Spare capacity is tight, so oil prices could spike higher.The June OPEC agreement to increase oil output provided only a brief respite to oil consumers. After a temporary dip, prices started to rise steadily again, with Brent gaining USD4 per barrel and WTI more than USD7 between 22 June and 6 July. The larger rise in the West Texas Intermediate (WTI) price was due to a Canadian oil-sands outage that drained stockpiles in North America.Taking into account falling oil output in Venezuela, the risk to Iranian output from sanctions and the bottlenecks facing US production, the world supply-demand balance relies on OPEC’s spare capacity of just over 2 million barrels per day. This is a very small cushion to deal with demand and is vulnerable to supply disruption. There is a marked risk we

Topics:

Jean-Pierre Durante considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Spare capacity is tight, so oil prices could spike higher.

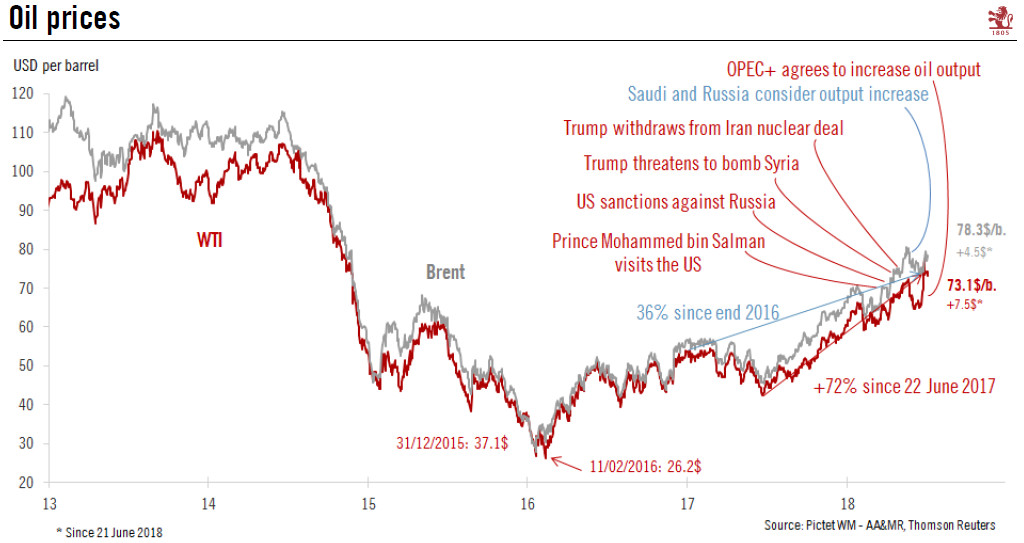

The June OPEC agreement to increase oil output provided only a brief respite to oil consumers. After a temporary dip, prices started to rise steadily again, with Brent gaining USD4 per barrel and WTI more than USD7 between 22 June and 6 July. The larger rise in the West Texas Intermediate (WTI) price was due to a Canadian oil-sands outage that drained stockpiles in North America.

Taking into account falling oil output in Venezuela, the risk to Iranian output from sanctions and the bottlenecks facing US production, the world supply-demand balance relies on OPEC’s spare capacity of just over 2 million barrels per day. This is a very small cushion to deal with demand and is vulnerable to supply disruption. There is a marked risk we will see oil prices spike well above their long-term fundamental equilibrium this summer.

Early signs of an economic and international trade slowdown could help to smooth any oil shortages towards the end of the year. However, a more comfortable supply / demand balance will only come into view in mid-2019 when new pipeline facilities become operational in the US.

As a result, our end-2018 oil price forecast remains unchanged at USD77 per barrel for Brent oil (USD70 for WTI), with a clear risk that prices overshoot before then.