Covid vaccine results from AstraZeneca and Oxford University brought another wave of optimism; dollar weakness has resumed; that said, we will refrain from making any longer-term calls for the demise of the dollar Reports suggest President-elect Biden is pushing House Democrats to reduce the size of their fiscal package demands to unlock negotiations; Republicans have an interest in compromising President-elect Biden has reportedly picked his diplomatic team; it’s a quiet week in the US due to the Thanksgiving holiday The latest Brexit headlines have been as optimistic as can be for this stage of the process; Eurozone preliminary November PMI readings were weaker than expected; UK preliminary November PMI readings were stronger than expected Korea posted a strong

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Covid vaccine results from AstraZeneca and Oxford University brought another wave of optimism; dollar weakness has resumed; that said, we will refrain from making any longer-term calls for the demise of the dollar

- Reports suggest President-elect Biden is pushing House Democrats to reduce the size of their fiscal package demands to unlock negotiations; Republicans have an interest in compromising

- President-elect Biden has reportedly picked his diplomatic team; it’s a quiet week in the US due to the Thanksgiving holiday

- The latest Brexit headlines have been as optimistic as can be for this stage of the process; Eurozone preliminary November PMI readings were weaker than expected; UK preliminary November PMI readings were stronger than expected

- Korea posted a strong bounce in exports for the first 20 days of November

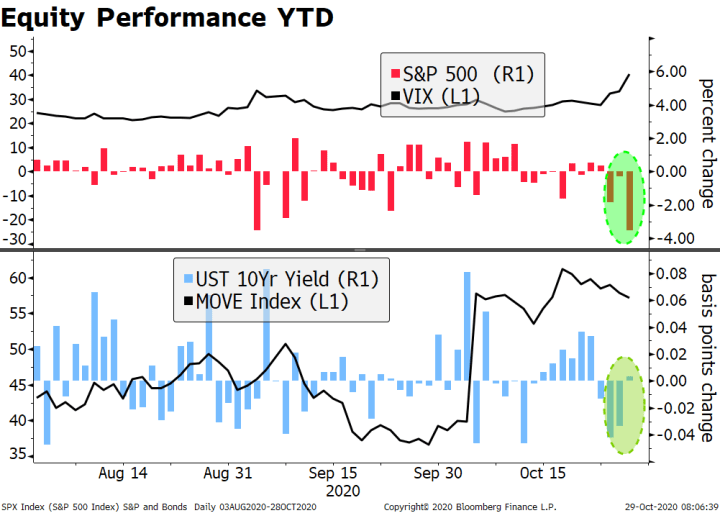

Covid vaccine results from AstraZeneca and Oxford University brought another wave of optimism. Even if less effective (70% efficacy) than other treatments, this seems to be a far more practical solution from a logistical point of view, meaning it would be easier to distribute beyond the developed markets.

