Spain is the first country of the four biggest economies to publish Q3 figures. Its good performance bodes well for the euro area as a whole. According to INE’s flash estimate, Spanish real GDP expanded by 0.8% q‑o‑q (3.4% y-o-y) in Q3, in line with consensus expectations. This comes after GDP grew by 1.0% q-o-q in Q2 and 0.9% q-o-q in Q1. Details of the expenditure breakdown for Q3 are not yet available (to be published on 26 November). Nevertheless, based on monthly macroeconomic indicators and Bank of Spain forecasts, GDP growth in Q3 seems to have been driven by domestic demand, whereas net trade looks to have contributed negatively to growth. Looking ahead, forward-looking sentiment indicators (ESI, PMI) suggest that growth in activity will ease. For 2015, the Spanish economy is set to grow by around 3%, one of the fastest GDP growth rates among developed countries. Greater uncertainty, however, persists on the political front where general elections are scheduled for 20 December with the latest opinion polls not yet signalling any clear majority emerging. Spain is also the first country of the four biggest economies in the euro area to publish its Q3 GDP figures. The good performance by the Spanish economy in Q3, which accounts for 11% of total euro area GDP, bodes well for the euro area as a whole (Q3 GDP figure to be published on 13 November).

Topics:

Nadia Gharbi considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Spain is the first country of the four biggest economies to publish Q3 figures. Its good performance bodes well for the euro area as a whole.

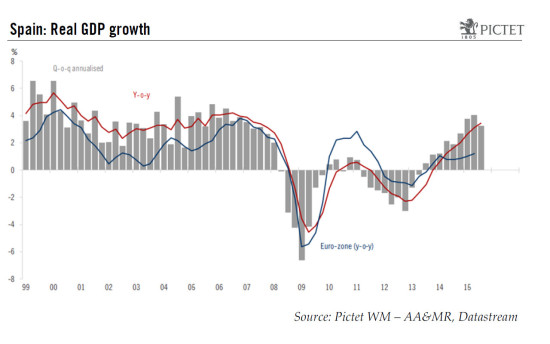

According to INE’s flash estimate, Spanish real GDP expanded by 0.8% q‑o‑q (3.4% y-o-y) in Q3, in line with consensus expectations. This comes after GDP grew by 1.0% q-o-q in Q2 and 0.9% q-o-q in Q1. Details of the expenditure breakdown for Q3 are not yet available (to be published on 26 November). Nevertheless, based on monthly macroeconomic indicators and Bank of Spain forecasts, GDP growth in Q3 seems to have been driven by domestic demand, whereas net trade looks to have contributed negatively to growth.

Looking ahead, forward-looking sentiment indicators (ESI, PMI) suggest that growth in activity will ease. For 2015, the Spanish economy is set to grow by around 3%, one of the fastest GDP growth rates among developed countries.

Greater uncertainty, however, persists on the political front where general elections are scheduled for 20 December with the latest opinion polls not yet signalling any clear majority emerging.

Spain is also the first country of the four biggest economies in the euro area to publish its Q3 GDP figures. The good performance by the Spanish economy in Q3, which accounts for 11% of total euro area GDP, bodes well for the euro area as a whole (Q3 GDP figure to be published on 13 November). Our euro area GDP growth forecasts are unchanged at 1.5% for 2015 and 1.7% for 2016.

More balanced GDP growth

The Spanish economy has been growing for over two years now in the aftermath of its extended double-dip recession in 2008-2013 (see the previous chart). The recovery was initially lacklustre, but began to build up steam in the middle of 2014. Impressive rates of GDP growth (averaging 0.8% q-o-q growth since Q3 2014) reflect progress in tackling the root causes of the country’s crisis, but Spain has also benefited from external tailwinds, including low oil prices, supportive ECB monetary policy and the euro’s depreciation.

