What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Who Ultimately Pays the Cost of Protective Tariffs?

It is a benefit of sound economic theory that it proves very useful in the refutation of popular fallacies and misconceptions about the workings of the market economy. One such fallacy is the assertion that government interventions through protective tariffs are without negative consequences for the people of the imposing country. Politicians and statesmen have employed these talking points to earn the support of the majority of the voting masses who are mostly...

Read More »Rosso’s Top 2025 Reads and Holiday Gift Idea.

As most know, books are my passion. For me, it's all about gifting knowledge for the holiday season. There's nothing more exciting to me than to peruse used book outlets and antique stores that sell ancient reads for pennies on the dollar. Also, new book releases excite me. My reading topic interests vary. However, most tend to be business or macroeconomic trend related. With that: Here are my top reads for 2025 and holiday gift idea for all the voracious...

Read More »Swiss National Bank lowers key interest rate by 0.5%

SNB lowers key interest rate by 0.50 percent Keystone-SDA Listen to the article Listening the article Toggle language selector...

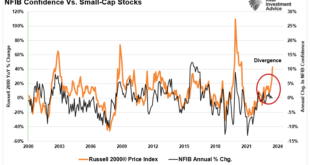

Read More »CPI Was On The Screws: The Fed Has The Green Light

Yesterday's CPI report was seemingly the last hurdle for the Fed to cut interest rates. With the CPI index matching Wall Street forecasts, the Fed Funds futures market now implies a 97% chance the Fed will cut rates next Wednesday. The data was OK but elicits fears that the downward price progress has stalled. The CPI rate was 0.3%, a tenth higher than last month. The year-over-year rate rose from 2.6% to 2.7%. Core CPI was +0.3% monthly and +3.3% annually. The...

Read More »Swiss fintech Leonteq has profits confiscated after regulatory breach

Finma closes proceedings against Leonteq and confiscates profits Keystone-SDA Listen to the article Listening the article Toggle language selector...

Read More »Swiss minister flirts with inheritance tax idea

Baume-Schneider flirts with inheritance tax in favor of AHV Keystone-SDA Listen to the article Listening the article Toggle language selector...

Read More »The USS Liberty and America’s Greatest “Ally”

The recent destruction of the Syrian regime, replaced by Islamists and Jihadists, reminds us that the American foreign-policy establishment in Washington continues to do the bidding of the State of Israel which exerts its influence through one of the most well-funded and extensive lobbying efforts Washington has ever known. The surreptitious alliance of terrorist Syrian Rebels, Israelis, and Americans, is just the latest manifestation of this working...

Read More »No, A Continuing Resolution Is Not a Stopgap

Congress recently passed a “continuing resolution” to avoid a government shutdown. We are good to go now. Government agencies may continue to operate while Congress tries to agree on the actual budget for the 2025 fiscal year that started on October 1st.A continuing resolution (CR) is commonly called a “stopgap.” In fact, a Google search yields almost no other modern uses of the term. But is “stopgap” an appropriate term for this thing?Modern dictionaries define...

Read More »Provoked: The Long Train of Abuses that Culminated in the Ukraine War

[Provoked: How Washington Started the New Cold War with Russia and the Catastrophe in Ukraine, by Scott Horton, The Libertarian Institute, 2024; 690 pp.]“A fox knows many things, but a hedgehog knows one big thing.” Scott Horton is the liberty movement’s foreign policy hedgehog, endeavoring to convince the American public of one essential truth: the folly of war. But within that sphere, Horton is a fox, weaving an encyclopedic knowledge of various conflicts into an...

Read More » SNB & CHF

SNB & CHF