Stock Market Selloff Showed Gold Can Reduce Portfolio Risk – Recent stock market selloff showed gold can deliver returns and reduce portfolio risk– Gold’s performance during stock market selloff was consistent with historical behaviour– Gold up nearly 10% in last year but performance during recent selloff was short-lived– The stronger the market pullback, the stronger gold’s rally– WGC: ‘a good time for investors to consider including or adding gold as a strategic component to their portfolios.’– Gold remains one of the best assets outperforming treasuries and corporate bonds A recent World Gold Council (WGC) study has concluded that the market selloff on February 5th made the case for gold as both a diversifier and

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newslettersent, Stock markets

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

– Recent stock market selloff showed gold can deliver returns and reduce portfolio risk

– Gold’s performance during stock market selloff was consistent with historical behaviour

– Gold up nearly 10% in last year but performance during recent selloff was short-lived

– The stronger the market pullback, the stronger gold’s rally

– WGC: ‘a good time for investors to consider including or adding gold as a strategic component to their portfolios.’

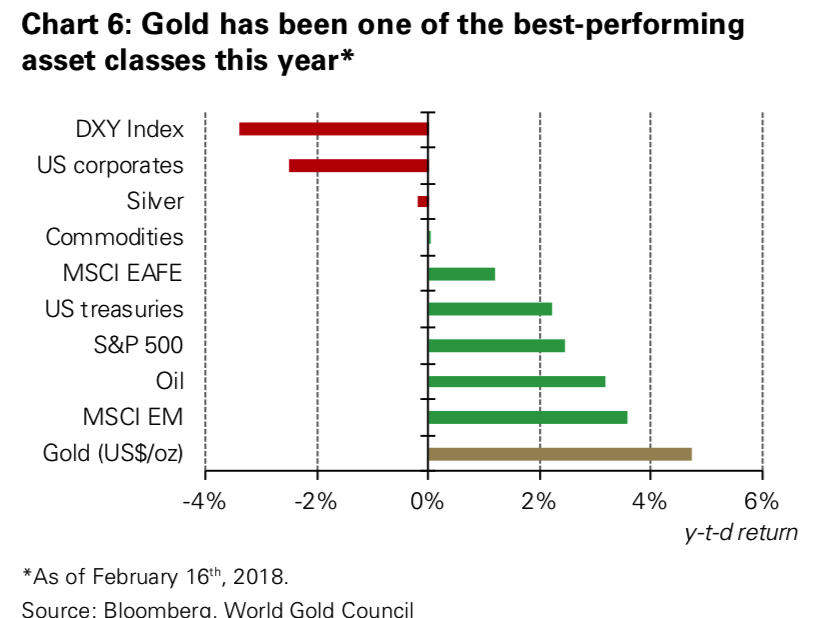

– Gold remains one of the best assets outperforming treasuries and corporate bonds

| A recent World Gold Council (WGC) study has concluded that the market selloff on February 5th made the case for gold as both a diversifier and an asset that protects portfolios during market downturns.

