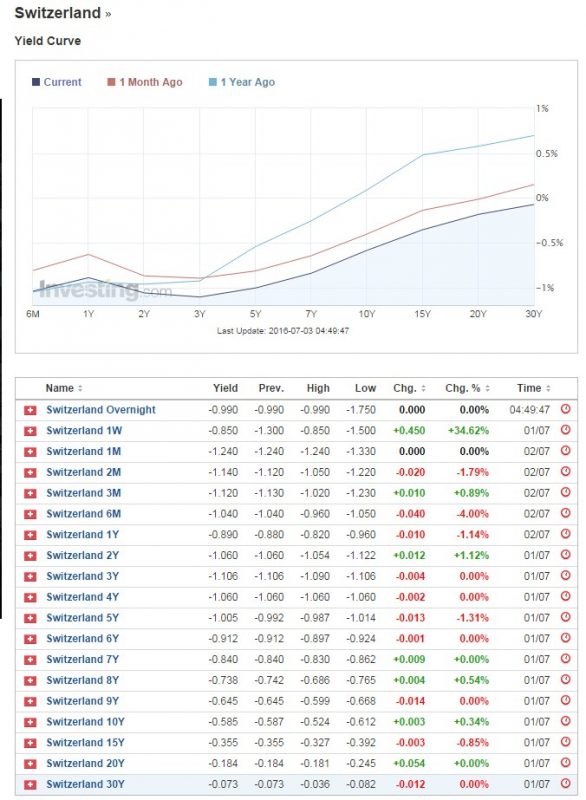

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are “more negative than others”, because investors expect a slow appreciation of the Swiss franc. Sometimes it’s critical to look clearly at the big picture. The big picture is that the financial world has allocated capital… trillions of dollars of capital, based on Central Banks trying to corner the bond market. In the current debt-based monetary system, sovereign bonds are the bedrock of finance. Every other asset under the sun trades based on where sovereign bonds (like US Treasuries or German bunds) are trading. So if Central Banks are manipulating bonds via QE purchases and ZIRP/NIRP, the entire financial system begins to misprice risk. Consider Switzerland today.Swiss sovereign bonds are currently posting negative yields as far out as 30 years. Pay the Swiss Government for owning their bonds Put another way, the bond market is priced in such a way that investors are willing to pay the government of Switzerland through 2046 for the right to own their bonds. They are doing this for two reasons: 1) The ECB has announced it will be buying bonds for months to come.

Topics:

Graham Summers considers the following as important: Bond, Central Banks, CHF FX, default, Featured, Market Crash, newslettersent, Switzerland

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are “more negative than others”, because investors expect a slow appreciation of the Swiss franc.

Sometimes it’s critical to look clearly at the big picture.

The big picture is that the financial world has allocated capital… trillions of dollars of capital, based on Central Banks trying to corner the bond market.

In the current debt-based monetary system, sovereign bonds are the bedrock of finance.

Every other asset under the sun trades based on where sovereign bonds (like US Treasuries or German bunds) are trading.

So if Central Banks are manipulating bonds via QE purchases and ZIRP/NIRP, the entire financial system begins to misprice risk.

Consider Switzerland today.

Swiss sovereign bonds are currently posting negative yields as far out as 30 years.

Pay the Swiss Government for owning their bondsPut another way, the bond market is priced in such a way that investors are willing to pay the government of Switzerland through 2046 for the right to own their bonds. They are doing this for two reasons: 1) The ECB has announced it will be buying bonds for months to come. So investors are simply front-running the ECB’s purchases. 2) Capital is aware that the whole system is a bubble and so is fleeing into safe havens like Swiss bonds. There is simply no way this situation ends well. Yes, it might make some sense based on the current risk profile of the world. But if that profile changes at all, Swiss bonds, like all negative yielding bonds, will adjust accordingly. That adjustment would not simply affect bonds… it would affect everything. Now, forget Switzerland and apply this to the entire financial system. Corporates have been issuing debt at a record pace based on where yields (sovereign bonds) are trading. Currently the average corporate bond rating in the US is junk. This is a bubble looking for a needle. US corporates are not alone. Emerging market companies have borrowed over $3 trillion in debt, most of it denominated in US Dollars. If the US Dollar begins to rally hard again, this too will be a bubble that will burst. Then there are the big banks. The big banks have over $555 trillion (with a “T”) in derivatives trading based on bond yields. We are told repeatedly that this is not a problem because the people trading these things are the smartest people in the world. But for perspective, the credit default swap market which nearly imploded the entire financial system in 2008 was 1/10th of this size. Everywhere you look there are massive misallocations of capital or bubbles… all of them based on the fact bonds are mispricing risk because of Central Bank intervention. Indeed, perhaps the single biggest bubble today is the Central Bank bubble= the bubble of belief that Central Banks can somehow manage this situation. |

Swiss government trade in negative yield up to 30 years |

They’ve lost control before. They will do so again.

Only this time they will have already used up most of their ammunition when it hits.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming crash will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

We are giving away just 1,000 copies of this report for FREE to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research