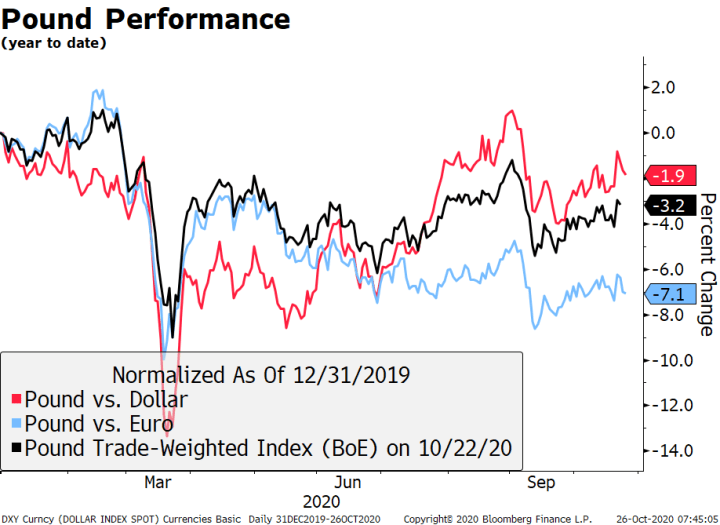

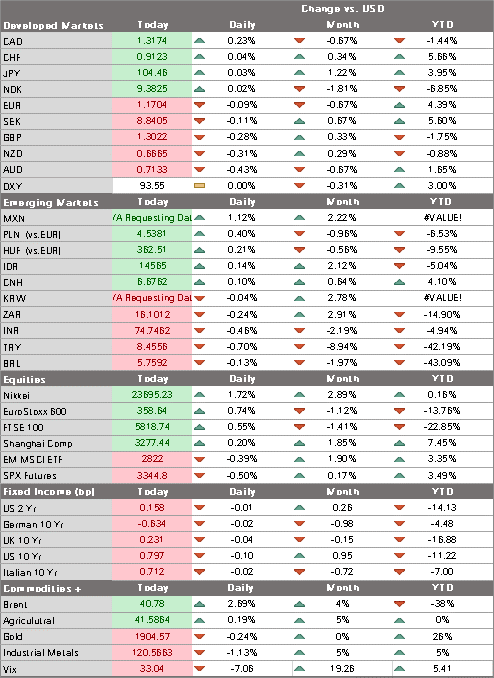

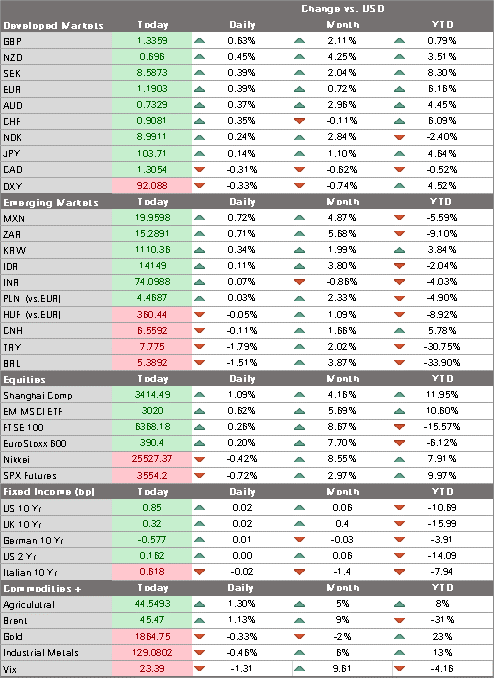

Dollar weakness has resumed. DXY is trading at the lowest level since September 1 and is on track to test that day’s low near 91.746. Given our bearish US outlook for Q4 and early Q1, weakness should persist beyond that level and so we are left looking at the February 2018 low near 88.253. There’s really not much in the way of significant chart points in between. With regards to the euro, that suggests the September 1 high near $1.2010 is the next big target. After that the equivalent February 2018 high comes in near $1.2555. Sterling is marching to the tune of its own Brexit drummer but a successful deal should see cable test the September high near $1.3480 and perhaps make some good headway towards the April 2018 high near $1.4375.

That said, we will refrain from making any longer-term calls for the demise of the dollar. We note that weakening to those 2018 lows would still keep the dollar within broad trading ranges seen since 2015. That is, it should not be seen as some historic dollar decline. We still think this is cyclical dollar weakness, not structural, and believe that President-elect Biden’s efforts to rein in the virus will eventually be key to improving the dollar’s medium-term outlook. Aggressive Fed easing has once again set the table for a solid rebound, but much work needs to be done to actually serve the meal.

AMERICAS

Reports suggest President-elect Biden is pushing House Democrats to reduce the size of their fiscal package demands to unlock negotiations. Their hope is to deliver something before inauguration as the virus continues to hobble the economy even as emergency unemployment benefits are set to run out at year-end. In exchange for expediency, Biden’s team appears willing to accept a smaller deal that’s closer in size to Senate Majority Leader McConnell’s skinny bill of around $500 bln. However, Democratic Congressional leaders have so far shown little willingness to go below $2 trln. Reports also suggest Biden is weighing several executive orders extending the moratorium on evictions and foreclosures and deferring student loan payments.

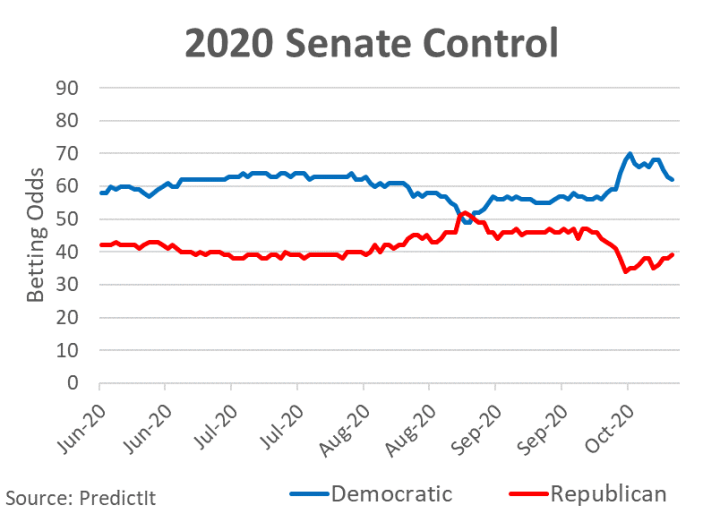

Republicans have an interest in compromising. With two Senate seats up for grabs in Georgia, the optics of another failed stimulus compromised would be bad. Reports emerged last week that Treasury Secretary Mnuchin is trying to revive stalled stimulus talks. Mnuchin talked with Senate Majority Leader McConnell and House Minority Leader McCarthy last Friday to devise a strategy for approaching House Speaker Pelosi and Senate Minority Leader Schumer. Pelosi and Schumer last week wrote to McConnell asking to restart stimulus talks. Congress is on recess this week and returns to work November 30 and is then expected to adjourn no later than December 18 and so time is of the essence.

