Just one rate hike this year will limit the greenback’s gains, but Asian currencies will be worth watching The US dollar has been in a long-term upward cycle, at least since July 2011. But the dollar stuttered in April after the release of some poor economic data, and again at the beginning of June, when poor nonfarm payrolls data was released, leading some to believe that we are at the end of this cycle. But we think this is not necessarily the case for at least two reasons. First, the real trade-weighted value of the US dollar is not that very far from its long-term value, but is still well below the extreme values it reached in 2002. Second, an environment of relatively weak global growth, of the kind we are currently seeing, tends to support the US dollar. In particular, we believe the durable slowdown of China’s economy combined with reasonable US growth will continue to favour the dollar. After a downbeat first quarter, when GDP grew by just 0.8%, we expect that US growth will come in at around 2.5% this quarter and at about 1.8% over 2016 as a whole.However, this rate of growth is not spectacular. Combined with other factors (not least the incipient weakness in non-farm payrolls), we are therefore inclined to believe the Fed will only push through one quarter-percent hike in base rates this year.

Topics:

Luc Luyet considers the following as important: currency volatility, exchange rates, Macroview, PBOC trilemma, US dollar

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joseph Y. Calhoun writes Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

Joseph Y. Calhoun writes Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

Just one rate hike this year will limit the greenback’s gains, but Asian currencies will be worth watching

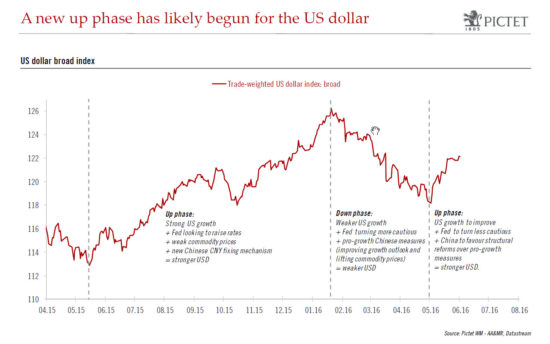

The US dollar has been in a long-term upward cycle, at least since July 2011. But the dollar stuttered in April after the release of some poor economic data, and again at the beginning of June, when poor nonfarm payrolls data was released, leading some to believe that we are at the end of this cycle. But we think this is not necessarily the case for at least two reasons. First, the real trade-weighted value of the US dollar is not that very far from its long-term value, but is still well below the extreme values it reached in 2002. Second, an environment of relatively weak global growth, of the kind we are currently seeing, tends to support the US dollar. In particular, we believe the durable slowdown of China’s economy combined with reasonable US growth will continue to favour the dollar. After a downbeat first quarter, when GDP grew by just 0.8%, we expect that US growth will come in at around 2.5% this quarter and at about 1.8% over 2016 as a whole.

However, this rate of growth is not spectacular. Combined with other factors (not least the incipient weakness in non-farm payrolls), we are therefore inclined to believe the Fed will only push through one quarter-percent hike in base rates this year. As a result, while we expect the dollar to regain some traction, we also believe its rise will remain limited through to the end of this year.

The shift in the Chinese growth toward lower, but more sustainable and more domestically focused growth and its need to deleverage after a sharp build-up in debt is putting the Chinese yuan under pressure. At the same time, the People’s Bank of China finds itself before the “trilemma” of trying to free up capital flows, conduct an independent monetary policy and still run a fixed-exchange system. Something will have to give. Indeed, in response to capital flight, the PBOC quickly placed restrictions on currency exports — proof that the Chinese have, in the short term at the least, reined in their ambitions to free up the capital account. But China has also been trying to adapt its fixed-exchange system, with varying results. One remembers that market turmoil was triggered last August when the PBOC decided to reform the yuan’s daily fix against the US dollar by taking more account of market forces, including global currency movements. And then further market volatility in January was due to the perception that the PBOC was trying to weaken the currency to prop up Chinese exports.

We also believe the yuan will continue to be a source of increased currency volatility in the months ahead, for while the PBOC has used the daily fix to keep a rein on changes in the yuan’s value against the US dollar, the yuan has been allowed to weaken steadily against a basket of its main trading partners’ currencies. Thus, the yuan exchange rate against other Asian currencies could be more volatile. Asian currencies are also exposed to further dollar strength, all the more as US dollar-denominated debt has grown significantly in the rest of Asia as well as in China in recent years.

As for other major currencies, we believe the Fed’s cautious tightening of rates will lead to further widening of the yield spread between US and European assets, and thus a gradual decline in the value of the euro by the end of this year. By contrast, we believe the Japanese yen will remain under upward pressure. The Bank of Japan is fast running out of options to weaken the currency, as it already buys all Japanese government debt issued and negative interest rates have already had adverse effects. In addition, Japan runs a current account surplus and the yen remains undervalued when compared with its historic value against the dollar. Sterling has proved relatively resilient in the run-up to the Brexit referendum on June 23, but has begun to underperform as some polls tighten ahead of the vote. The UK’s current account deficit together with its resilience so far leads us to believe the upside potential for sterling in the event of a vote to stay will remain relatively limited.