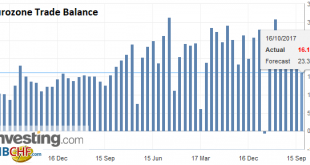

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »10 Franc Note: Banknote App Updated

Discover all of the new Swiss notes on mobile devices - Click to enlarge The Swiss National Bank (SNB) is releasing an updated version of ‘Swiss Banknotes’, an app for mobile devices designed to help the public familiarise themselves with the new banknotes.The popular app, which has been downloaded over 70,000 times, now also showcases the new 10-franc note. It can be downloaded free of charge from the Apple...

Read More »Brexit UK Vulnerable As Gold Bar Exports Distort UK Trade Figures

– Brexit UK vulnerable as gold bar exports distort UK trade figures – Britain’s gold exports worth more than any other physical export – Gold accounted for more than one in ten pounds of UK exports in July 2017– UK’s stock of wealth has collapsed from a surplus of £469bn to a net deficit of £22bn – ONS error– Brexiteers argue majority of trade is outside EU, this is due to large London gold exports– Single gold bar...

Read More »Brexit UK Vulnerable As Gold Bar Exports Distort UK Trade Figures

– Brexit UK vulnerable as gold bar exports distort UK trade figures – Britain’s gold exports worth more than any other physical export – Gold accounted for more than one in ten pounds of UK exports in July 2017– UK’s stock of wealth has collapsed from a surplus of £469bn to a net deficit of £22bn – ONS error– Brexiteers argue majority of trade is outside EU, this is due to large London gold exports– Single gold bar...

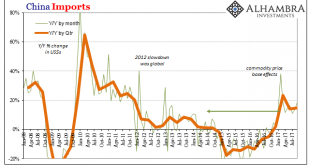

Read More »China Exports/Imports: Enforcing A Global Speed Limit

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month. What is becoming very clear is that China’s economy is behaving no differently than the global economy. Most of that increase for...

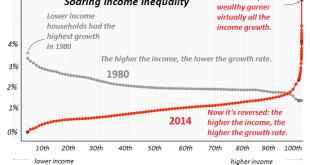

Read More »The Fading Scent of the American Dream

The theme this week is The Rot Within. It’s been 10 years since I devoted a week to the theme of The Rot Within (September 17, 2007). Back in 2007, I listed 16 systemic sources of rot in our society, politics and economy; none have been fixed. Instead, the gaping holes have been filled with Play-Do and hastily painted to create the illusion of shiny solidity. We live in a simulacrum society in which the fading scent of...

Read More »Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fundamental Developments The prices of the metals shot up last week, by $28 and $0.57. Heavy metals became pricier last week, but we should point out that the stocks of gold and silver miners barely responded to this rally in the metals, which very often (not always, but a very large percentage of the time) is a sign...

Read More »Central Bank Chiefs and Currencies

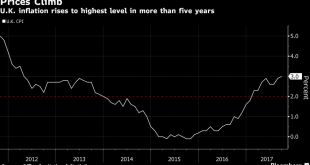

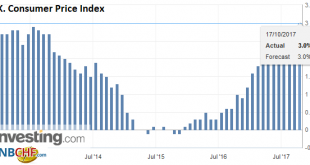

Summary: Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election. The market is fickle. It has jumped from one candidate to another as the most likely Fed Chair. Until his belated and mild criticism of the President dealing with race issues,...

Read More »NAFTA Worries Take Toll, Yellen’s Best Guess Supports Greenback

Summary: Risk that NAFTA collapses weighs on CAD and MXN. Yen is slightly firmer despite US yields edging higher and weekend polls suggesting LDP could nearly secure a 2/3 majority of its own. The sterling is consolidating after sharp moves at the end of last week. (Greetings from San Francisco, where I will be speaking at a CFA seminar on currencies tomorrow. The rebuilding from destruction of the of...

Read More »Taleb Explains How He Made Millions On Black Monday As Others Crashed

Former trader and author of best-selling book “The Black Swan” sat down for an interview with Bloomberg News to mark the upcoming thirtieth anniversary of the stock-market crash that occurred on Oct. 19, 1987 – otherwise known as Black Monday. Taleb famously supercharged his career – and earned a considerable sum of money (though turns out it was less than Taleb felt he deserved) – thanks to his trading profits from...

Read More » SNB & CHF

SNB & CHF