Markets are starting the week in risk-off mode; the dollar is firm on some safe haven flows but this is likely to prove temporary US politics is coming in to focus as the election nears; we fear that the likely horse-trading and arm-twisting will take away any residual desire to get another stimulus package done The trend towards more restrictive measures continues with London in focus; between the virus numbers and Brexit risks, sterling remains under pressure China left its Loan Prime Rates (LPR) unchanged, as expected; trade data out of Korea and Taiwan came in firm Markets are starting the week in risk-off mode. It’s hard to point to one single cause, as there are many risks building. These include (but are in no way limited to) rising viral numbers in Europe,

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Markets are starting the week in risk-off mode; the dollar is firm on some safe haven flows but this is likely to prove temporary

- US politics is coming in to focus as the election nears; we fear that the likely horse-trading and arm-twisting will take away any residual desire to get another stimulus package done

- The trend towards more restrictive measures continues with London in focus; between the virus numbers and Brexit risks, sterling remains under pressure

- China left its Loan Prime Rates (LPR) unchanged, as expected; trade data out of Korea and Taiwan came in firm

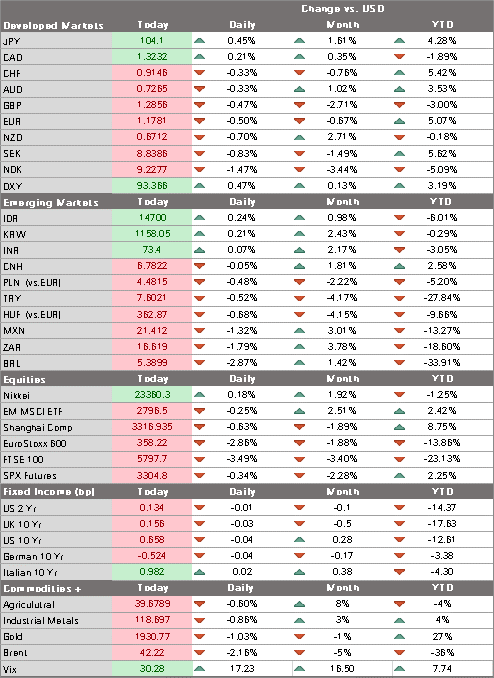

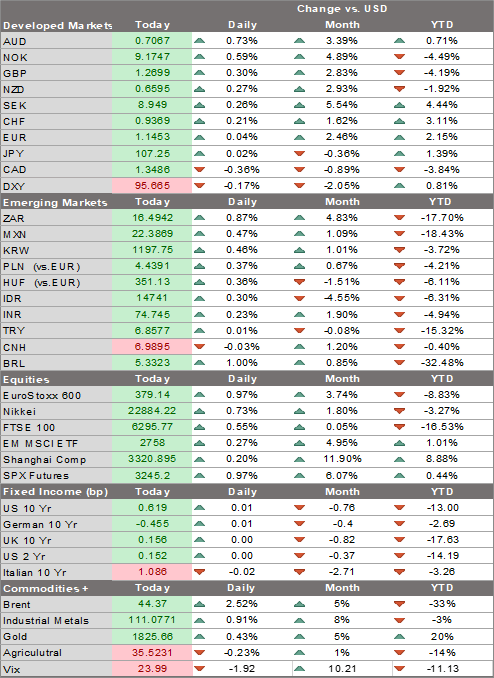

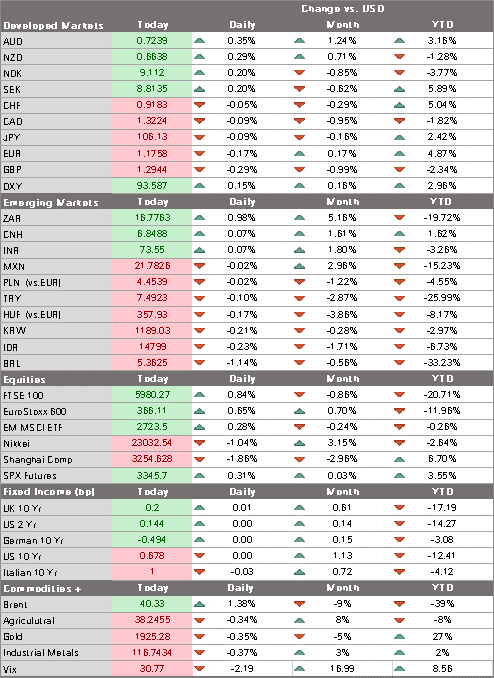

Markets are starting the week in risk-off mode. It’s hard to point to one single cause, as there are many risks building. These include (but are in no way limited to) rising viral numbers in Europe, rising hard Brexit risks, softening recoveries in the major economies, rising political risk in the US, and a negative report on the global banking sector (see below). Some of these drivers have been present for weeks, if not months, but the confluence of so many negative factors has been too much for equity markets to ignore. The Asian session passed quietly but sentiment has soured during the European morning.

