– Gold gained 1.8% and silver 2.5% to ,333/oz and .60/oz yesterday – Gold climbs as Fed increases interest rates by 0.25% – now 1.5% to 1.75% range – Dovish Fed Chair Powell plans fewer than expected rate hikes in 2018 – Markets disappointed at lack of hawkish comments from new Fed Chair – Dollar LIBOR rises to highest level since November 2008 – 0 trillion worth of dollar-denominated financial products including mortgages based off LIBOR – Trade wars look set to escalate and Trump expected to announce tariffs on Chinese imports today Editor: Mark O’Byrne Gold gained 1.7% and silver 2.5% to ,333/oz and .60/oz respectively yesterday after the Federal Reserve announced a 25 basis point increase in rates

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

– Gold gained 1.8% and silver 2.5% to $1,333/oz and $16.60/oz yesterday

– Gold climbs as Fed increases interest rates by 0.25% – now 1.5% to 1.75% range

– Dovish Fed Chair Powell plans fewer than expected rate hikes in 2018

– Markets disappointed at lack of hawkish comments from new Fed Chair

– Dollar LIBOR rises to highest level since November 2008 – $200 trillion worth of dollar-denominated financial products including mortgages based off LIBOR

– Trade wars look set to escalate and Trump expected to announce tariffs on Chinese imports today

Editor: Mark O’Byrne

| Gold gained 1.7% and silver 2.5% to $1,333/oz and $16.60/oz respectively yesterday after the Federal Reserve announced a 25 basis point increase in rates to the slightly higher range of 1.5% to 1.75%. Gold and silver consolidated on those gains overnight in Asia and this morning in European trading, as markets digested the Federal Reserve’s post-announcement comments. |

Gold Price in USD, 15 - 22 March 2018(see more posts on Gold prices, ) |

| The first Federal Reserve meeting chaired by Jerome Powell offered little in the way of surprise. A hawkish tone was expected from new Chair Powell, however his statement was slightly more dovish despite what he claimed was a strengthened economic outlook and confidence that tax cuts and government spending will provide an much needed boost. |

Gold Daily, Nov 2016 - Mar 2018 |

| The Fed confirmed that there would be just three rate hikes this year, as stated in the December 2017 minutes. Currently the interest rate remains 50bp below LIBOR which continues to climb, widening the spread between itself and OIS.

Should this continue to worsen the impact could be greater on the economy and wealth, than Fed set interest rates. On this basis, the Powell and co. may well decide on additional rate hikes on top of the two expected this year and those forecast for 2019 and 2020. Yesterday CME Group reported that speculative betting on future Fed rate rises in June are 84.4% likely (up from 58.5% a month ago) and September’s meeting 52.2% (jumping from 37.3% a month ago).

|

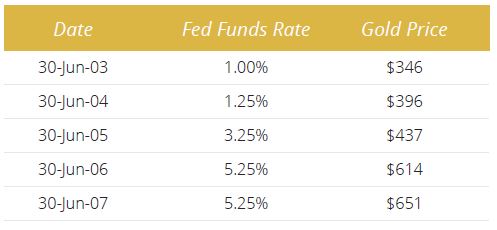

Gold Interest Rates Source: New York Federal Reserve for Fed Funds Rate, LBMA.org.uk for Gold (PM fix) - Click to enlarge Data shows rising interest rates is positive for gold as seen in 1970s and again from 2003 to 2007. |

Gold to find further support in trade warsLater today President Trump will almost certainly announce tariffs on Chinese imports. The White House is said to be considering between $30bn-$60bn in tariffs and measures that would restrict investment. Yesterday the country’s top trade negotiator, Robert Lighthizer, told Congress the US will put “maximum pressure on China and minimum pressure on US consumers”. Any changes to current trade arrangements will no doubt increase tension between the super powers. Many expect retaliation from Beijing (to any US measures) prompting a trade war and there is also the real of currency wars returning with a vengeance. Elsewhere, EU leaders will today consider how best to respond to Trump’s decision to place tariffs on aluminium and steel imports, another move likely to trigger a trade war. Recent Fed meetings and interest rate announcements have coincided with short term lows in the gold price and a good entry point for those looking to accumulate on the dip (see chart above). We expect the same on this occasion and we should again test resistance at $1,360/oz in the coming weeks. Growing uncertainty and deepening risks will provide further support for gold and should see higher gold prices. |

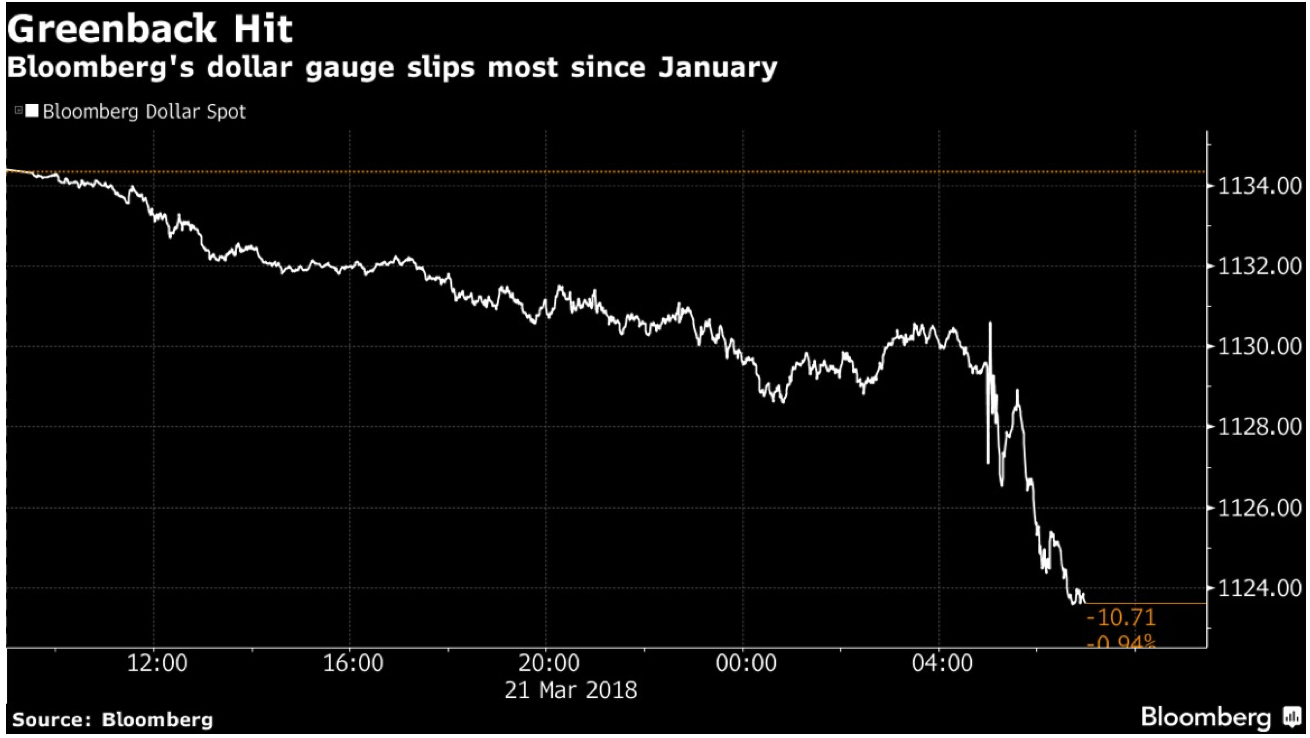

Bloomberg's Dollar Spot, 21 March 2018 |

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below |

Tags: Daily Market Update,Featured,newsletter