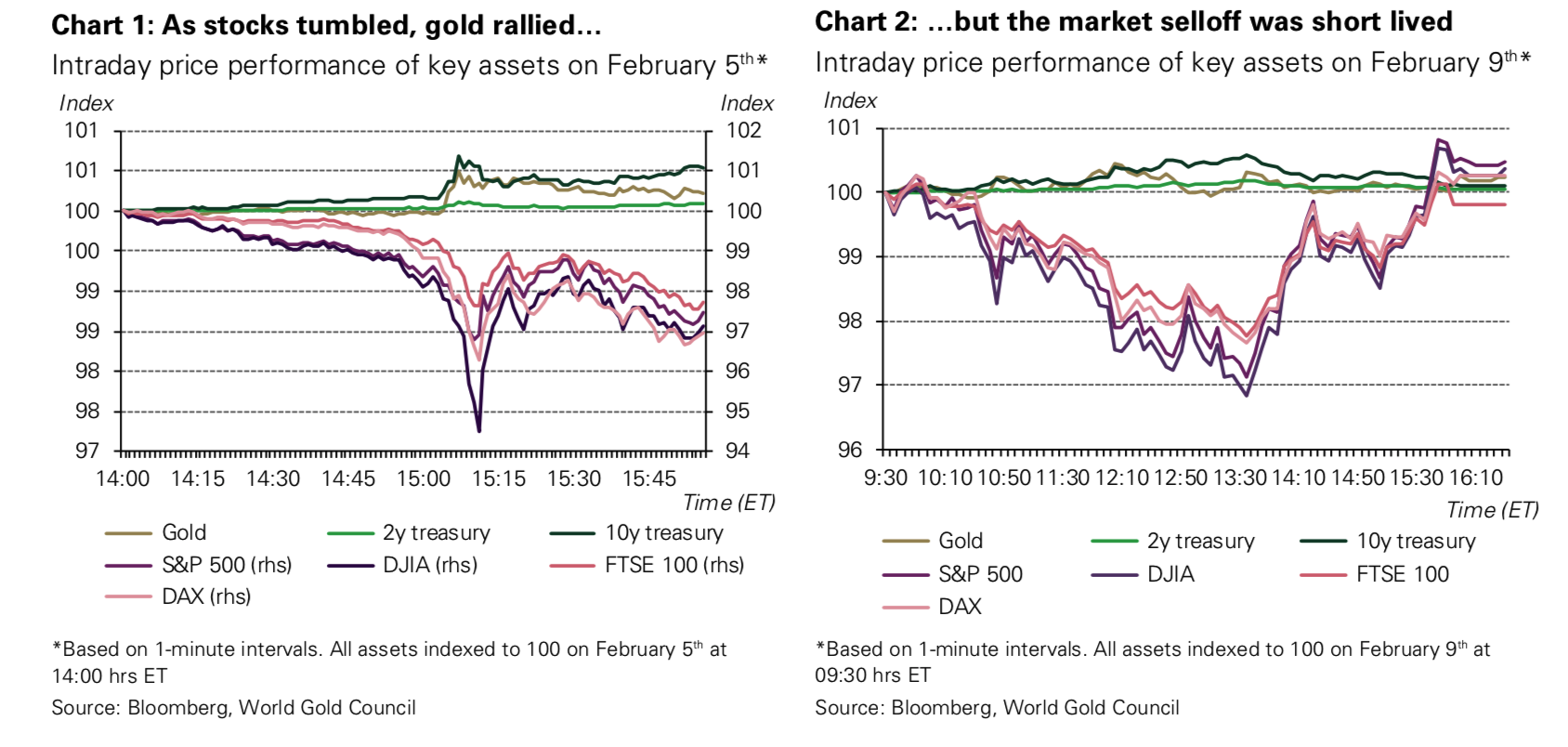

The stock market selloff of early February saw stocks tumble. But, whilst it was sharp it was also short-lived. Many watching the gold price were disappointed to see gold lose around 0.8% of its USD price between February 5th and February 12th, when both the Dow Jones and European stocks and begun to recover losses. Yet to judge gold on its price performance alone is to misunderstand gold (or, in fact any asset’s) role in a portfolio. In order to appreciate it’s performance one must compare it to other assets as well as it’s long-term behaviour. |

