The only realistic Plan B is a fundamental, permanent re-ordering of the cost structure of the entire U.S. economy. The fantasy of a V-shaped recovery has evaporated, and expectations for a W or L-shaped recovery are increasingly untenable. So forget V, W and L; the letters that will shape the future are N, P, B: there is No Plan B. All the hopes for a recovery were based on a quick return to the economy that existed in late 2019. All the bailouts and stimulus programs were based on this single goal: a quick return to The Old Normal. This was Plan A. For all the reasons that have been laid out here over the past six months, The Old Normal is gone for good. The Old Normal economy was too precarious, too brittle and too fragile to survive the toppling of any domino,

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The only realistic Plan B is a fundamental, permanent re-ordering of the cost structure of the entire U.S. economy.

The fantasy of a V-shaped recovery has evaporated, and expectations for a W or L-shaped recovery are increasingly untenable. So forget V, W and L; the letters that will shape the future are N, P, B: there is No Plan B.

All the hopes for a recovery were based on a quick return to the economy that existed in late 2019. All the bailouts and stimulus programs were based on this single goal: a quick return to The Old Normal. This was Plan A.

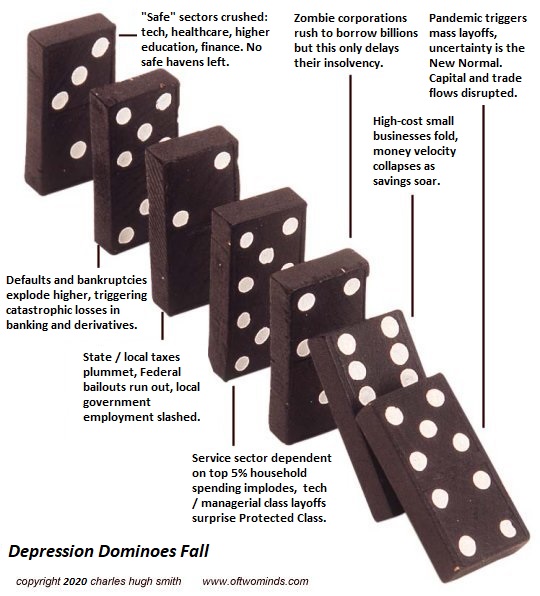

For all the reasons that have been laid out here over the past six months, The Old Normal is gone for good. The Old Normal economy was too precarious, too brittle and too fragile to survive the toppling of any domino, as the only Plan A “solution” was to push destabilizing extremes to new extremes, i.e. doing more of what failed spectacularly and increasing the fragility of precariously fragile systems.

|

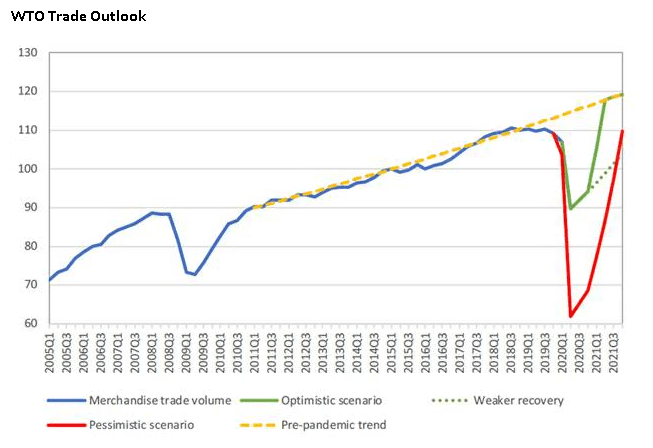

A short list of what’s been irreversibly destabilized due to a systemic collapse in demand, exponential rise in risk and uncertainty, dependence on over-indebtedness, imploding global supply chains, structural decline in income and employment and the rapid emergence of new business models that obsolete high-cost, inefficient, sclerotic, bureaucratic monopolies include: 1.Healthcare 2. Higher education 3. Commercial real estate 4. Tourism 5. Restaurants / live entertainment 6. Business travel / conferences 7. Office parks, commutes, urban work forces, etc. 8. High-cost urban lifestyles We could also include entire sectors that have yet to recognize the tsunami that’s about to wash away their Old Normal: marketing, finance, local governance, etc. The problem is there’s no Plan B for anything in the U.S. economy. There is only Plan A, a return to 2019 / The Old Normal. If that’s no longer possible, there is literally nothing left on the policy / response plate. What nobody dares even ask is: what businesses and industries will still be financially viable running at 50% capacity? How many cafes, restaurants, resorts, airlines, etc. will turn a profit operating at 50% capacity? How many can not just survive half of the seats being empty, but turn a profit? |

Depression Dominoes Fall |

| The short answer is very few, because the operating costs of most businesses are unbearably high. The likely survivors are those enterprises with low fixed costs and low operating costs– enterprises that own their facilities in locales with low property taxes, and enterprises that can be run by the owners without employees.

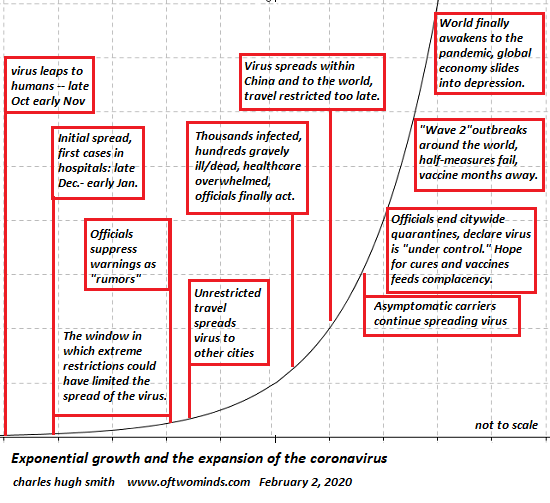

How many enterprises have these kinds of barebones cost structures? Very few. For most enterprises, the only way they can lower their costs to a level that enables their survival is to cut costs by half: cut rent, mortgages, debt service, property taxes, fees, utilities, insurance, etc. by half. That would mean everyone down the line would have to survive on half of their previous revenues: landlords, banks, local municipalities, service providers, and so on. How many of these institutions and enterprises could survive on 50% of their previous revenues? The only realistic Plan B is a fundamental, permanent re-ordering of the cost structure of the entire U.S. economy. Call it DeGrowth, or creative destruction, or disruption if you prefer, but whatever name we use, the reality will be extraordinarily disruptive, uncertain, risky and unpredictable. As many of us has explained over the years, unstable, brittle, fragile systems characterized by soaring inequality, pay-to-play political corruption and dependence on debt, leverage and speculative bubbles were unsustainable. Plan B can be a chaotic mess of denial and failed half-measures that only make all the problems worse, or it can be a positive transformation that results in a society that does more with less. The choice is ours. Unfortunately, the pandemic chart I composed on February 2, 2020 is still playing out, increasing uncertainty. |

Exponential growth and the expansion of the coronavirus |

Tags: Featured,newsletter