See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Ballistically Yours One nearly-famous gold salesman blasted subscribers this week with, “Gold Is Going to Go Ballistic!” A numerologist shouted out the number ,000. At the county fair this weekend, we ran out of pocket change, so we did not have a chance to see the Tarot Card reader to get a confirmation. Even if you think that the price of gold is going to go a lot higher (which we do, by the way—but to lean on Aragorn again, today is not that day) this rubbish should bother you. At the least, one should be critical of arguments that agree with you. One should look for the errors in one’s logic. And there’s

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold prices, gold silver ratio, newslettersent, Precious Metals, silver basis, Silver co-basis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Ballistically YoursOne nearly-famous gold salesman blasted subscribers this week with, “Gold Is Going to Go Ballistic!” A numerologist shouted out the number $10,000. At the county fair this weekend, we ran out of pocket change, so we did not have a chance to see the Tarot Card reader to get a confirmation. Even if you think that the price of gold is going to go a lot higher (which we do, by the way—but to lean on Aragorn again, today is not that day) this rubbish should bother you. At the least, one should be critical of arguments that agree with you. One should look for the errors in one’s logic. And there’s something bigger, and a bit ironic. Let us explain. These shouts and touts do not offer sober or serious analysis. At best, they offer confirmation bias. At worst, they are self-serving self-promotion. Say what you will about the big banks, their investment advisors and wealth managers don’t talk like this. They take a measured, if not objective, tone when discussing investments. They offer no wild targets ($10,000 is wild), let alone say things like “I guarantee it!” We are no fans of government regulation, but we have to note that regulated financial advisors speak the language of mainstream investors. Gold is unregulated, and some gold dealers sound like the boiler room stock brokers of the late 1920s. Carnivals and circus entertainment is also unregulated, and the pioneer of that space (in)famously said “there’s a sucker born every minute.” The irony is that the price of gold will not go anywhere near $10,000 until the mainstream public is buying gold. However, irresponsible promotions put a tarnish on gold. Most mainstream investors regard gold as somewhat of a scam (we have heard this directly from billionaires and wage-earners). We, the gold industry, should abide by reasonable standards for responsible advertising and analysis. |

|

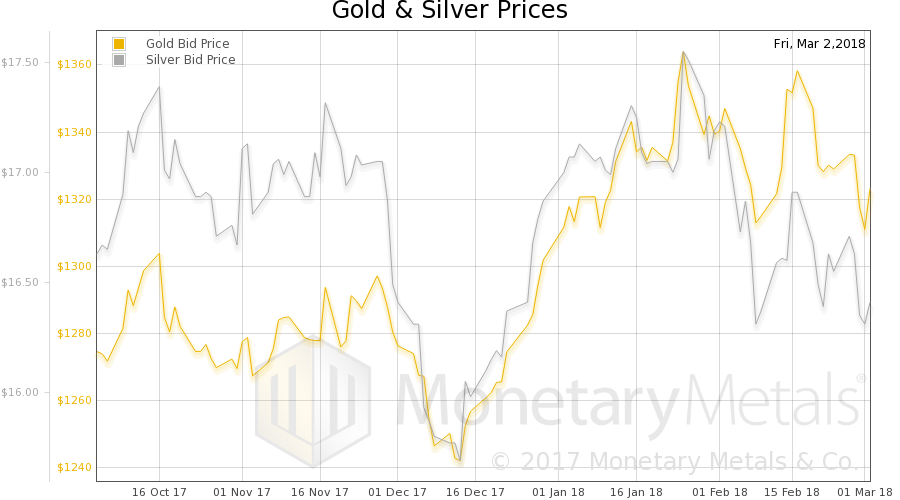

Fundamental DevelopmentsLast week the price of gold dropped six bucks, and that of silver four cents. Let’s take a look at the only true picture of the supply and demand fundamentals for the metals. But first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on Gold prices, silver prices, ) |

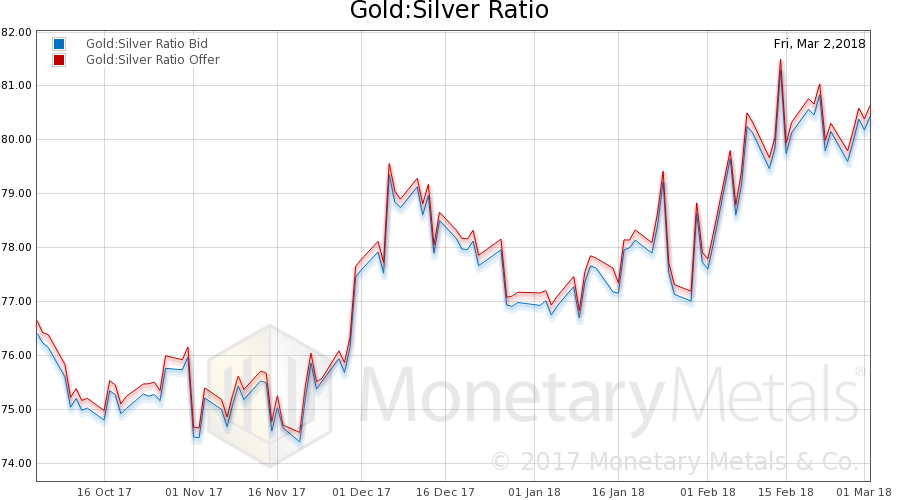

| Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio fell slightly. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

| Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold. |

Gold Basis, Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

| There is certainly no sign of the kind of supply-demand imbalance that would predict a price move of $600 to get back near the high of 2011, much less a move of $8,600. We note that the April co-basis is -0.56% — nowhere near backwardation. The Monetary Metals Gold Fundamental Price slipped $6 this week, to $1,381.

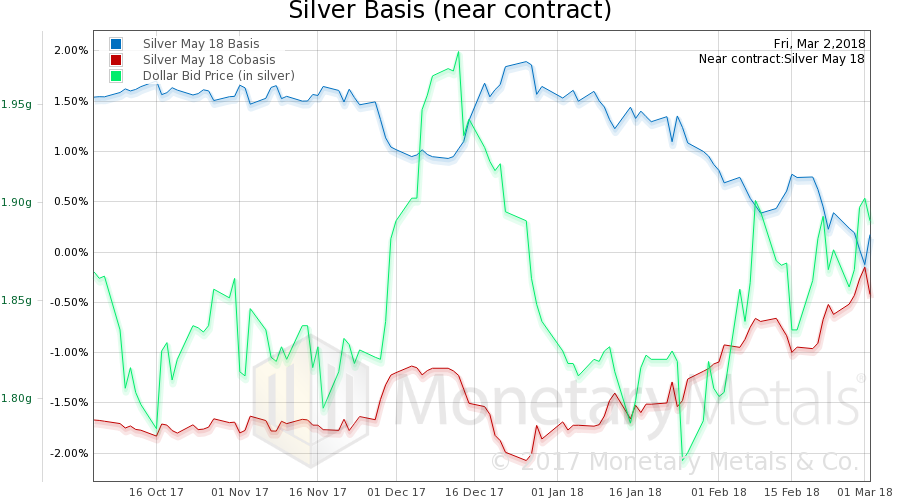

Now let’s look at silver. |

Silver Basis, Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

The Monetary Metals Silver Fundamental Price rose 9 cents to $17.21.

© 2018 Monetary Metals

Tags: dollar price,Featured,gold basis,Gold co-basis,Gold prices,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis