Swiss Franc The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 – 1.0700 that constituted the previous intervention area. Reasons can be found in the weak U.S. GDP weak, in Trump’s foreign trade policy and in the strong Swiss trade balance. Who has understand the principles of the balance of payments, knows that private investors and the SNB must export the equivalent of the current account surplus. The trade surplus is major component of the current account. If private investors refuse to export all the capital, the SNB can Either intervene or make the foreign currencies more attractive for private investors After the record trade surplus, the SNB chose option 2. EUR/CHF - Euro Swiss Franc, January 30(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The foreign exchange market is quiet and mixed. The focus is on the weakness of global equities and the continued sell-off in European bonds. The eventful week that sees the Fed, BOJ, and BOE meet, US employment report, PMIs, and EMU GDP, inflation and unemployment are starting slowly.

Topics:

Marc Chandler considers the following as important: EUR, Eurozone Consumer Confidence, Featured, FX Daily, FX Trends, Germany Consumer Price Index, Japan Retail Sales, JPY, newslettersent, Spain Gross Domestic Product, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 – 1.0700 that constituted the previous intervention area. Reasons can be found in the weak U.S. GDP weak, in Trump’s foreign trade policy and in the strong Swiss trade balance. Who has understand the principles of the balance of payments, knows that private investors and the SNB must export the equivalent of the current account surplus. The trade surplus is major component of the current account. If private investors refuse to export all the capital, the SNB can

After the record trade surplus, the SNB chose option 2. |

EUR/CHF - Euro Swiss Franc, January 30(see more posts on EUR/CHF, ) |

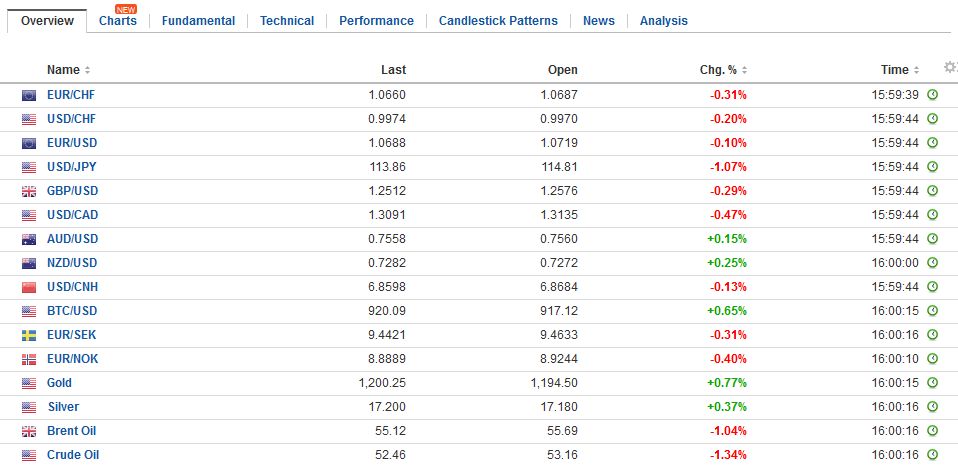

FX RatesThe foreign exchange market is quiet and mixed. The focus is on the weakness of global equities and the continued sell-off in European bonds. The eventful week that sees the Fed, BOJ, and BOE meet, US employment report, PMIs, and EMU GDP, inflation and unemployment are starting slowly. |

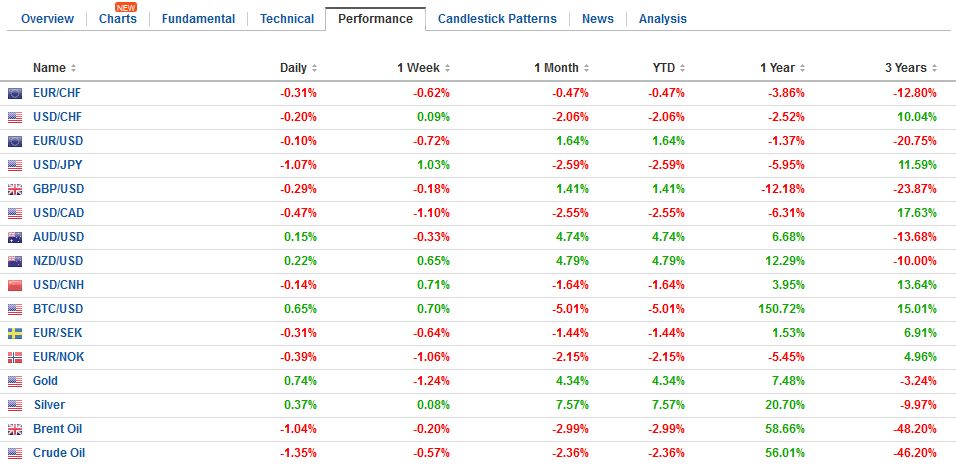

FX Performance, January 30 2017 Movers and Shakers Source: Dukascopy - Click to enlarge |