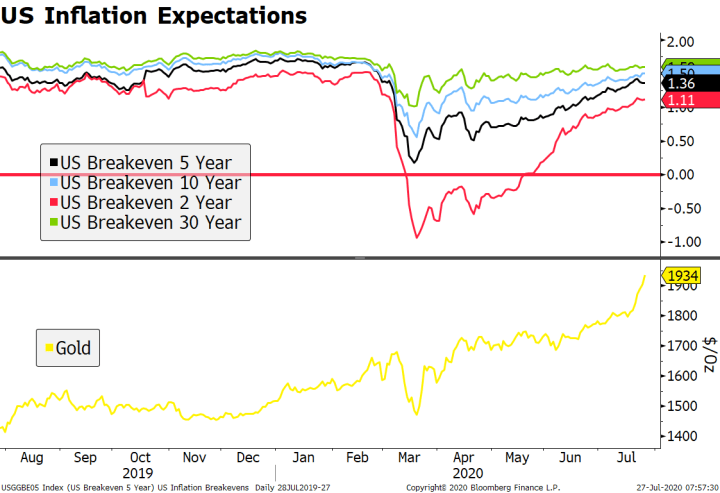

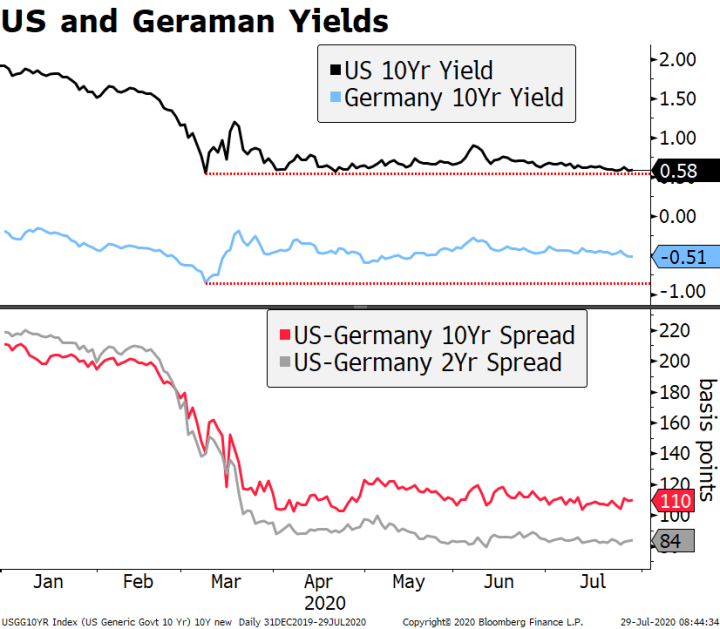

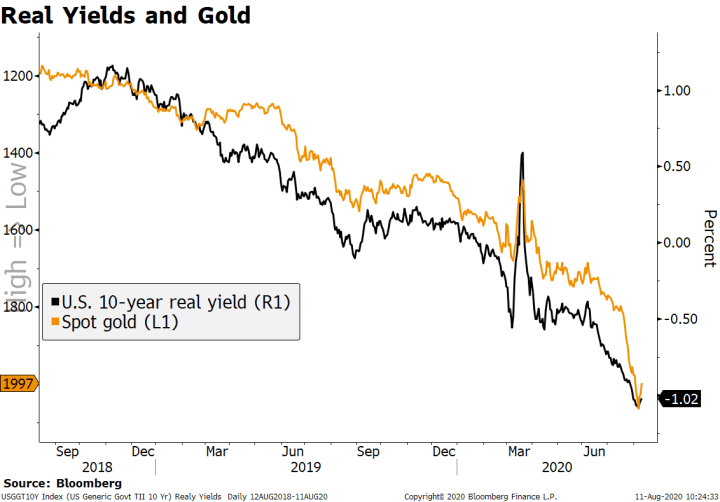

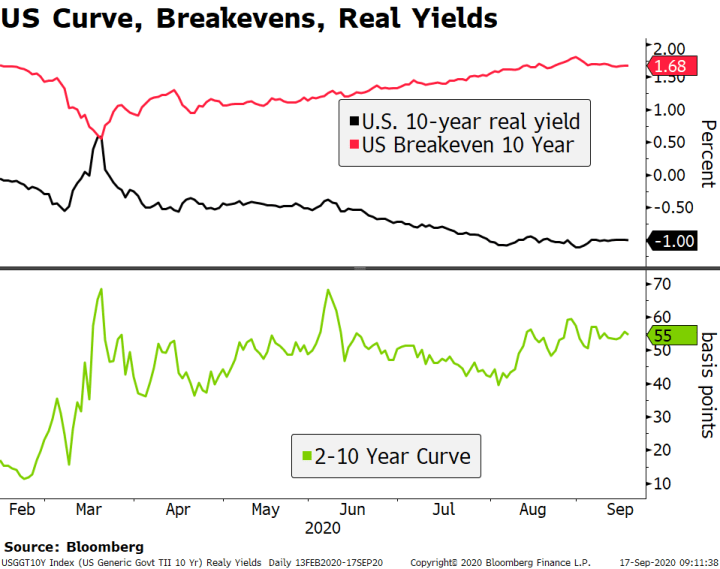

The dollar is firm on some safe haven flows but this is likely to prove temporary. Since the pandemic intensified in March, the dollar has seen some bouts of risk-off buying but these has always proved to be temporary. This time is likely to be no different and DXY should prove unable to break above the key 94 area. The easiest route to express our dollar view right now may be against the yen, as USD/JPY is easily making new lows for this move and has broken below the July 31 low near 104.20. Charts point to a test of the March low near 101.20. The broad-based weak dollar trend should resume as we remain negative on the dollar due to the now-familiar combination of an ultra-dovish Fed and softening US economic data. Now, we can add US political risk into the mix (see below).

Global banks are under pressure after leaked documents showed that many of them continued to undertake suspicious activities after the financial crisis. The report from the International Consortium of Investigative