Disappointing consumption numbers point to growth deceleration in early 2019, but government measures beginning to be felt. Hard data out of China for October was mixed. On the positive side, growth in infrastructure picked up, suggesting the government’s fiscal policy easing is taking effect in the real economy. Industrial production numbers stopped declining, and the mining sector has a particularly strong performance. Growth in fixed asset investment rebounded strongly in October, to 8.1% year-over-year from 6.1% in September. Investment in manufacturing continued to rise, coming in at 9.1% y-o-y in October from 8.7% the previous month. Consumption continued to disappoint, with retail sales growth declining

Topics:

Dong Chen considers the following as important: 2) Swiss and European Macro, China economy, china fiscal stimulus, China growth momentum, Featured, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Disappointing consumption numbers point to growth deceleration in early 2019, but government measures beginning to be felt.

Hard data out of China for October was mixed. On the positive side, growth in infrastructure picked up, suggesting the government’s fiscal policy easing is taking effect in the real economy. Industrial production numbers stopped declining, and the mining sector has a particularly strong performance.

Growth in fixed asset investment rebounded strongly in October, to 8.1% year-over-year from 6.1% in September. Investment in manufacturing continued to rise, coming in at 9.1% y-o-y in October from 8.7% the previous month.

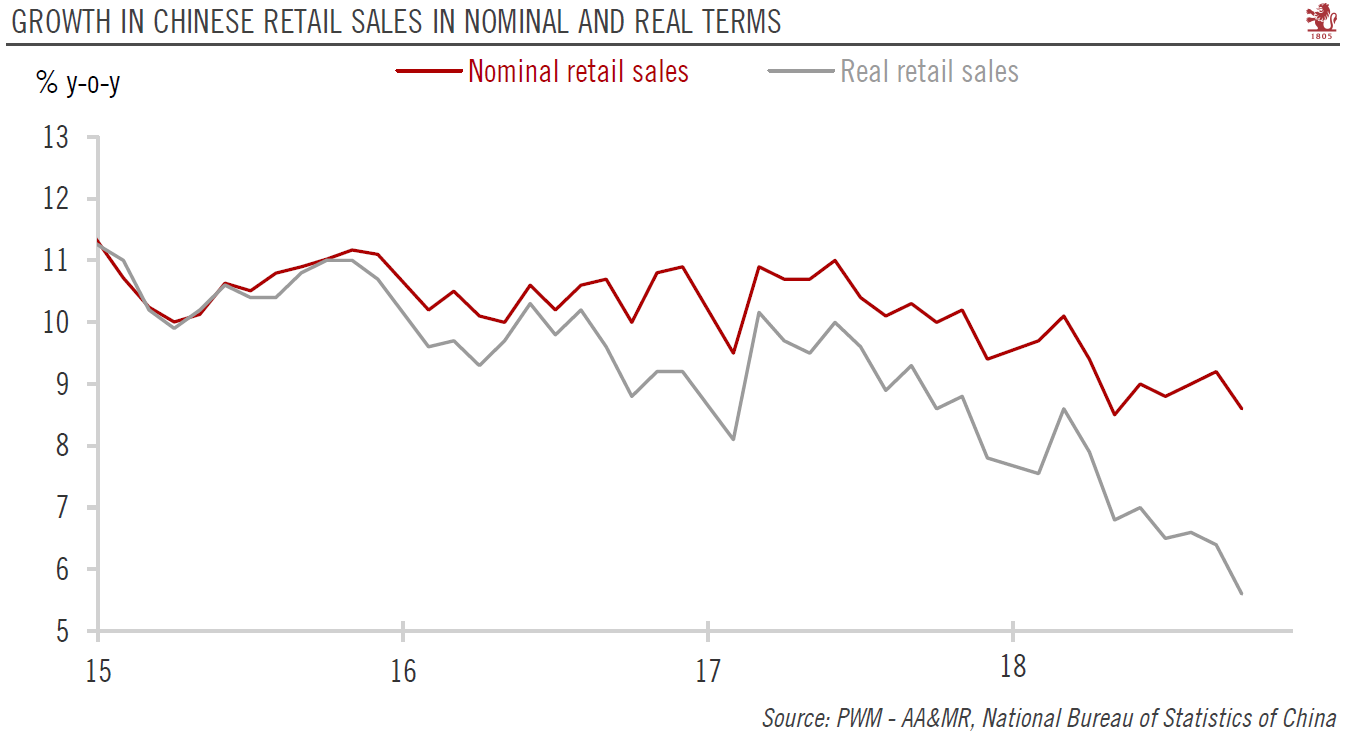

Consumption continued to disappoint, with retail sales growth declining further. This is in line with our expectation of a rebound in growth momentum in Q4, but the downturn will likely resume in Q1 2019 when exports are expected to drop significantly.

| Investment in property is expected to moderate going forward, as the government has tightened property policies again in the wake of the surge in housing prices nationwide since 2016, by enacting stricter home purchase restrictions and more stringent requirements for mortgage loans. Leading indicators such as new property project starts and developer land acquisitions further point to a softening in property investment going forward.

While industrial production was mostly stable in October, with growth rising marginally to 5.9% y-o-y from 5.8% the previous month, we see the industrial sector as being exposed to downside risks, as Chinese exports are expected to slow down significantly in Q1 2019 when the US likely raises tariffs on USD200 billion of Chinese imports to 25% from the current 10%. Retail sales continued to disappoint in October, with growth coming in at 8.6% y-o-y in October from 6.4% in September. Auto sales were once again a drag, due to the removal of tax incentives introduced in 2016 and high base effects. In our view, the major factors behind the consumption slowdown slower income growth, fading wealth effects and subdued consumer sentiment. |

China Retail Sales in Nominal and Real terms, 2015-2018(see more posts on China Retail Sales, ) |

Tags: China economy,china fiscal stimulus,China growth momentum,Featured,Macroview,newsletter