President-elect Biden has reportedly picked his diplomatic team. Reports suggest his long-time aide Anthony Blinken will be Secretary of State. The posts of National Security Adviser and Ambassador to the UN have also apparently been chosen but Biden plans to officially name his first cabinet picks Tuesday. No news yet on the economic team, but Biden said last week that he has already picked the important Treasury post. Many believe Yellen’s stock has risen while Brainard’s has fallen, but either choice would be an excellent one. The relationship between Treasury and the Fed has been damaged and both choices would help mend fences and improve coordination.

It’s a quiet week in the US due to the Thanksgiving holiday. Mostly minor data will be reported early in the week, with October Chicago Fed National Activity Index and Markit preliminary November PMIs kicking things off today. PMI readings are expected to soften, with manufacturing expected to fall to 53.0 from 53.4 and services to 55.0 from 56.9. Chicago Fed NAI is expected to remain steady at 0.27, confirming that momentum in the US economy has yet to be regained as Q4 starts off. Barkin, Daly, and Evans speak today.

| EUROPE/MIDDLE EAST/AFRICA

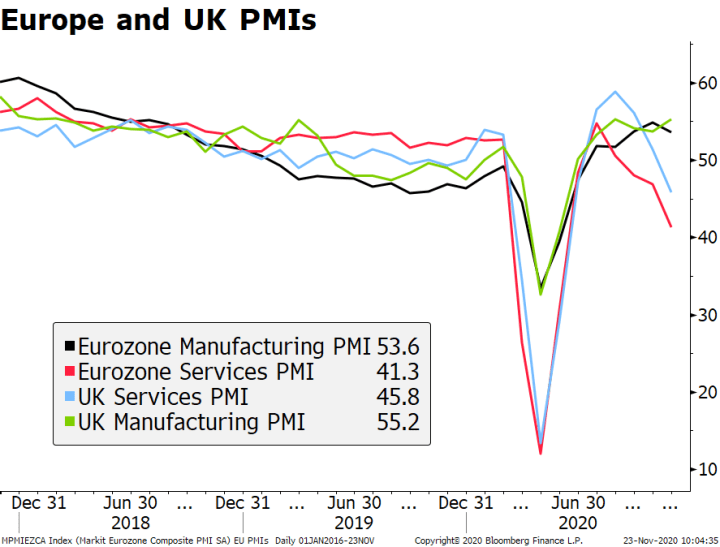

The latest Brexit headlines have been as optimistic as can be for this stage of the process. EU officials said a deal is 95% agreed, while UK officials are hopeful. Still, we probably won’t cross the finish line for days still. Reports suggest UL Prime Minister Johnson will make a “significant intervention” this week in talks with EC President von der Leyen in an effort to break the deadlock. While the deadline is a moving target, sources suggest next Tuesday December 1 is what both sides are working with. Face to face talks are expected to restart Thursday. Eurozone preliminary November PMI readings were weaker than expected. Headline manufacturing fell to 53.6 vs. 53.2 expected and 54.8 in October, while services fell to 41.3 vs. 42.0 expected and 46.9 in October. As a result, the eurozone composite PMI fell to 45.1 vs. 45.6 expected and 50.0 in October. Looking at the country breakdown, the service sectors were also hit harder than manufacturing. France was hit the hardest as its composite PMI fell to 39.9 from 47.5 in October, while the German composite only fell to 52.0 from 55.0 in October. The observed patterns are very much the outcome one would expect from the second wave lockdowns clamping harder on services such as restaurants and leisure activities. This supports our view that the overall economic impact from the second lockdowns should end up being considerably smaller than the first. Final PMI readings will be reported December 1. UK preliminary November PMI readings were stronger than expected. Manufacturing rose to 55.2 vs. 50.5 expected and 53.7 in October, services fell to 45.8 vs. 43.0 expected and 51.4 in October, and the composite PMI fell to 47.4 vs. 42.5 expected and 52.1 in October. Although all readings were above forecast, the services and the composite PMIs fell back into contractionary territory. The bounce in UK manufacturing could also be partially due stockpiling ahead of separation from the EU and its associated risks. |

Europe and UK PMIs, 2018-2020 |

| ASIA

Korea posted a strong bounce in exports for the first 20 days of November. This early reading registered 11.1% y/y growth, though this strength was due in part to half an extra working day this year. Adjusting for this, average daily exports rose 7.6% y/y, which is still robust. The November data points to strong external demand, especially in electronics and semiconductors. Exports to China rose 7.2%. Imports rose 1.3% y/y, recovering from a steep decline last month. The readings bode well for the rest of the region too. The Korean won is outperforming on the day (+0.3% against the dollar) while the Kospi posted a near 2% gain, now up almost 20% on the year. |

. |

Tags: Articles,Daily News,Featured,newsletter