Journalists was published by online and allegedly show institutions moving illicit funds and helping clients bypass sanctions despite warnings from US officials. European banking stocks are getting hit hard. The EuroStoxx banks sub-index is down some 6% on the day and 44% on the year, compared to a decline of 13% for the EuroStoxx 600.

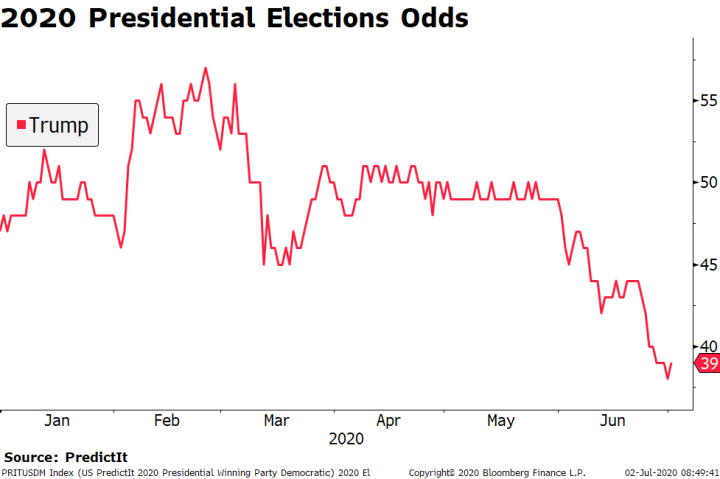

AMERICAS

US politics is coming in to focus as the election nears. The death of Supreme Court Justice Ginsburg has introduced a huge element of uncertainty and volatility into the situation. The most direct impact is likely to be further delays in the stimulus package. Indeed, we think it has become less likely that a deal comes before the election, as the Republican-led Senate appears to be marshaling all its forces now into pushing through a replacement for Justice Ginsburg. This is likely to be very acrimonious and risks widening the already wide partisan divide. Two Republican Senators (Collins and Murkowski) have already come out in opposition to installing her replacement ahead of the election. Two more Republicans opposing the move would effectively end it.

