In 2020, increasing monetary and fiscal stimulus will be the equivalent of spraying gasoline on a fire to extinguish it. Economically, the 11 years since the Global Financial Crisis of 2008-09 have been one relatively coherent era of modest growth, rising wealth/income inequality and coordinated central bank stimulus every time a crisis threatened to disrupt the domestic or global economy. This era will draw to a close in 2020 and a new era of destabilization and uncertainty begins. Why will all the policies that have worked so well for 11 years stop working in 2020? All the monetary/fiscal policies of the past decade were simply extreme versions of tried-and-true policies that central banks and governments have used for the past 75 years to restore growth in a

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In 2020, increasing monetary and fiscal stimulus will be the equivalent of spraying gasoline on a fire to extinguish it.

Economically, the 11 years since the Global Financial Crisis of 2008-09 have been one relatively coherent era of modest growth, rising wealth/income inequality and coordinated central bank stimulus every time a crisis threatened to disrupt the domestic or global economy.

This era will draw to a close in 2020 and a new era of destabilization and uncertainty begins.

Why will all the policies that have worked so well for 11 years stop working in 2020?

All the monetary/fiscal policies of the past decade were simply extreme versions of tried-and-true policies that central banks and governments have used for the past 75 years to restore growth in a recession or financial crisis: lower interest rates, increase credit/liquidity, and ramp up government spending (i.e. deficit spending) to compensate for declining private-sector spending.

These policies were designed to be short-term stimulus programs to jump-start the economy out of a slowdown (recession), which typically lasted between 9 and 18 months.

These policies are now permanent, as the system is now dependent on these policies. Any reduction in central bank stimulus causes a market crash (witness the 20% drop in 2018 as the Fed slowly raised interest rates from near-zero) and any reduction in deficit spending threatens to trigger a recession.

The problem is that these policies create distortions that cannot be fixed with more of what caused the distortions in the first place: more extreme monetary and fiscal stimulus.

|

Systemic distortions include: A. Soaring wealth-income inequality across the entire global economy. B. Dependence on asset bubbles to generate the “wealth effect” that encourages spending by the top 5% who own two-thirds of the assets bubbling higher. C. Dependence on asset bubbles to generate capital gains and property tax revenues for state/local governments. D. Loss of cost discipline: the solution across the entire spectrum–government, corporate and household–is now to borrow more, not trim costs via innovation or increases in productivity and efficiency. E. Reliance on debt to fund spending leads to rising defaults which will collapse the system. (Soaring auto-loan defaults are the canary in the coal mine.) F. Zero interest rates have generated over-capacity/over-production as everyone seeks a return on capital by expanding market share. Now there are global gluts in everything from autos to natural gas to electronics. G. With the yield on savings now less than zero due to inflation, investors must gamble in the asset-bubble casino as this is only available way to earn a return. H. Buffers are thinning. I’ve discussed this in depth over the years; dependence on stimulus lowers systemic resilience, rendering the entire system increasingly vulnerable to a phase-shift that fatally destabilizes the system. I. Prior to the 2008-2019 era, the “real economy” of sales, wages and profits led the stock market. Now the stock market dominates the real economy, as the central banks have turned the stock market into the ‘signaling device’ that all is well and the source of bringing demand forward (i.e. the wealth effect). In Mohammed El-Erian’s words: “The Fed can’t pull back because it’s worried it will disrupt markets that can be a spillover on the economy. The Fed’s in a lose, lose, lose situation, they can’t stay where they are, they can’t do more, they can’t do less.” In Andy Xie’s words: “The Fed has gone from the financial bubble’s hostage to its guardian.” J. There are limits on encouraging more borrowing by lowering interest rates to zero. Even at zero interest rates, income must be devoted to paying principal. At some point, all available income is already consumed in debt service. Anecdotally, we’re already there: zombie corporations (that only survive by increasing their debt loads) are becoming more numerous, and households burdened with student loans, auto loans, credit cards and mortgages cannot afford more debt even at zero interest. |

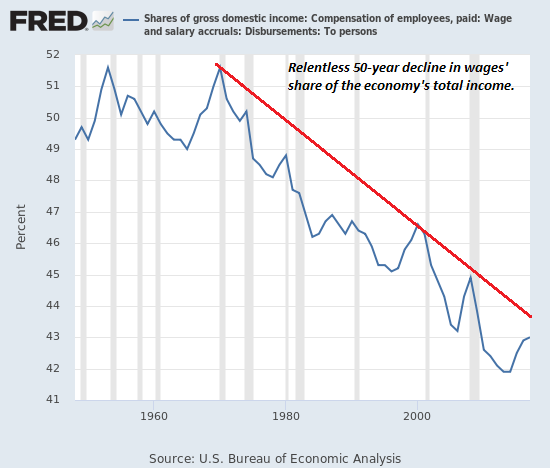

Shares of Gross Domestic Income, 1960-2019 |

| Policy makers are now trapped. Unable to reverse the policies that have created the distortions lest that crash the system, they only have two responses, neither of which actually address the distortions undermining the system:

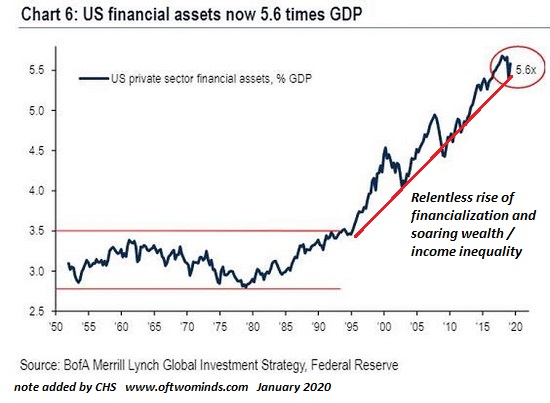

1) push extremely distorting policies to new extremes, or 2) attempt policy-tweaks–higher taxes on the wealthy, etc.–that ignore the causes of the distortions. These policy tweaks are the classic “band-aids treating cancer.” The abject failure of these policies (short-term turned into permanent, with all the resulting long-term distortions) is now visible to all, and we’re seeing articles in the most influential mainstream media outlets questioning the current versions of global capitalism; for example, the new issue of Foreign Affairs magazine is devoted to The Future of Capitalism, an implicit confirmation that the current version, dependent on extremes of debt, speculation and stimulus, has no future. Is there a way out? No. That these policies have not restored “organic growth” (i.e. growth that isn’t dependent on zero interest rates, speculative bubbles and tens of trillions of dollars in permanent stimulus) must be accepted, along with the need for a painful re-set. The odds of this happening are near-zero, as politicians who cause economic pain lose the support of the populace. This leaves us with the pain of ever-greater distortions, which will drive economic instability, fragmentation, social disorder and financial crashes. Inherently unstable systems can appear stable for quite some time as the instability builds beneath the placid surface. In 2020, increasing monetary and fiscal stimulus will be the equivalent of spraying gasoline on a fire to extinguish it. These two charts summarize the disastrous consequences of permanent monetary stimulus: wages’ share of the economy are in relentless decline, while the equally relentless rise of financialization has generated soaring wealth / income inequality that increasingly threatens to rip our society and economy to shreds. This essay was drawn from the Musings Reports, which are emailed weekly exclusively to patrons and subscribers. |

US financial assets now 5.6 times GDP, 1960-2020 |

Tags: Featured,newsletter