USD/CHF The USDCHF pair provided negative trades after 0.9488 proved its strength against the recent positive attempts, to keep the bearish trend scenario valid efficiently in the upcoming period, supported by the EMA50 that pushes negatively on the price, waiting to test 0.9373 initially. Breaking the mentioned level will extend the bearish wave to reach 0.9300 as a next station, while holding below 0.9488...

Read More »Fintech lending platform Loanboox eyes French expansion

The agile fintech has so far been able to slip over EU borders (Loanboox) - Click to enlarge Award-winning Swiss fintech firm Loanboox is planning further expansion into Europe having obtained a foothold in Germany. The digital portal for matching institutions with investors plans a move into France and is also looking at other European markets. The Zurich-based company started off operations in Switzerland...

Read More »Prices and Predictions – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Smoke Signals Gold went up by 33 of the Master’s Notes, but silver went up only 22 of the His Cents. The rising gold-silver ratio is one thing we add to others that signal the not-good economy. Silver has industrial uses, but gold basically does not. So a rising ratio shows rising monetary demand relative to industrial...

Read More »FX Daily, March 26: Equity Meltdown Aborted, Dollar Eases

Swiss Franc The Euro has risen by 0.43% to 1.1747 CHF. EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a poor start in Asia, equities recovered. The MSCI Asia Pacific initially extended last week’s losses and fell to its lowest level since February 12 before recovering to finish near its highs, 0.4% above last week’s close. European...

Read More »Swiss gold refiners accused of sourcing illegal and conflict gold

Illegal gold mining in Peru's Madre de Dios province has damaged the environment and had a negative impact on indigenous communities (Keystone) - Click to enlarge A report by the NGO Society for Threatened Peoples (STP) has accused Swiss gold refiner Metalor of procuring gold from controversial suppliers in Peru. Metalor denies the charge. The reportexternal link, released on Thursday to time with the...

Read More »How to make friends with a Swiss person

Misinformed stereotype or stark reality? Whichever way round it is, how to make friends with the Swiss is a topic for most expats at some point during their time here. This animated guide lays out some ground rules for forming friendships with the Swiss - all with a heavy dose of humour. (SRF, swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events....

Read More »Swiss government set to remove ‘mariage tax penalty’

In Switzerland, married couples file one combined tax return. Because tax rates rise in line with income it means that second incomes of married couples are taxed at a higher rate than those of single cohabitating ones. © Tero Vesalainen | Dreamstime.com - Click to enlarge Those campaigning to have this changed argue that it is unfair and acts as a disincentive for second income earners. In 1984, Switzerland’s Federal...

Read More »Decrypting the Appointment of John Bolton

So perhaps the dominant wing of the Deep State is finally willing to cut a deal with Trump. To many observers, the appointment of John Bolton as national security advisor is the functional equivalent of appointing the Anti-Christ–or maybe worse. Indeed, these observers would, when comparing the two, find grudging favor with the Anti-Christ. Bolton is a founding member of the neoliberal, neoconservative, neo-colonial...

Read More »What Fed Chair Powell Forgot to Mention

Son of the Imperial City What are the chances of Federal Reserve Chairman Jerome Powell being wrong? The chances he’ll be wrong on the economy’s growth prospects, the direction of the federal funds rate, and inflation itself? Our guess is his chances of being wrong are quite high. The new central planner-in-chief. - Click to enlarge Central banks are facing a special case of the socialist calculation problem...

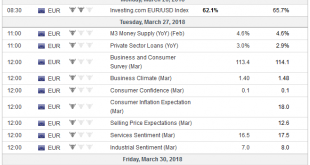

Read More »FX Weekly Preview: The Investment Climate

Eurozone The investment meme of a synchronized global upturn has been undermined by the recent string of US and European economic data. The flash March eurozone composite reading fell to 55.3, the lowest reading since January 2017. Although Q4 17 US GDP may be revised higher (toward 2.8% from 2.5%) mostly due to greater inventory accumulation, the curse of weak Q1 GDP appears to be showing its hand again, with...

Read More » SNB & CHF

SNB & CHF