Technocrats frequently pressure the US government to increase R and D as a strategy to upstage China. The assumption is that public R and D will lead to innovation and economic growth because research generates the science that spurs innovation. Yet the formula is mistaken, for history has shown that science often lags technology. Innovations prior to the advent of modern science in Europe occurred without crucial advancements in scientific knowledge. But this does...

Read More »Committing Domestic Violence against Men . . . Just for a Giggle

Domestic violence is a stain on society, but it is worse if we only care about violence committed against people of one sex. Original Article: "Committing Domestic Violence against Men . . . Just for a Giggle" [embedded content] Tags: Featured,newsletter

Read More »The Saudi-China-Iran Partnership Creates a New Middle East

Ryan and Zack look at how China, Iran, and Saudi Arabia are reshaping the Middle East into a region where the United States no longer dominates. This is a good thing for ordinary Americans. Additional Resources "Thanks to Sanctions, the US Is Losing Its Grip on the Middle East" by Ryan McMaken: Mises.org/WES_11_A "The Petrodollar-Saudi Axis Is Why Washington Hates Iran" by Gary Richied: Mises.org/WES_11_B "Peace is Breaking Out in the Middle East… and...

Read More »Econometric Models Cannot Fulfill the Role of an Economics Laboratory

Many economists believe that economics must emulate the physical sciences with controlled experiments to be credible. Econometric models, they claim, can fulfill the role of laboratory experiments. Through mathematical and statistical methods, an economist supposedly establishes relationships between various economic variables. For example, personal consumer outlays are related to personal disposable income and the interest rates, while capital expenditure is...

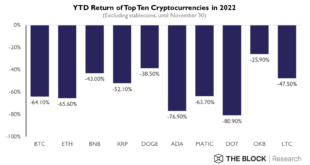

Read More »Formula 1 Sponsorship Deals with Blockchain Companies Shrink Amid Crypto Scandals and Bear Market

After a buoyant year 2022, sponsorship deals with blockchain and cryptocurrency companies for the Formula One (F1) race are shrinking this year on the back of high-profile collapses and turbulent markets. A Bloomberg analysis found that while all teams had at least one crypto-native sponsors in 2022, that proportion declined to 70% this year, as of June. The trend suggests that F1 may be re-evaluating its ties with the crypto industry amid the FTX scandal and a...

Read More »How Capitalism Redefined Masculine Virtue

One of the main fronts in the current culture war in the United States is the debate over "masculinity." Certain corners of the Left tell us that "toxic masculinity" is a terrible thing. Yet, it's often unclear whether masculinity is itself necessarily toxic, or if toxic masculinity is just one type of masculinity. How masculinity is defined is essential to the debate, and every pundit wants to define it his or her own way. Thus, David French, in his May 28...

Read More »Thanks to Sanctions, the US Is Losing Its Grip on the Middle East

While the US ratchets up efforts to isolate its many enemies, the Chinese, the Saudis, the Arab League, and OPEC all shrug and look to increasing international communication and trade. Original Article: "Thanks to Sanctions, the US Is Losing Its Grip on the Middle East" [embedded content] Tags: Featured,newsletter

Read More »Environmentalism and the Immoral Low Ground

Last month, the Biden administration’s Environmental Protection Agency proposed new power plant regulations that would put harsh limits on the amount of carbon dioxide released while producing electricity. This comes from the same administration pushing to electrify all parts of daily life, from driving to cooking. As if slamming the power grid with artificial demand is not enough, now the federal government has also set its sights on electricity suppliers. Policies...

Read More »Living by a Premise

More than forty years ago, Leonard Read urged graduates of Hillsdale College to find a premise, a belief in a universal idea of liberty. Original Article: "Living by a Premise" [embedded content] Tags: Featured,newsletter

Read More »RBA Surprises with a Quarter-Point Hike and German Factory Orders Disappoint

Overview: The Reserve Bank of Australia surprised many with a quarter-point hike and German factory orders unexpectedly fell. Reports suggest that China has asked banks to cut deposit rates. The next result is the Australian dollar is the strongest currency in the G10 and helped lift the Canadian dollar ahead of the Bank of Canada meeting tomorrow. Australian stocks sold off (~1.2%) while large markets outside of China rose in the region. Europe's Stoxx 600 is...

Read More » SNB & CHF

SNB & CHF