SNB will soon cut the guide rate, will it go negative again in 2025? Keystone-SDA Listen to the article Listening the article Toggle language selector...

Read More »Hunter Biden Is Evil—and So Is Joe

The unusually extensive “pardon” by lame-duck “President” Biden has been much in the news lately, but the pardon is not the main issue we should be interested in. The real issue is that the Bidens, both father and son, are evil. Hunter’s Biden’s “lost” laptop—which 501 “security professionals” falsely claimed was a Russian fake —reveals warmongering brazen in its duplicity.Concerning the pardon, only this need be said. Of course no one should be prosecuted for tax...

Read More »US Dollar tries to keep gains for a fourth straight day despite flat CPI

The US Dollar sees earlier gains cut in half after inflation for November falls in line of expectations. Traders boost bets for a last rate cut next week from the Fed. The US Dollar Index (DXY) is trading around 106.50 and fails to jump higher. The US Dollar (USD) is holding on to minor gains on Wednesday after the US Consumer Price Index (CPI) came broadly in line of expectations. No real outliers with the Monthly Headline Inflation coming...

Read More »“THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Share this article DR. THORSTEN POLLEIT (WWW.BOOMBUSTREPORT.COM) INTERVIEWS CLAUDIO GRASS Thorsten Polleit (TP): On November 5, 2024, Donald J. Trump was elected the new U.S. president with a landslide victory. His declared goal is to take on the “Deep State” and its bureaucracy. His advisor, Elon Musk, is urging the reduction of national debt, and even the inflationary Federal Reserve (Fed) has become a target, described as an evil that must be healed. Is all...

Read More »The Real Scandal of Hunter’s Pardon

Politicians and pundits spent much of last week commenting on President Biden’s pardon of his son Hunter for lying on a federal gun purchase form, failing to pay taxes, and any other offenses he may have committed over the past decade. Much of the controversy is because President Biden repeatedly pledged that he would never pardon his son.Some have also observed that the pardon’s timeline starts the year Hunter Biden joined the board of the Ukraine energy company...

Read More »The Pretense of Knowledge

[Today is the fiftieth anniversary of Friedrich A. Hayek’s Nobel Prize Lecture, delivered at the ceremony awarding him the Nobel Prize in economics in Stockholm, Sweden, December 11, 1974. This lecture, along with “A Free-Market Monetary system,” can be found here in book form.]The particular occasion of this lecture, combined with the chief practical problem which economists have to face today, have made the choice of its topic almost inevitable. On the one hand the...

Read More »Can Trump Save the Dollar?

During his 2024 presidential campaign Donald Trump repeatedly and in grave terms highlighted the possibility of the US dollar losing its world reserve currency status. This occurred at summits with business leaders at the New York and Chicago Economic Clubs.Trump occupies a rather unique position in this debate since he recognizes the real possibility of the dollar losing its world currency status, he opposes this change and wishes to prevent it, and yet he is not a...

Read More »Progressivism and the Murder of a Health Insurance CEO

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

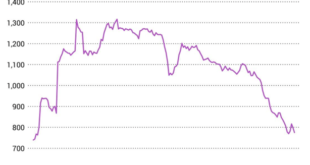

Read More »China Is No Longer The Marginal Buyer Of Oil

From 2010 through 2022, the US Energy Information Administration (EIA) calculates that global oil demand grew by 10 million barrels per day (Mb/d). Over 60% of the demand growth was due to China's phenomenal economic growth. For context, American demand increased by less than 10%. The graph below shows that China once drove global oil demand, but that is no longer true. Given the impact oil prices have on inflation, this is an essential macroeconomic factor to...

Read More »MicroStrategy And Its Convertible Debt Scheme

MicroStrategy (MSTR) stock is soaring alongside Bitcoin. In the wake of extreme confidence, we fear many MicroStrategy investors fail to grasp the inherent risks with its unique convertible bond funding and leverage scheme. A recent podcast featuring Tom Lee presented some positive facts about MicroStrategy's recent convertible bond offering but failed to tell the whole story. Left out of Tom Lee's enthusiastic outlook is that the "novel strategy" can also bankrupt...

Read More » SNB & CHF

SNB & CHF