We fear that the likely horse-trading and arm-twisting will take away any residual desire to get another stimulus package done. The compromise proposed by the so-called Problem Solvers Caucus has gone nowhere and now the Supreme Court battle is heating up. Data last week support our view that the US economy is softening and in need of another dose of fiscal stimulus. The Fed has promised to do all it can to sustain the recovery but monetary policy can only do so much.

What does the court battle mean for the actual election? One can make a case that it will energize voter turnout in both parties. With so much at stake (reproductive rights, healthcare, the environment, immigration), voters across the US political spectrum will likely turn out in even greater force. Indeed, one possible scenario would be for President Trump to keep the nomination hanging as a motivation for conservative voters to come out in his support. Or he could try to push a replacement through, leaving the courts skewed 6-3 towards the conservative side, which may matter during a possible post-electoral dispute. These developments also conveniently shift the conversation away from the virus, which continues to rage in many states. With so much uncertainty, no wonder the markets are taking some profits now and moving to the sidelines with 43 days left until the election.

With the media embargo lifted, quite a few Fed officials will speak this week. All will be quizzed extensively about the Fed’s new framework and what it means for Fed policy. To us, it’s clear that US rates will stay lower for longer than previous Fed incarnations would allow. Brainard speaks today. The only US data out today is August Chicago Fed National Activity Index, which is expected at 1.19 vs. 1.18 in July.

EUROPE/MIDDLE EAST/AFRICA

The trend towards more restrictive measures continues with London in focus. This may be more of a political decision than a medical one. The UK government was badly burned by its handling of the pandemic’s first round, leaving it more vulnerable to public opinion in its handling of the second round. Once again, the much lower levels of hospitalizations and deaths this time around should inform policymakers to towards specific rather than broad (or national) reactions. But again, it’s a political decision.

Between the virus numbers and Brexit risks, sterling remains under pressure. After failing to break above $1.30, cable is testing the downside . The $1.2720 area may be key, as it represents the last major retracement objective from the rally since June and also coincides with the 200-day moving average currently around $1.2730. Break below this area would set up a test of the June 29 low near $1.2250.

| ASIA

China left its Loan Prime Rates (LPR) unchanged, as expected. The 1-year rate remains at 3.85% and the 5-year at 4.65%, where they are likely to remain for some time. With the domestic economy still recovering at a good pace, we think a fallout in external demand might be the key variable that could prompt further action. The main risks to external demand are probably further economic restrictions from government reactions to a second virus wave, and a potential escalation of the US-China trading conflict. We think the former risk is larger than the latter, at least ahead of the US elections. Korea reported trade data for the first 20 days of September. Exports rose 3.6% y/y while imports fell -6.8% y/y and are a clear improvement from August, where revised data show exports contracted -10.1% y/y and imports contracted -15.8% y/y. If sustained for the entire month, the y/y gain would be the first since February. Korea is clearly benefiting from the regional recovery in trade and activity. While USD/KRW is trading at the lowest level since January, the more important JPY/KRW cross is about 7% higher during that same period as it appears that yen strength has helped keep Korean exporters competitive. Taiwan reported strong August export orders. Orders rose 13.6% y/y vs. 9.7% expected and 12.4% in July. This is the strongest reading since January 2018 and have risen y/y since March, pointing to export strength in H2. Last week, the central bank kept rates steady at 1.125% and raised its growth forecast for this year by a tick to 1.6%. Governor Yang said Taiwan’s solid performance is being driven by strong exports. We note that export strength is all the more remarkable given TWD is trading at the strongest level against USD since February 2018. |

Tags: Articles,Daily News,Featured,newsletter