| The weekend news from the US over the controversial actions on refugees, immigrants, including green card holders, is an obvious talking point, though with seemingly little impact on the capital markets. The dollar, for example, largely recovered from the losses seen initially in Asia, where participation was thinned in any event due to the Lunar New Year celebration is many countries, including China (including Hong Kong and Taiwan), South Korea, Singapore, and Malaysia. |

FX Daily Rates, January 30 |

| After poking through JPY115 at the end of last week, the dollar could not sustain the upward momentum. It was sold a little through JPY114.30 before rebounding back to almost JPY115.00 by early Europe. Initial support may be seen in the JPY114.30-JPY114.50 area.

The euro was bid to $1.0740 initially in thin Asian turnover and had fallen back to $1.0690 before the European session began in earnest. The intraday technicals suggest the first move in North America may be higher. Re4call that last week, the euro was blocked several times in the $1.0770 and recorded the lows for the week just below $1.0660 last Thursday and Friday. |

FX Performance, January 30 |

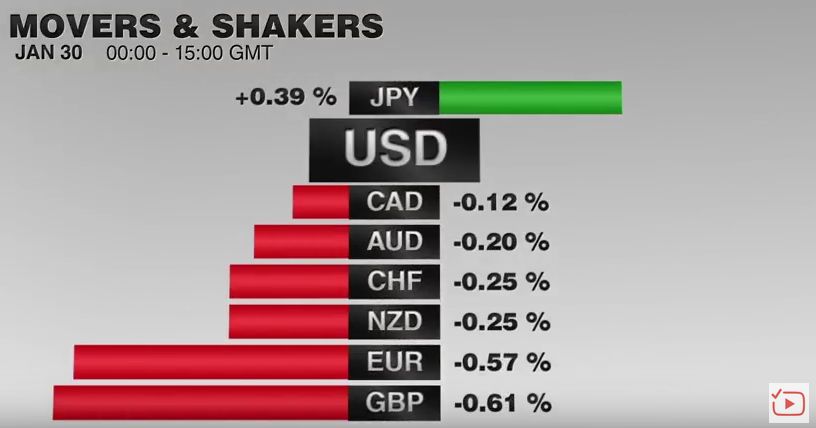

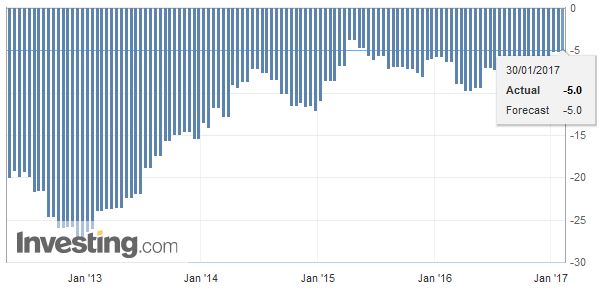

JapanThe Nikkei’s 0.5% loss broke a three-day advance from the end of last week. Losses were led by financials and telecoms. Consumer staples were the strongest sector, gaining 0.2%. This comes as Japan released disappointing retail sales figures for last month. Retail sales fell 1.7% in December. This was more than three times larger than the Bloomberg median forecast of a 0.5% decline. The year-over-year rate fell to 0.6% from 1.7%. Consumer spending remains a soft spot for the world’s third largest economy, and this point will likely be driven home tomorrow. The economy is finding better traction (expecting industrial output to have risen 0.3% in December for a 3% year-over-year pace), and the labor market is tight (December unemployment to be reported tomorrow will likely show a steady 3.1% unemployment rate). Overall household spending remains soft (December figures will be reported tomorrow and are expected to have fallen 0.9% year-over-year) and a 4.4% decline in December 2015 and a 3.4% falling December 2014). |

Japan Retail Sales YoY, December 2016(see more posts on Japan Retail Sales, ) Source: Investing.com - Click to enlarge |

