Summary:

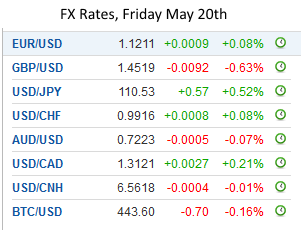

The combination of stronger US economic data and signals from the Federal Reserve that it is looking to continue the normalization process helped the dollar extended its recovery. The dollar posted a significant technical reversal against many of the major currencies on May 3. The Dollar Index rose for its third week, as the greenback climbed against all the major currencies but sterling (+0.9%). Sterling was aided by some polls indicating a shift toward the Remain camp. The referendum will be held a month from Monday. Also, April retail sales rose twice the median forecast, pointing to a good start to Q2 for consumption. Sterling’s advance retraced more than 61.8% of the losses since May 3. We are skeptical of referendum-inspired gains. It is not like the referendum had blocked sterling. It appreciated 6.8% from late-February through early-May. It is in the options market that the referendum risk can be managed more effectively than in the spot market. The overall dollar direction is important for sterling, and the challenges for the UK transcend EU-relations. The market sold into the upticks, and sterling dropped 0.75% before the weekend and closed a little above .45. Initial support is seen near .4460, and then .4400, with the month’s low around .4335, which coincides with the lower Bollinger Band. The euro traded below .

Topics:

Marc Chandler considers the following as important: Daily FX, EUR, Featured, FX Trends, JPY, newsletter, SPY, USD

This could be interesting, too:

The combination of stronger US economic data and signals from the Federal Reserve that it is looking to continue the normalization process helped the dollar extended its recovery. The dollar posted a significant technical reversal against many of the major currencies on May 3. The Dollar Index rose for its third week, as the greenback climbed against all the major currencies but sterling (+0.9%). Sterling was aided by some polls indicating a shift toward the Remain camp. The referendum will be held a month from Monday. Also, April retail sales rose twice the median forecast, pointing to a good start to Q2 for consumption. Sterling’s advance retraced more than 61.8% of the losses since May 3. We are skeptical of referendum-inspired gains. It is not like the referendum had blocked sterling. It appreciated 6.8% from late-February through early-May. It is in the options market that the referendum risk can be managed more effectively than in the spot market. The overall dollar direction is important for sterling, and the challenges for the UK transcend EU-relations. The market sold into the upticks, and sterling dropped 0.75% before the weekend and closed a little above .45. Initial support is seen near .4460, and then .4400, with the month’s low around .4335, which coincides with the lower Bollinger Band. The euro traded below .

Topics:

Marc Chandler considers the following as important: Daily FX, EUR, Featured, FX Trends, JPY, newsletter, SPY, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Australian dollar has fallen for five consecutive weeks. It has dropped 8.4% since peaking on April 21 near $0.7835. With the push below $0.7200, the Aussie retraced 61.8% of the advance off the year’s low set in mid-January a little below $0.6830. The technical indicators are getting stretched, but they have not turned. Speculative longs in the futures market continue to exit, but there is scope for more liquidation. Participants should be on the look out of a reversal pattern to signal a correction. We look for the $0.7270-$0.7300 area should cap corrections.

Oil

The July crude oil futures contract spent the last three sessions consolidating the gains of the previous two sessions. It managed to close higher for the second consecutive week, and the sixth week in the past seventh. Many participants are talking about a test on $50 a barrel mark, though once burnt by over-expecting from OPEC, will not be anxious to repeat the experience. Technical support may be found near $47.25 initially. The trendline connecting the April 5, 16 and May 10 lows is at $46.45 at the end of next week.

Bonds

US 10-year notes sold off in the first half of last week and consolidated in the second half. The market is reluctant to push the yield back above 1.90%, and that of course is ahead of the 2.0% threshold. The 10-year yield has been largely in a 1.70%-1.90% range since late-March. Given the evidence for better growth prospects in Q2 may mean that yields may not need to fall below the middle of the range. Basis the June futures contract, the 129-30 to 130-06 may contain upticks.

Stocks

After briefly pushing through the band of support we identified in the 2030-2040, the S&P 500 bounced back in the second half of last week and closed a little above 2050. The 0.6% gain before the weekend were sufficient to ensure a higher settlement on the week to snap a three-week declining streak. Technical indicators do not appear to be generating strong signals at the moment, but follow through gains may run into the “sell in May and go away” offers in the 2065-2080 area.

(data and graphs added by George Dorgan, original post on Marc to Market)