Find out practical ideas that you can use from an economic genius in your business. This is for those involved in entrepreneurial activites whether or not you own your own business. Keith Weiner, PhD, is an economist who talks about investments, gold and more. In this discussion we talked about practical economics, gold, bitcoin and other cryptocurrencies, and more. Please leave a comment about what you think.

Read More »Practical Economics for Entrepreneurs with Dr. Keith Weiner

Find out practical ideas that you can use from an economic genius in your business. This is for those involved in entrepreneurial activites whether or not you own your own business. Keith Weiner, PhD, is an economist who talks about investments, gold and more. In this discussion we talked about practical economics, gold, bitcoin and other cryptocurrencies, and more. Please leave a comment about what you think.

Read More »Why a Polish/Scottish couple became Swiss

A Polish/Scottish couple decided to apply for Swiss citizenship to boost their children's integration. This is their story. (Julie Hunt, swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »Airbnb has ‘impact’ on housing market

The app of Airbnb, a website for people to list, find and rent lodging, and other apps on a smart phone (Keystone) Online accommodation platforms such as Airbnb have negative effects on the Swiss housing market and lead to fewer homes available for tenants and higher rental prices, a study has revealed. According to a survey by the Inura Zurich Institute, commissioned by the Zurich Tenants’ Associationexternal link and...

Read More »Perth Mint Gold Coins Sales Double In September

– Perth Mint gold coins see sales double on month in September – Perth Mint silver bullion coin sales surge 78% in September – Perth Mint sold 46,415 ounces of gold in September– Nearly six times more gold coins sold at Perth Mint than U.S. Mint in September – Sales surge at Perth Mint from low base; could indicate trend change and higher demand in coming months Gold Coin Sales, Aug 2012 - Jul 2017(see more posts on...

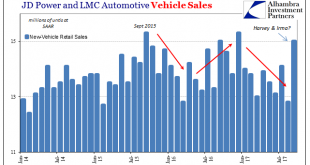

Read More »Auto Sales Up Last Month, But Why?

Auto sales rebounded sharply in September, with most major car manufacturers reporting better numbers. Sales at Ford were up 8.9% last month from September 2016; +11.9% at GM; Toyota +14.9%; Nissan +9.5%; Honda +6.8%. The only negatives were reported by FCA (-9.7%) and Mercedes (-1.7%). US Vehicle Sales, Jan 2014 - Jul 2017(see more posts on vehicle sales, ) - Click to enlarge The question is whether these...

Read More »Federal Reserve President Kashkari’s Masterful Distractions

The True Believer How is it that seemingly intelligent people, of apparent sound mind and rational thought, can stray so far off the beam? How come there are certain professions that reward their practitioners for their failures? The central banking and monetary policy vocation rings the bell on both accounts. Today we offer a brief case study in this regard. Photo credit: Linda Davidson / The Washington Post -...

Read More »FX Weekly Preview: Forces of Movement

Over the past few weeks, the markets have come to accept the likelihood of a December Fed hike. US interest rates have adjusted. The pricing of December Fed funds futures contract is consistent with around an 80% chance of a hike. The two-year yield is trading at the upper end of what is expected to be the Fed funds target range at the end of the year, after slipping below the current range a month ago. The Dollar Index...

Read More »Emerging Markets: Week Ahead Preview

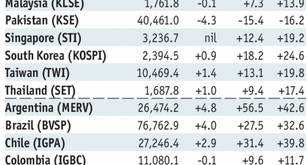

Stock Markets EM FX ended the week under pressure, as US data points to a rate hike in December and perhaps more in 2018. FOMC minutes this Wednesday will be closely studied for clues. US retail sales and CPI data Friday will also be important. We believe the most vulnerable currencies in this environment are ZAR and TRY, but one could also add MXN and perhaps RUB to that mix too. Stock Markets Emerging Markets,...

Read More »Talk of cutting Swiss pensions paid to foreign residents

© Michael Smith | Dreamstime - Click to enlarge According to Le Matin, Jean-Luc Addor, a parliamentarian and member of the Swiss People’s Party (UDC/SVP), wants to know what savings could be made if pensions paid to those abroad were adjusted for living costs in those countries. According to the newspaper, after the rejection of the vote to reform Swiss pensions, Addor said that the rejected reform was aimed at...

Read More » SNB & CHF

SNB & CHF