The surprise resignation of governor of the Reserve Bank of India poses a question mark over its policies and independence ahead of next year’s election.Urjit R. Patel, the governor of the Reserve Bank of India (RBI), unexpectedly resigned on 10 December, just four days before a crucial board meeting on discuss internal governance issues.His resignation came amid a period of acute tension between the RBI and the Indian government over a range of issues, from banking regulations and the use of excess reserves to central bank governance—but in a nutshell it comes down to the question of the RBI’s independence.In the short term, the impact of Patel’s departure on the Indian economy and RBI policies may be fairly limited, but RBI’s monetary policy may turn more dovish from its current

Topics:

Team Asset Allocation and Macro Research considers the following as important: Central Banks, India, India economy, Macroview

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Marc Chandler writes Continued Backing Up of US Rates Extend the Greenback’s Gains

Marc Chandler writes Consolidation Featured

Marc Chandler writes Fragile Turn Around Tuesday

The surprise resignation of governor of the Reserve Bank of India poses a question mark over its policies and independence ahead of next year’s election.

Urjit R. Patel, the governor of the Reserve Bank of India (RBI), unexpectedly resigned on 10 December, just four days before a crucial board meeting on discuss internal governance issues.

His resignation came amid a period of acute tension between the RBI and the Indian government over a range of issues, from banking regulations and the use of excess reserves to central bank governance—but in a nutshell it comes down to the question of the RBI’s independence.

In the short term, the impact of Patel’s departure on the Indian economy and RBI policies may be fairly limited, but RBI’s monetary policy may turn more dovish from its current “calibrated tightening” stance under his appointed successor, Shaktikanta Das (although any change in policy could be justified more by shifting fundamentals in the Indian and global economy rather than the change of RBI governor per se).

Initial market jitters after Patel’s resignation quickly faded, similar to what happened when the previous governor, Raghuram Rajan, announced in June 2016 that he would not seek a second term. Patel’s departure may even prove moderately positive for equities in the short term, as it could herald a more accommodative RBI stance on regulatory and monetary policy issues. The shares of state-owned banks and several non-bank financing firms – two sectors that had been under particularly strong scrutiny by the RBI – have rallied on hopes of looser restrictions and stronger support for credit growth. Other sectors such as construction may also benefit from a change in the RBI’s tone. But Patel’s resignation sends a bad signal about RBI’s independence, and thus could be negative for the economy in the long term.

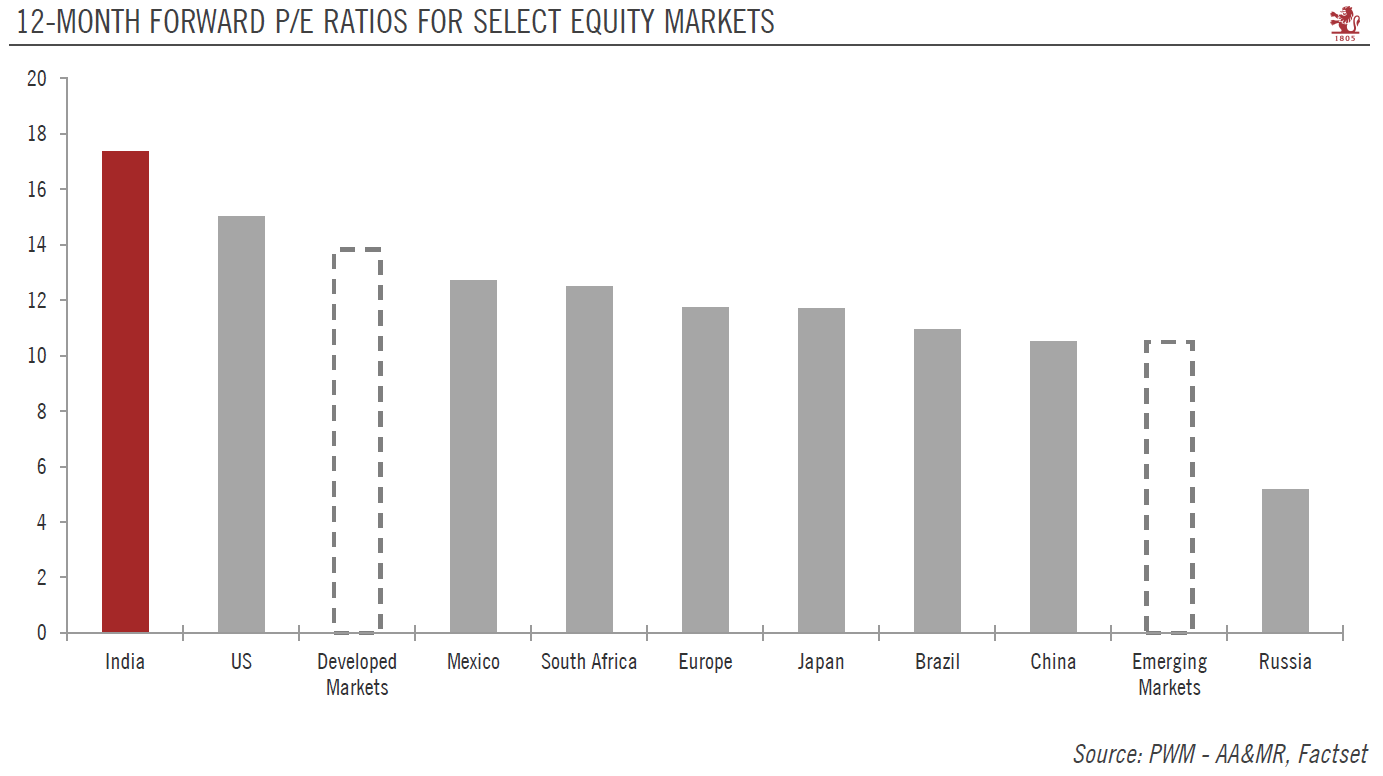

Beyond the uncertainties caused by events at the RBI, the general elections in April/May 2019 and corporate earnings should prove the main drivers of Indian equity performance in the months to come. A victory by the ruling BJP party would provide political stability and facilitate the continuation of gradual reforms. But equity valuations in India are notoriously higher than in most markets, and earnings growth expectations for 2019 are elevated (above 20%). Indian equities could thus be vulnerable to any earnings disappointments. While we still like the long-term growth story in India relative to other emerging markets (which led us to start building exposure in November), weexpect further market turbulence in the run-up to the elections.

In the longer run, it will be critical for Indian financial markets that the RBI’s independence be preserved, despite recent events. Otherwise, international investors may baulk at the double risk of below-potential growth and foreign-exchange losses that wipe out any market gains.