The foreign exchange market is unusually calm. The US dollar is little changed against currencies. While the selling pressure that took sterling below $1.39 and the euro below $1.10 has subsided, neither has been able sustain upticks. The euro rose to $1.1040 before sellers re-emerged. Sterling was capped near $1.3965. The dollar had slipped to almost JPY111.00 yesterday, coming within five ticks of the February 11 low, before rebounding with the recovery in US stocks and advance in...

Read More »Dollar is Little Changed, US Leadership Awaited

The foreign exchange market is unusually calm. The US dollar is little changed against currencies. While the selling pressure that took sterling below $1.39 and the euro below $1.10 has subsided, neither has been able sustain upticks. The euro rose to $1.1040 before sellers re-emerged. Sterling was capped near $1.3965. The dollar had slipped to almost JPY111.00 yesterday, coming within five ticks of the February 11 low, before rebounding with the recovery in US stocks and advance in...

Read More »The Return of Moral Economy?

The concept of moral economy was first used by 18th-century thinkers trying to make sense of the rising capitalist values. In feudal society, a "fair price" was preferred over a free price especially for the necessities of the day. The reciprocal rights and responsibilities of feudalism let the lord set the fair price. The British historian E. P. Thompson showed how farmers clung to this belief. Large farmers who sold their product at a higher price elsewhere while there was some...

Read More »The Return of Moral Economy?

The concept of moral economy was first used by 18th-century thinkers trying to make sense of the rising capitalist values. In feudal society, a "fair price" was preferred over a free price especially for the necessities of the day. The reciprocal rights and responsibilities of feudalism let the lord set the fair price. The British historian E. P. Thompson showed how farmers clung to this belief. Large farmers who sold their product at a higher price elsewhere while there was some...

Read More »Great Graphic: Trade-Weighted Look at Major Currencies

When considering the impact of changing currency prices on an economy, trade-weighted measures are appropriate. The Federal Reserve has cited the dollar's appreciation as a headwind on the economy and a depressant on prices. Given the moves in the spot market, and proximity of the G20 meeting, it may be useful to review what has happen to the trade weighted measures of the major currencies. The data is from the Bank of England. It calculates the trade-weighted indices are a broad range...

Read More »Great Graphic: Trade-Weighted Look at Major Currencies

When considering the impact of changing currency prices on an economy, trade-weighted measures are appropriate. The Federal Reserve has cited the dollar's appreciation as a headwind on the economy and a depressant on prices. Given the moves in the spot market, and proximity of the G20 meeting, it may be useful to review what has happen to the trade weighted measures of the major currencies. The data is from the Bank of England. It calculates the trade-weighted indices are a broad range...

Read More »Banking truth exposed, soon to crash – Bill Bonner

New Law Cracks Down on Right to Use Cash: U.S. government is trying to restrict your access to cash. But not for the reason you think. According to leaked evidence, it’s much, much worse.

Read More »Euro and Sterling are Sold into Upticks, Yen Firms Further

The US dollar and yen remain firm. The ramifications of Brexit continue to weigh on sterling and the euro. After nearing $1.4050 yesterday, sterling could not move much above $1.4150 before sellers re-emerged. The euro, which came close to $1.10 yesterday, was sold into about half a cent bounce. It marginally extended yesterday's decline, slipping to almost $1.0990. There is no fresh catalyst, but Germany's IFO survey did the single currency no favors. The assessment of the...

Read More »Euro and Sterling are Sold into Upticks, Yen Firms Further

The US dollar and yen remain firm. The ramifications of Brexit continue to weigh on sterling and the euro. After nearing $1.4050 yesterday, sterling could not move much above $1.4150 before sellers re-emerged. The euro, which came close to $1.10 yesterday, was sold into about half a cent bounce. It marginally extended yesterday's decline, slipping to almost $1.0990. There is no fresh catalyst, but Germany's IFO survey did the single currency no favors. The assessment of the...

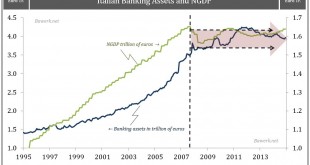

Read More »How Italy will fail and drag down the European Project

Italy is big enough to matter (it is the eight largest economy on the planet), but so uneventful that most does not pay any attention to what is going on there. We contend that Italy will, during the next year or two, be on everyone’s radar screen as it has the potential to derail the European project for real. Greece, Portugal and Ireland were mere test subjects for what will come. Spain would have been a challenge, but were narrowly avoided. Italy will drag the whole structure down if...

Read More » SNB & CHF

SNB & CHF