Misinformation and Delusions PARIS – Too bad about Ted Cruz. His tax plan was pretty good. A flat tax of 10% on anything over $36,000. And a 16% “business transfer tax” to replace the corporate income tax and all payroll taxes. Photo credit: David J. Phillip / AP Ted Cruz bows out… allegedly he did so because of losing the Indiana primary. But we know better of course. He read this article, and that was the straw that broke the camel’s back. Sorry ’bout that. Not perfect. But a step...

Read More »Securitas instead of the police

In Switzerland, fear of crime is changing the security landscape, with private security companies taking on some tasks formerly performed by the police. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch...

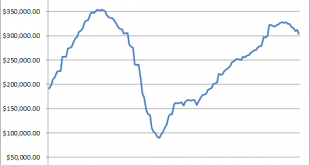

Read More »Corporate Tax Receipts Reflect Economic Slowdown

Tax Receipts vs. the Stock Market Following the US Treasury’s update of April tax receipts, our friend Mac mailed us a few charts showing the trend in corporate tax payments. Not surprisingly, corporate tax payments and refunds mirror the many signs of a slowing economy that have recently emerged. An overview in chart form follows below. First up, corporate tax receipts in absolute figures. Corporate Tax Receipts Corporate tax receipts in absolute dollars and cents – this is quite...

Read More »Incrementum Advisory Board Meeting, Q2 2016

A New Bull Market in Gold? On April 10, the Incrementum Fund’s advisory board held its quarterly meeting. Two of the regulars (Zac Bharucha and Rahim Taghizadegan) were unable to attend this time, but we were joined by special guest Brent Johnson, the CEO of Santiago Capital. The transcript of the meeting with all charts can be downloaded further below. Gold, June futures contract, daily As indicated, the main (but not the only) topic of the discussion was gold. This was an obvious choice...

Read More »Gold and Gold Stocks – Is the Correction Finally Beginning?

Triangle Thrust and Reversal In mid April, we discussed weekly resistance levels in the HUI Index. Given the recent almost blow-off like move in the index and its subsequent reversal, we decided to provide a brief update on the situation. First, here is a daily chart comparing the HUI, the HUI-gold ratio and gold: After building another triangle, the HUI has delivered an upside thrust in the direction of the preceding trend. This is quite normal, and so is the subsequent move back to its...

Read More »Migrant Rape Epidemic Reaches Austria

Submitted by Soren Kern via The Gatestone Institute, A 20-year-old asylum seeker from Iraq confessed to raping a 10-year-old boy at a public swimming pool in Vienna. The Iraqi said the rape was a "sexual emergency" resulting from "excess sexual energy." Those who dare to link spiraling crime to Muslim mass migration are being silenced by the guardians of Austrian multiculturalism. According to data compiled by the Austrian Interior Ministry, nearly one out of three asylum seekers in...

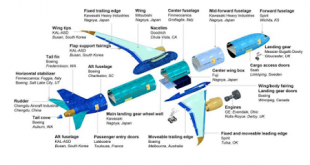

Read More »Great Graphic: Non-Consensus Thinking on Trade

This Great Graphic was posted by Eric Nelson, the managing editor of the Chamber of Commerce’s Above the Fold publication. It shows many of the different components of the 737 single-aisle airplane and where they are sourced. There is a complex supply chain that stretches from Australia, through Asia (e.g., Japan, South Korea, and China) through Europe (France, Sweden, the UK, and Italy). It extends into Canada and several US states as well. Some of the foreign-sourced...

Read More »FX Daily, May 5: Dollar Performance Turns More Nuanced

The US dollar is firm, near the best levels of the week against the euro, yen, and sterling. However, against the dollar-bloc and several actively traded emerging market currencies, including the Turkish lira and South African rand, the greenback has given back some of yesterday’s gains. Oil is snapping a four-day decline. News that US output fell by 113k barrels a day last week, the biggest drop in eight months, coupled with a Canadian wildfire that is threatening as much as one...

Read More »Cool Video: Trump and the Dollar–Bloomberg TV

I was invited to discuss the potential impact of a Trump presidency on the US dollar with Bloomberg's with Joe Weisenthal, Oliver Renick, and Alix Steel on "What'd You Miss" show yesterday afternoon, Of course the topic lends itself to all sorts of partisanship. However, I put aside my own political axes and focused on two potential channels through which could impact the dollar. The first is through a foreign economic policy that undermines US treaty obligations under various trade...

Read More »Swiss sculptor Giacometti goes digital

Fans of one of Switzerland’s most famous artists, Alberto Giacometti, can now discover the places he knew and loved, with the help of their smartphones. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch...

Read More » SNB & CHF

SNB & CHF