Swiss Franc The Euro has risen by 0.37% to 1.1755 CHF. EUR/CHF and USD/CHF, January 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is stabilizing but the tone remains fragile. The euro, which has advanced for five consecutive sessions coming into today is slightly lower. The euro had stalled yesterday as it approached last year’s high set in September...

Read More »Great Graphic: Progress

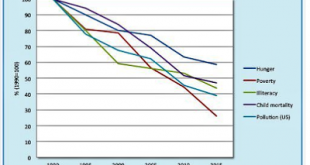

The world looks like a mess. While the economy appears to be doing better, disparity of wealth and income has grown. Debt levels are rising. Protectionism appears on the rise. Global flash points, like Korea, Middle East, Pakistan, Venezuela are unaddressed. At the same time, this Great Graphic tweeted by @DinaPomeranz, with a hat tip to @bill_easterly is a helpful corrective. The clear decline in hunger, poverty,...

Read More »Great Graphic: Progress

The world looks like a mess. While the economy appears to be doing better, disparity of wealth and income has grown. Debt levels are rising. Protectionism appears on the rise. Global flash points, like Korea, Middle East, Pakistan, Venezuela are unaddressed. At the same time, this Great Graphic tweeted by @DinaPomeranz, with a hat tip to @bill_easterly is a helpful corrective. The clear decline in hunger, poverty,...

Read More »Digitalisation will reverse offshoring trends, says ABB head

Are robots replacing jobs or helping to bring them back home? (Keystone) - Click to enlarge Thanks to advances in robotics and digitalisation, the trend towards the offshoring of manufacturing jobs to cheaper countries is set to be reversed, according to the president of Zurich-based industry giant ABB group. In an interview published Sunday in the NZZ am Sonntag newspaper, Peter Voser said that digital...

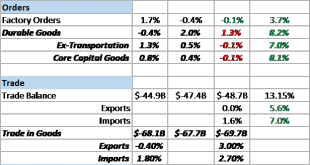

Read More »Bi-Weekly Economic Review: Housing Market Accelerates

The economy ended 2017 with current growth just slightly above trend. In general the reports of the last two weeks of the year were pretty good with housing a standout performer going into the new year. We are still trying to get past the impact – positive and negative – from the hurricanes a few months ago though so it is probably prudent to wait for more evidence before making any definitive pronouncements about the...

Read More »98,750,067,000,000 Reasons to Buy Gold in 2018

98,750,067,000,000 Reasons to Buy Gold in 2018 – World equity index market capitalization touching distance of $100 trillion dollars at beginning of December – Key indicators across global financial markets are looking decidedly bubble-like – Little indication that we are through the worst of the financial crisis that started in 2007 – Apparent lack of concern regarding the over-heated and overpriced markets – Since...

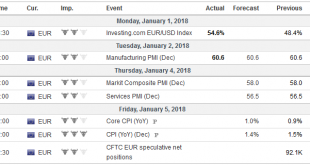

Read More »The Past is Not Passed: 2017 Spills into 2018

The New Year may have begun in fact, but in practice, full participation may return only after the release of US employment data on January 5. The macroeconomic and policy tables have been set, though interpolating from the Overnight Index Swaps market, there is 45% chance the Bank of Canada hikes rates at its policy meeting near the middle of the month. In the currency markets, sentiment appears to be as uniformly...

Read More »Anatomy of the U.S. Dollar End Game Part 1 of 5

MacroVoices and Erik Townsend welcome Jeffrey Snider, Mark Yusko and Luke Gromen to the show. In Part 1 of the 5 Part Series, Jeffrey Snider presents perspectives on where we are today. Looks at how Russia and Brazil dealt with US dollar funding through derivatives and FX repo auctions. They further discuss China’s management of the U.S. dollar and the evolving Chinese response.

Read More »FX Daily, January 2: Dollar Slump Accelerates

Swiss Franc The Euro has risen by 0.03% to 1.1703 CHF. EUR/CHF and USD/CHF, January 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s slump seen in the final two weeks of 2017 is carried into today’s activity. The greenback’s sell-off extends to the emerging market currencies as well. The Hungarian forint is the strongest rising nearly 1%, ostensibly...

Read More »Swiss VAT rate to fall in 2018

©_Toscawhi _ Dreamstime.com - Click to enlarge The current rate of 8% is set to drop on 1 January 2018. Temporarily increased by 0.4% in 2011 to shore up funding for disability welfare, the rate will revert to 7.7%. The 0.1% difference between the new rate and pre 2011 rate of 7.6% is a new increase that will be used to help finance rail infrastructure. Switzerland has three VAT rates: a standard rate (8%), a hotel...

Read More » SNB & CHF

SNB & CHF