Offending People Left and Right Bill Bonner, whose Diaries we republish here, is well-known for being an equal opportunity offender – meaning that political affiliation, gender, age, or any other defining characteristics won’t save worthy targets from getting offended. As far as we are concerned, we generally try not to be unnecessarily rude to people, but occasionally giving offense is not exactly beneath us...

Read More »MACRO ANALYTICS – 06 03 16 – Bull in the China Shop – w/Charles Hugh Smith

ABSTRACT: http://www.gordontlong.com/Macro_Analytics.htm#Smith-06-03-16

Read More »Janet Yellen – Backtracking Again

Muhammad Ali Could Take a Punch BALTIMORE – You had to admit. Muhammad Ali could take a punch. Unlike Donald Trump, Dick Cheney, George W. Bush, and Bill Clinton, he was a real war hero. He stood up and faced his enemies on the draft board, rather than dodging them. And when the feds walloped him as a criminal draft resister, Ali didn’t throw in the towel in a whimpering surrender to superior force. Instead, he used...

Read More »Great Graphic: Despite Higher Oil Prices, Middle East Pegs Remain Under Pressure

With today’s gains, the price of Brent has nearly doubled from its lows in January. Of course, the price of oil is still less than half of levels that prevailed two years ago. At the same time, many leveraged investors cast a jaundiced eye toward currency pegs. Many have concluded that the Middle East currency pegs cannot be sustained. Through a combination of the moral suasion and the power of sovereign, Saudi...

Read More »Swiss Consumer Price Index in May 2016: Consumer prices increase by 0.1 percent

08.06.2016 09:15 – FSO, Prices (0353-1606-00) Swiss Consumer Price Index in May 2016 For the third time in a row, prices in Switzerland increased against the previous month. Inflation was -0.4% against last year. Still in 2015 yearly inflation was mostly around -1.5% y/y. Now yearly HCPI inflation is -0.5%. Will this rising price tendency continue? It will be surely a problem for the SNB. They might need a stronger...

Read More »Checking whether rumours on social media are true

How can journalists ensure that the information they are gathering from online sources can be trusted? An EU-funded project called Pheme is developing a tool to speed up verification and swissinfo.ch is involved in the project. (Michele Andina, swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit...

Read More »Swiss Reserves: Not what They Seem

This posts shows again the stupidity of the financial media, that mixes up assets and liabilities for central banks.SNB FX reserves are assets. They are in different foreign currencies and subject to the valuation effect of these currencies.Our weekly sight deposits report show the liabilities. They are measured in Swiss franc and therefore not subject to valuation effects. They are the only way to measure...

Read More »Charles Hugh Smith – A Radically Beneficial World

SpokenTome.media Audiobooks presents Charles Hugh Smith in conversation with Mark Jeftovic. Charles discusses his book "A Radically Beneficial World", the monetary system, and creating meaningful work for all.

Read More »FX Daily, June7: Another Breakdown of EUR/CHF

Swiss Franc Once again both EUR and USD broke down against the franc. The adverse effect of the Friday US jobs reports is visible again.Moreover, CHF appreciated with the Asian block, with AUD and NZD and with the oil price. Swiss sales are pretty high to Asian countries. We also know that rising oil prices usually lead to a stronger CHF. Japan The Japanese yen is the major currency not to be gaining against...

Read More »The Real Reason We Have a Welfare State

From Subject to Citizen BALTIMORE – June 5th, the Swiss cast their votes and registered their opinions: “No,” they said. We left off yesterday wondering why something for nothing never works. Not as monetary policy. Not as welfare or foreign aid. Not in commerce. Not never, no how. But something for nothing is what people most want. The Swiss voted against awarding all citizens a “universal basic income” of about...

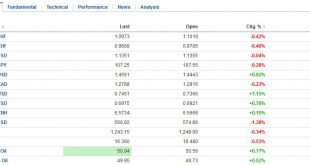

Read More » SNB & CHF

SNB & CHF