily show both why JPY is crashing and also how the Fed has nothing to do with it. And that's actually the most frightening part. https://www.youtube.com/channel/UCrXNkk4IESnqU-8GMad2vyA Eurodollar University's Money & Macro Analysis Twitter: https://twitter.com/JeffSnider_AIP...

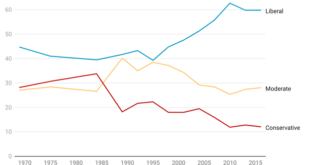

Read More »Higher Education in Crisis: The Problem of Ideological Homogeneity

In my second article on the college problem, I discussed the public policy factors that contribute to the rising cost of higher education. But politics makes its way into education through more than public policy, as professors bring their political views into their classrooms and research. Nothing has contributed more to my personal disillusionment with higher education than seeing the extent to which the ideological problem has affected the university system. At...

Read More »Currency and Bond Markets Challenge the Bank of Japan

Overview: Asia Pacific equities were mixed as the China, Hong Kong, Taiwan, and South Korean markets, among the large markets were unable to gain in the wake of a solid performance in the US. Europe is also struggling to maintain the upside momentum that has lifted the Stoxx 600 for the past four sessions. It is nearly flat as this note is penned. US futures are firm. Benchmark bond yields are higher, and the 10-year US Treasury yield is edging above 4.05%. European...

Read More »Credit Suisse pays $495 million to settle legacy case

The Swiss bank said it had reached a final settlement with the New Jersey Attorney General © Keystone / Michael Buholzer Credit Suisse has agreed to pay $495 million (CHF496 million) to settle a case brought against it in the United States, the latest pay-out related to past blunders that have battered the Swiss bank’s reputation. Credit Suisse said it would make the pay-out to settle claims brought by the New Jersey Attorney General related to the bank’s...

Read More »Geneva taxi drivers strike in protest of Uber

Uber’s activities in Switzerland have sparked legal disputes. © Keystone / Christian Beutler Dozens of taxi drivers staged a strike in Geneva to protest a decision by the authorities to allow the ride-hailing company to resume business in the Swiss city. The strike follows months of dispute and failed negotiations over the conditions of Uber drivers and the legal status of the American company. On Friday, the Geneva authorities decided to suspend a ban on Uber...

Read More » SNB & CHF

SNB & CHF