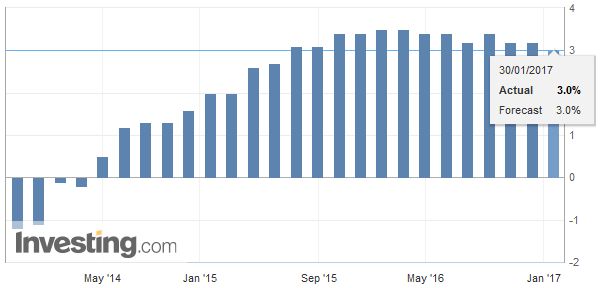

EurozoneEuropean stocks and bonds are under pressures. The Dow Jones Stoxx 600 is off almost 1.0% near midday in London. The second consecutive losing session is led by energy and financials. It may be the biggest drop since November. Italian bank shares are off 3.2%, and it is the third consecutive decline (for around 6%). The proximate cause today are reports that the ECB has demanded improvements in Italy’s largest bank’s plans to address the bad loans (by the end of next month). European bonds are under pressure. Greek bonds are getting crushed, with the 10-year yield up more than 20 bp and the two-year yield surging 50 bp. The failure of the Eurogroup to find common ground last week coupled with a sobering IMF report, reiterating its position that the situation is not sustainable. Greece has about 13 bln euros of bonds maturing in H1 17. The Eurogroup is seeking additional concessions, and Greece is balking. Portuguese and Italian bonds are 7-8 bp lower, while most eurozone benchmark yields are 2-4 bp higher, with German Bunds outperforming. This is important because the uptick in inflation primarily reflects the vagaries of energy prices, lower last year and stronger now. There may also be some impact from the past decline in the euro. The ECB has been putting more emphasis on the core rate to decipher the underlying signal. The eurozone aggregate estimate will be released tomorrow. Headline CPI rose from 0.6% to 1.1% in December. It is expected to have accelerated to 1.5%-1.6% in January. However, the core rate bottomed at 0.6% and has been 0.8%-0.9% since last May; stable but little traction. |

Eurozone Consumer Confidence, December 2016(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

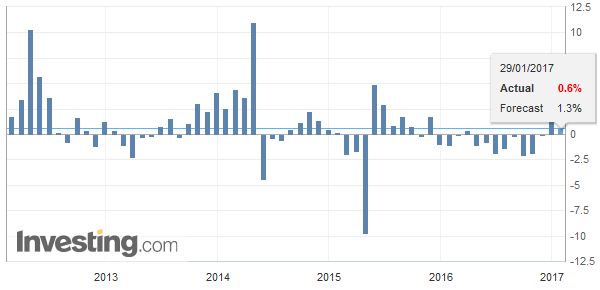

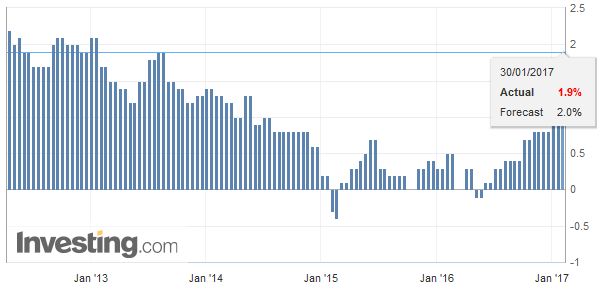

SpainThere are two main economic reports from the euro-area today. Spain reported a 0.7% rise in Q4 GDP. This was in line with the consensus. It is the same pace as in Q3, but slightly slower than in Q1 and Q2. The year-over-year pace is 3%, down from 3.2% in Q3. |

Spain Gross Domestic Product (GDP) YoY, December 2016(see more posts on Spain Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

GermanyGerman states reported January CPI figures. Higher energy and transportation costs are pushing the nationwide figure closer to 2% (1.7% in December). There is some risk that the core measure eased. |

Germany Consumer Price Index (CPI) YoY, December 2016(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

United StatesThe US reports December personal income and consumption expenditures. The data from these reports were contained in the preliminary Q4 16 GDP estimate seen before the weekend. A gain in pending home sales will be seen in the context of the 2.5% decline in November. The year-over-year rate may tick up slightly from 1.4% in November. The Dallas manufacturing activity report is for January, and we suspect there may be scope for a small upside surprise given the strong momentum and recovery of the oil sector. It stood at 15.5 in December, for the fourth monthly improvement in a row. Last January it reached its cyclical low of -34.6. The main focus is on this week’s FOMC meeting and employment report at the end of the week. |

U.S. Personal Income and Spending YoY, December 2016(see more posts on U.S. Personal Income, U.S. Personal Spending, ) Source: Zerohedge - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$EUR,$JPY,Eurozone Consumer Confidence,Featured,FX Daily,Germany Consumer Price Index,Japan Retail Sales,newslettersent,Spain Gross Domestic Product