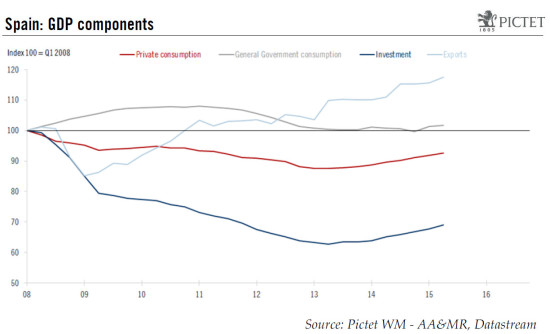

Initially, the recovery was driven by trade, but, over the last year, domestic demand has picked up strongly. Private consumption has surged upwards, supported by gains in real disposable income thanks to better labour market conditions and low oil prices. One development of note is that, since the start of 2014, growth in household spending has outpaced that of GDP, reaching its fastest pace of expansion since 2007 in Q2 (3.5% y-o-y). Monthly retail sales data suggest that household consumption continued to rise at a sustained pace in Q3.

Meanwhile, investment has boomed as well, rising at an annual rate of 6% in Q2 (latest data available). Both improved company balance sheets and a healthier banking system have underpinned the recovery by investment in equipment, which has recorded ten consecutive quarters of expansion. Investment in construction is now also starting gradually to recover after six years of contraction. In particular, residential investment, which accounts for 25% of total construction and had declined by more than 55% from its pre-crisis peak in Q1 2007 to its low in Q1 2014, is now gradually climbing.

The investment upswing should stay on track. This demand component is still pitched 31% below its pre-crisis level (see the chart above), so there is plenty of scope to see it rebound. Moreover, even though households and companies are still on a deleveraging path, the recovery in investment will be supported by better financial conditions and credit, improving company balance sheets and a revival in the housing market.

With regard to government spending, the beginning of easing of austerity policies will support GDP growth as well.

Tackling the most important problem: the labour market!

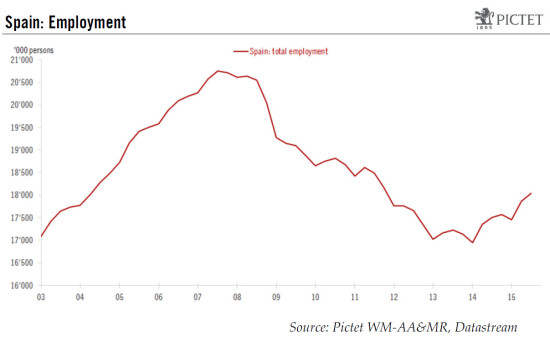

Improving labour market conditions have been key elements in the surge in private consumption. After years of jobs being destroyed, employment started to increase gradually at the outset of 2014. The latest data available on employment surprised on the upside. According to INE’s latest main labour force survey (EPA), Spain’s unemployment rate (seasonally adjusted) dropped by 1.2 percentage points to 21.2% in Q3, its lowest rate for four years. This was supported by a further rise in employment: the total number of employed was up by 182,000 people (+0.6% q-o-q after +1.0% q-o-q in Q2). Both private and public sectors recorded expansion in employment (+152,100 and 30,100, respectively). Meanwhile, the participation rate remained broadly stable around 59.5% in Q3.

Nonetheless, structural issues persist. Employment growth continues to rely mainly on temporary contracts. Rates of hiring on permanent contracts are still running below pre-crisis levels. This signals that, after the 2012 reforms to the labour market, more needs to be done to tackle this particular problem in the Spanish labour market. Moreover, two other structural issues remain: the youth jobless rate (47%) is still very high and the share of long-term unemployed has remained at a very high level, with over 52% of the unemployed looking for a job for more than a year.

Domestic demand: main engine of growth in 2016

Overall, domestic demand is likely to remain the main engine of Spain’s GDP growth in 2016 and to compensate for some of the slowdown in external demand, in particular from Latin America and Asia, the destinations for around 10% of Spain’s total exports. Even though the slight slowdown in quarterly growth might mark a cyclical peak in the y-o-y rate, the Spanish economy is likely to grow faster than its peers next year as well. For 2016, according to official institutions (IMF, consensus forecast, European commission), the range of latest forecasts showed real GDP growth of between 2.6% and 2.8% for Spain.