Swiss Franc flat versus US Dollar, down against its European rivals. Another weak economic report from the US keeps the Greenback and markets under pressure. The USD/CHF pair again was capped by the 1.0025/30 area and pulled back. Near the end of the session it is hovering around 0.9980/85 after falling to 0.9950. The Greenback weakened after US data and then recovered ground modestly. Despite rising against the US dollar, the Swiss Franc was the worst during the American session among European currencies. The bounce in equity prices favored other currencies. “The highlight of the session was the US ISM services, which dropped more than expected to a three-year low in September (52.6, consensus 55, prior 56.4). Growth in orders and business activity slowed

Topics:

Matías Salord considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Swiss Franc flat versus US Dollar, down against its European rivals.

- Another weak economic report from the US keeps the Greenback and markets under pressure.

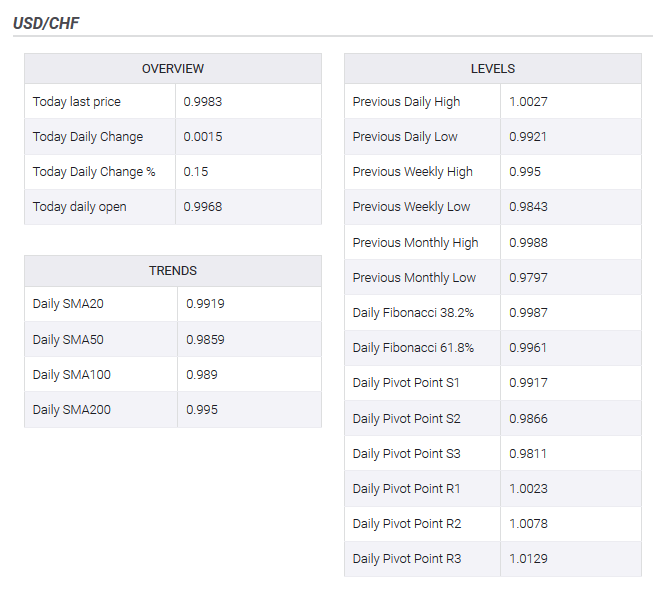

The USD/CHF pair again was capped by the 1.0025/30 area and pulled back. Near the end of the session it is hovering around 0.9980/85 after falling to 0.9950.

The Greenback weakened after US data and then recovered ground modestly. Despite rising against the US dollar, the Swiss Franc was the worst during the American session among European currencies. The bounce in equity prices favored other currencies.

“The highlight of the session was the US ISM services, which dropped more than expected to

a three-year low in September (52.6, consensus 55, prior 56.4). Growth in orders and business activity slowed abruptly, while the employment gauge registered its weakest print in more than five years. Elsewhere, the Eurozone’s September services PMI was downwardly revised (51.6, consensus 52, prior 52), suggesting that the downturn is spreading from manufacturing to services as the private sector stagnates. However, Italy’s services PMI remained strong in September as its business confidence increases”, explained BBVA analysts.

They added that the gloomy US economic outlook “increased market expectations of an additional Fed rate cut by the end of October from 73% to 90%, whereas two additional cuts by the end of this year remains high (65%).” Those expectations weight on the US Dollar.

Technical outlookPrice continues to move within an ascendant channel with a key support around 0.9890 where the 100-day moving average also stands. Before that level, the 20-day SMA near 0.9920 is likely to offer support. On the upside, USD/CHF continues to be unable to consolidate on top of 1.0000 and remains capped by 1.0025/30. A firm break above 1.0030 would clear the way to more gains targeting 1.0055. |

Technical outlook(see more posts on USD/CHF, ) |

Tags: Featured,newsletter