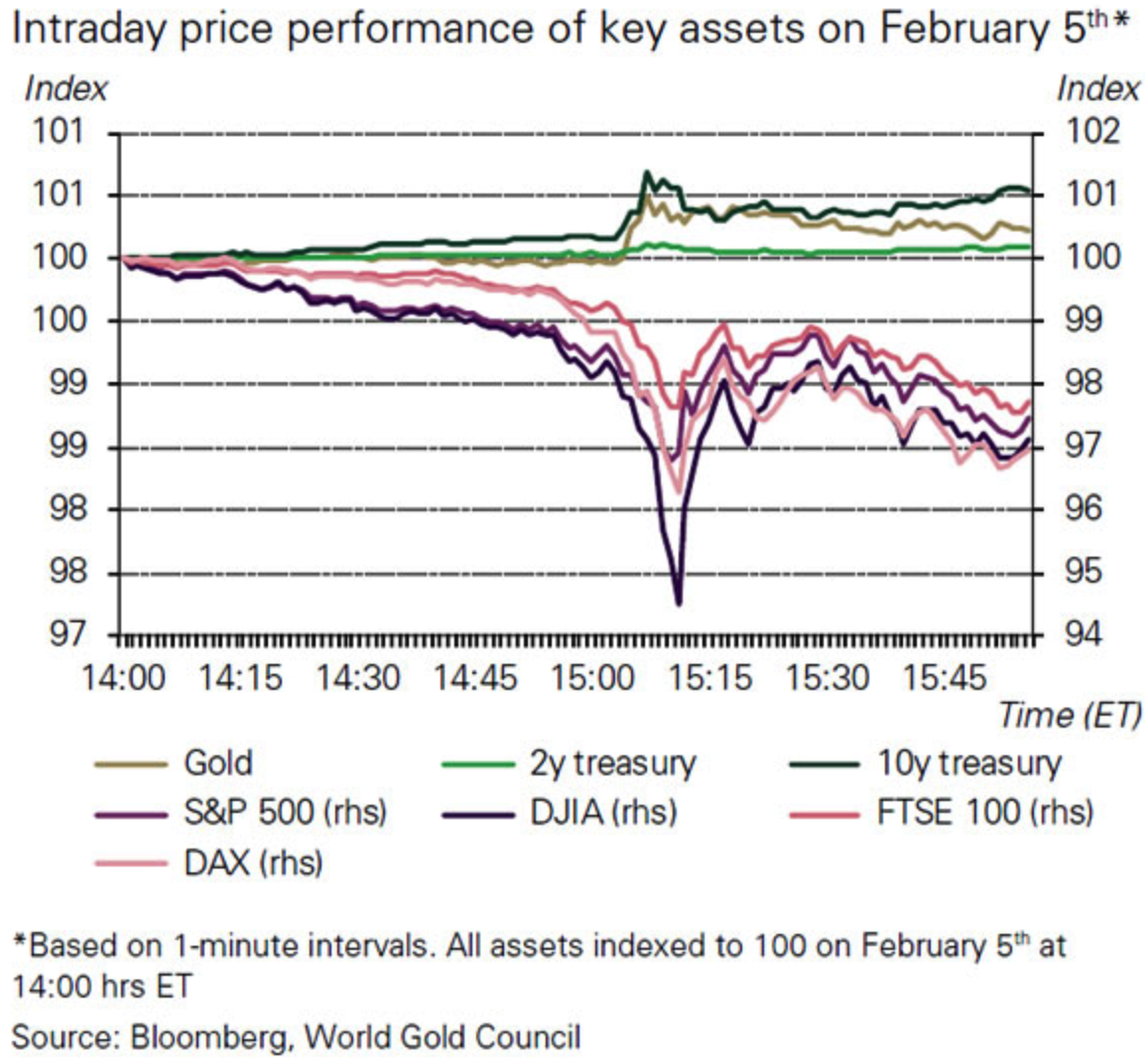

Intraday Price Performance of Key Assets, 5 February |

Gold’s protection was stronger than you realiseWhilst gold did drop by nearly 1% in USD terms it was a different story for other currencies (which account for 90% of gold demand). This was particularly the case in Europe where currencies weakened against the dollar, increasing gold prices. In euro terms old rallied by 0.9% and 1.8% in sterling, between Friday February 2nd and Monday February 12th. The 0.8% overall drop in the gold price over the beginning and end of the stock market selloff was not reflective of gold’s performance during the period:

