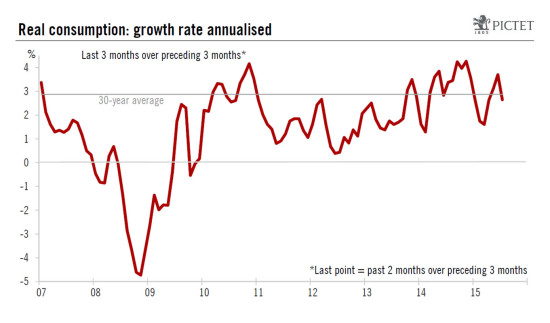

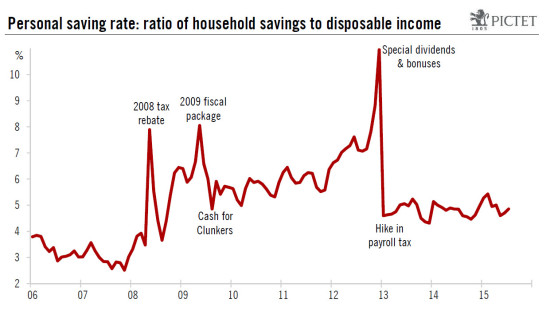

Today’s data on July’s consumer spending were less robust than expected. Nevertheless, we continue to expect consumption growth to reach some 3.0% overall in Q3. July data on household consumption and income were published today. Real consumption rose by 0.2% m-o-m in July, slightly below consensus estimates (+0.3%). Already published data on retail sales and car sales for July had been quite upbeat, suggesting a more solid reading. However, in line with the revised Q2 GDP data published yesterday, previous monthly figures for consumption were adjusted to a marginally stronger path. Nevertheless, the end-result was that, between Q2 and July, consumption grew by 2.5% annualised, after +3.1% q-o-q in Q2. The relatively moderate monthly outcome for July’s consumption cannot be blamed on a lack of growth in income. Real disposable income rose by a robust 0.4% m-o-m, following a smaller rise of 0.2% in June. As disposable income growth outpaced consumer spending growth in July, the corollary was a rise in savings. The saving rate increased from 4.7% (revised down from 4.8%) in June to 4.9% in July (see the chart below). Overall, we remain optimistic about future growth in consumption. The pace of job creation remains solid, consumer confidence is high (though volatile), and oil prices have fallen back markedly over the past few weeks.

Topics:

Bernard Lambert considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Today’s data on July’s consumer spending were less robust than expected. Nevertheless, we continue to expect consumption growth to reach some 3.0% overall in Q3.

July data on household consumption and income were published today. Real consumption rose by 0.2% m-o-m in July, slightly below consensus estimates (+0.3%). Already published data on retail sales and car sales for July had been quite upbeat, suggesting a more solid reading. However, in line with the revised Q2 GDP data published yesterday, previous monthly figures for consumption were adjusted to a marginally stronger path. Nevertheless, the end-result was that, between Q2 and July, consumption grew by 2.5% annualised, after +3.1% q-o-q in Q2.

The relatively moderate monthly outcome for July’s consumption cannot be blamed on a lack of growth in income. Real disposable income rose by a robust 0.4% m-o-m, following a smaller rise of 0.2% in June. As disposable income growth outpaced consumer spending growth in July, the corollary was a rise in savings. The saving rate increased from 4.7% (revised down from 4.8%) in June to 4.9% in July (see the chart below).

Overall, we remain optimistic about future growth in consumption. The pace of job creation remains solid, consumer confidence is high (though volatile), and oil prices have fallen back markedly over the past few weeks. We continue to expect growth in consumer spending to settle at around 3.0% q-o-q annualised in Q3, after +3.1% in Q2.

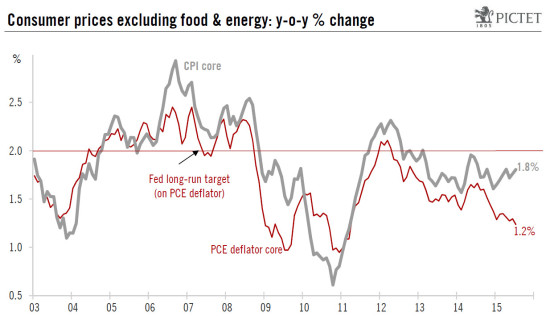

Core PCE inflation remains very subdued

In yesterday’s report on income and consumption, data were also published on the Personal Consumption Expenditures (PCE) deflator, the price measure targeted by the Fed. At core level (i.e. excluding food and energy), the PCE price index increased by 0.1% m-o-m in July, in line with consensus expectations. On a y-o-y basis, core PCE inflation rounded down to 1.2%, against 1.3% in June.

Core PCE inflation remains very moderate for the time being. With the lagged indirect impact of the ongoing latest spell of falling oil prices (and other commodities) and the recent further increase in the dollar, core PCE inflation is unlikely to pick up more than marginally, at least over the rest of this year.