Overview: The re-emergence of bank stress reverberated through the US markets yesterday, downgrading the perceived chances of a Fed hike next week and sending the US 2-year yield sharply lower. The yield settled 13 bp lower, the largest drop in three weeks. The risk-off sent the US dollar higher against most of the major and emerging market currencies. Follow-through US dollar gains today has been mostly limited to the Australian dollar, where after today's CPI...

Read More »User Authentication Enters New Era, Enabled by Biometrics, Blockchain, AI

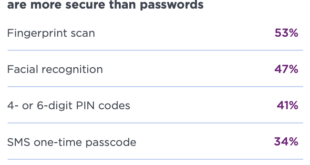

Technological advancements, including biometrics, blockchain, encryption and artificial intelligence (AI), are fueling the advent of more efficient and secure authentication mechanisms. New methods and trends including passworldless authentication are already seeing significant traction from customers, which perceive them as not only more convenient than traditional authentication methods but also more reliable, a study by Entrust, an authentication specialist,...

Read More »Why Fox Fired Tucker: BlackRock, Replacement Theory, and the ADL

Why did Fox News fire Tucker Carlson? Some claim that Tucker had planned to leave the network all along, and merely resigned. He had even had a studio built in his own home. He was fed up with Fox and decided to call it quits, so the story goes. But this theory is belied by the fact that Tucker’s production team was taken entirely by surprise by the news. For instance, I received the following text message from Scooter Downey, a producer of Tucker Carlson Originals,...

Read More »Invading Mexico in the Name of the Drug War Is a Really Bad Idea

Sen. Lindsey Graham recently called for US military intervention in Mexico to fight the drug cartels. Someone needs to remind him that Mexico is a sovereign country. Original Article: "Invading Mexico in the Name of the Drug War Is a Really Bad Idea" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »Government Budget Deficits Cannot Stimulate True Economic Growth

Keynesian economists say that during an economic slump, the government must run large budget deficits in order to keep the economy going. In contrast, Austrian economists maintain that increased budget deficits are usually monetized, leading to general price increases. Therefore, from this perspective, the government should avoid increasing budget deficits and instead balance the budget. Government Spending Takes Resources from Wealth Generators Governments do not...

Read More »Canada’s Legal Counterfeiting Ring Is a Product of Progressive Democracy

In 1934, at the behest of Prime Minister R.B. Bennett and with the approval of Parliament, Canada’s central bank, the Bank of Canada (BOC), was founded. It began operations in 1935. Its job is “to promote the economic and financial welfare of Canada.” It is now 2023, and more than half of Canadians are living hand to mouth, a trend that has been well established for many years. How much longer do we have to wait for the BOC to do its job? The BOC continues to operate...

Read More »The Ukraine War Isn’t about Democracy. It’s about States Seeking More Power.

Writing for The Volokh Conspiracy, hosted by Reason magazine, George Mason University law professor Ilya Somin argues that the war in Ukraine amounts to a clash between liberal democracy and authoritarian nationalism and that these stakes must be taken into account when continuing to support Ukraine. Somin argues that the ideology of the winning side in a war receives a boost, pointing to the rise and then fall of fascism and communism. These examples are lacking, to...

Read More »Boeing 737 MAX Disasters’ Root Cause Was Government Regulation

When the Boeing 737 MAX had two crashes, the usual suspects called for more regulation. It turns out that the crashes were due more to regulatory failure than anything else. Original Article: "Boeing 737 MAX Disasters' Root Cause Was Government Regulation" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »Ukrainian refugees go to school in Switzerland

In this short video, we meet a group of Ukrainian refugees who are going to school in Switzerland. The refugees are looking forward to integrating into Swiss society and learning a new language. Swiss schools are famous for their integration policies, which make it easy for refugees to learn the language and culture of Switzerland. This video shows how the refugees are getting to grips with their new school and how they're preparing to continue their education in Switzerland. Since the...

Read More »Yen: Short Overview

The yen is off about 1% this month to bring the year-to-date decline to about 2.4%. It fell by 12.2% in 2022 and 10.3% in 2021. The yen rallied against the dollar for the five preceding years. Over that five-year period the dollar fell from around JPY124 to JPY99, but it was all done in H1 16, and after a rally at the end of 2016 and very early 2017 (to about JPY118.65), the dollar ground down around JPY101. This year’s dollar low was set in mid-Jan near JPY127.25...

Read More » SNB & CHF

SNB & CHF