|

Intraday Price Performance of Key Assets, 5 February |

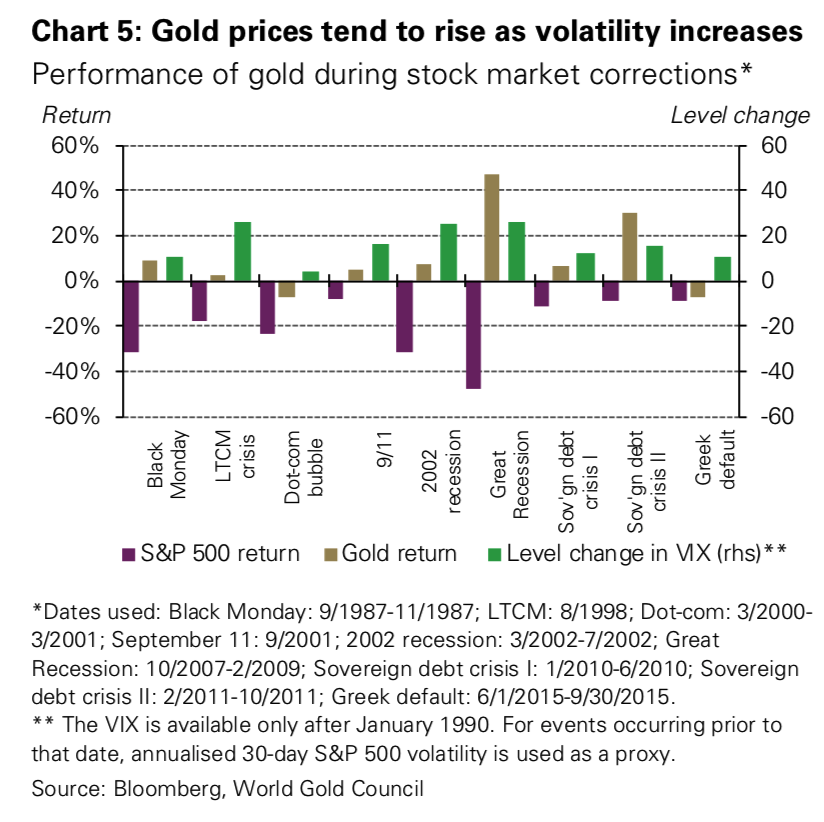

“Gold’s effectiveness as a hedge increases with systemic risks”Gold and stocks are inversely correlated in market downturns. This is thanks to the behaviour of investors who typically show a ‘flight-to-quality’ behaviour. This benefit of gold is better seen when market crises are broader or last longer than the stock market correction we saw in February.

|

Performance of Gold During Stock Market Corrections, Sep 1987 - 2015 |

Looking beyond the short-term stock market selloffAs we often discussed, mainstream media and market commentary have a strong bias towards short-term views. This leads to a very blinkered approach and often an all-too-easy dismissal of gold as a worthy investment. There has been talk of a stock-market correction for a long-while. Frothy asset prices, pumped-up valuations and the ongoing uptick in stock market prices appeared to be just asking for a market selloff. We finally saw a selloff last month when the DJIA had it’s biggest drop in history. Was this the end of the bubble? Prices did recover but that doesn’t mean it wasn’t the final bell in what has been a long run. An environment is now forming where a number of corrections are becoming more likely in the near-future. Interest rates are slowly being hiked up, how markets and economies will cope with this after a record-long period of ultra-low interest rates is something we are just beginning to get a taste of. Trade wars are looming, inflation levels are climbing and political sabre-rattling is growing stronger. With this in mind the World Gold Council reminds us of gold’s ‘four key roles in a portfolio’: – delivering positive long-term returns – improving diversification – providing liquidity, especially in downturns – enhancing portfolio performance through higher risk-adjusted returns

|

Gold Performance, 16 February 2018 |

‘Consider including or adding gold as a strategic component to portfolios.’

The World Gold Council notes that there has been an increase in bullish positioning in gold options. ‘In our view, this type of bullish positioning suggests that investors may be increasing their portfolio protection against further market downturns…this is as good a time as any for investors to consider including or adding gold as a strategic component to their portfolios.’

Tags: Daily Market Update,Featured,newslettersent