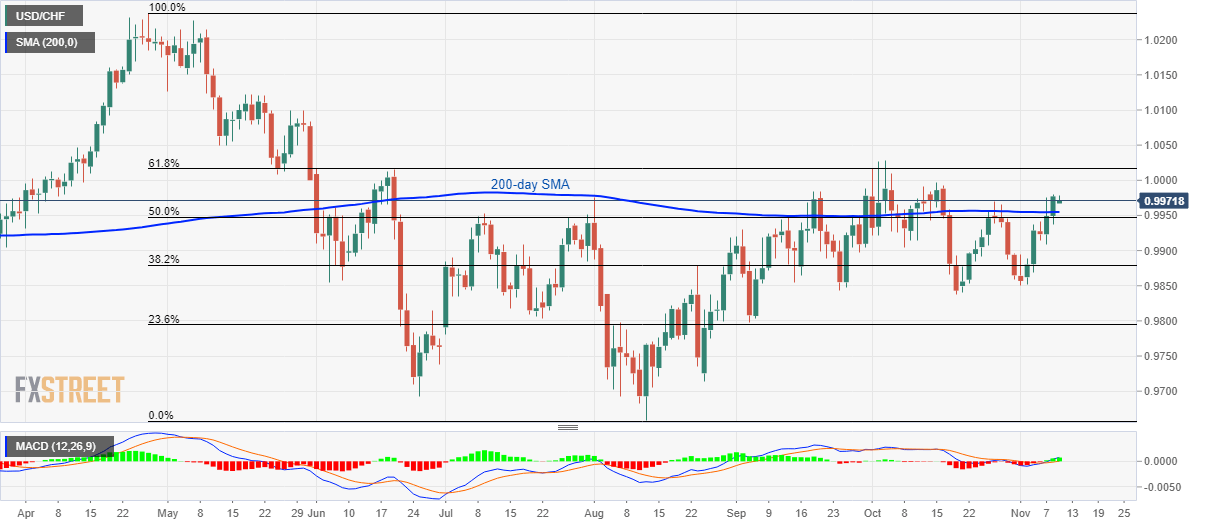

USD/CHF fails to cross mid-October high, 61.8% Fibonacci retracement. A downside break of 0.9948 could recall 0.9900 on the chart Bullish MACD keeps buyers hopeful. The USD/CHF pair’s failure to rise beyond mid-October highs can’t be considered as it’s weakness unless the quote traders above 200-day SMA, 50% Fibonacci retracement of April-August downpour. The prices seesaw around 0.9970 during early Monday. Also favoring the buyers are the bullish signals from 12-bar Moving Average Convergence and Divergence (MACD). As a result, prices could keep targeting a sustained move beyond October 15 high around 1.0000, also clearing 61.8% Fibonacci retracement level of 1.0016, to question May-end top near 1.0100. On the contrary, pair’s declines below 50% Fibonacci

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF fails to cross mid-October high, 61.8% Fibonacci retracement.

- A downside break of 0.9948 could recall 0.9900 on the chart

- Bullish MACD keeps buyers hopeful.

| The USD/CHF pair’s failure to rise beyond mid-October highs can’t be considered as it’s weakness unless the quote traders above 200-day SMA, 50% Fibonacci retracement of April-August downpour. The prices seesaw around 0.9970 during early Monday.

Also favoring the buyers are the bullish signals from 12-bar Moving Average Convergence and Divergence (MACD). As a result, prices could keep targeting a sustained move beyond October 15 high around 1.0000, also clearing 61.8% Fibonacci retracement level of 1.0016, to question May-end top near 1.0100. On the contrary, pair’s declines below 50% Fibonacci retracement level of 0.9948 could drag the quote to 0.9900 while the monthly bottom close to 0.9850 and the October 18 low of 0.9837 might please sellers then after. In a case where bears keep the reins after 0.9837, 23.6% Fibonacci retracement level of 0.9795 will be on their radars. |

USD/CHF daily chart(see more posts on USD/CHF, ) |

Trend: Bullish

Tags: Featured,newsletter,USD/CHF