– Will digital gold provide the benefits of physical gold?– Digital gold and crypto gold products claim to combine efficiencies of blockchain with value of gold– They are yet to provide the same benefits or safety as owning physical gold– National mints jumping in on the ‘sexy blockchain’ act – BOE declares bitcoin ‘not a currency;’ Royal Mint launches blockchain gold product– Digital gold, blockchain gold and crypto gold is frequently not fully backed, unallocated, pooled and unsecured gold holdings Editor: Mark O’Byrne At the beginning of last week Bank of England Governor Mark Carney claimed bitcoin was not a currency on the grounds that it is neither a medium of exchange or a store of value. Scoffs aside about

Topics:

Jan Skoyles considers the following as important: Ben Judge, Daily Market Update, Featured, GoldCore, Mark Carney, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

– Will digital gold provide the benefits of physical gold?

– Digital gold and crypto gold products claim to combine efficiencies of blockchain with value of gold

– They are yet to provide the same benefits or safety as owning physical gold

– National mints jumping in on the ‘sexy blockchain’ act

– BOE declares bitcoin ‘not a currency;’ Royal Mint launches blockchain gold product

– Digital gold, blockchain gold and crypto gold is frequently not fully backed, unallocated, pooled and unsecured gold holdings

Editor: Mark O’Byrne

| At the beginning of last week Bank of England Governor Mark Carney claimed bitcoin was not a currency on the grounds that it is neither a medium of exchange or a store of value.

Scoffs aside about what this means for the British Pound, there are many out there who are trying to satisfy Mark Carney’s definition of a currency by backing digital tokens with gold. The Royal Mint is one of them. They announced a new digital gold investment service entitled RMG back in December 2016. Interesting that a sister organisation to the Bank of England is looking at jumping into the crypto currency market by combining the blockchain with gold. There are plenty of others doing the same thing. It is unsurprising given the recent volatility and negative press around the cryptocurrency market that there are many out there seeing opportunity in the interesting nexus that is blockchain and gold. |

Ripple, Bitcoin, Ethereum |

Is there value to be found in ‘digital’ money?Is it possible to find ‘value’ in something which is as digital as fiat itself? For now, the jury is very much divided but there are some in the market who believe they can add value to cryptocurrency by backing it with gold (in some shape or form). Many in the mainstream believe that this is bitcoin coming full-circle. Since its inception it has frequently been referred to as ‘digital gold’. Now, the backing of crypto currencies, or in fact just digital tokens, with gold has made the term come into its own. Digital gold has, in fact, been around for many years. It is product offered by multiple online gold trading platforms. This involves buying ‘gold’ which is frequently pooled and the buyers locked into a closed-loop system with a single counter party. The owner does not own an actual physical gold coin or bar or coins or bars which are segregated and allocated in their name. They are captive to that particular platform with potentially poor liquidity, captive, monopoly pricing and counterparty risk exposure. In the last few weeks there have been a plethora of announcements from both new and well-established organisations that have announced new digital gold products, either with a cryptocurrency, blockchain or just digital token angle. There is a serious danger that new investors believe they are getting decent exposure to this booming cryptocurrency market but with the security of the gold market to support them. In truth, most of these new gold offerings are likely no better (and arguably worse) than the digital gold products that preceded them. As MoneyWeek’s Ben Judge concluded, last week, ‘my view is that so far, if you want exposure to gold, it’s better to stick with the real deal.’ |

Bitcoin |

Something not quite gold-standard about it all

The majority of those in the crypto space know there is something to be said for gold, hence the introduction of so many ‘gold-backed’ digital currencies. Many purport to have an advantage over more traditional means of gold ownership as there are low to zero transaction and storage fees.

This is fishy. Why store something for free and why buy something that is unallocated. We recently wrote about unallocated gold. We mentioned that whilst new gold investors might think that owning gold without having to pay storage fees seems highly attractive, it also comes with risks and, arguably hidden costs.

Unallocated gold is free to store because the bank or institution that you have chosen to buy it through, is using it for it’s own purposes. It is likely rehypotehated and loaned out. You the “investor” or “owner” is actually an unsecured creditor of multiple bank custodians.

Whilst the likes of the Royal Mint’s token is allocated, it is offering free storage. As we explained last year, this is a bit too picture perfect:

We’re all familiar with the expression ‘if it sounds too good to be true then that’s because it usually is’. The Royal Mint is owned by HM Treasury, it pays an annual dividend their way every year. It goes without saying that the United Kingdom is pretty broke at the moment and with the fallout of Brexit still playing out, against a backdrop of geopolitical uncertainty who knows how much worse it will become.

And when it does, how is the government planning on paying to keep the country going? Who knows, but it’s all happening at the same time that the government is trying to encourage you to hold gold in their vaults.

Ben Judge goes onto express our matching concerns about any national mint’s involvement in digital gold:

For many goldbugs, the Mint’s involvement might be a concern, given its ties to the government – governments have confiscated gold before (though not in the UK) and could well do so again. The Mint acknowledges this on its website, asking: “What protection against government confiscation does RMG offer?”, although it ducks the issue, as, of course, there is no protection.

Of course, this isn’t just an issue with offerings from the likes of the Royal Mint, the Canadian Mint or the Perth Mint’s soon-to-launch digital offering. It’s a common problem with many digital gold platforms, especially those purporting to be using blockchain technology.

MoneyWeek questions digital gold valueIn a quick summary of the latest digital gold offerings Ben Judge addresses three of them and raises some serious concerns:

Many digital and crypto platforms claim to make the gold ownership process simple. What is simple about backing a currency with pawned gold? How many counterparties and owners are involved there? And why would you pay for one gramme when you only get 75% of it? The jury might still be out on cryptocurrencies generally. For now, it makes sense to have a similar skepticism regarding the many new gold crytos. |

|

Cybersecurity riskNo matter what you hear nothing is unhackable. Anything that has a presence online or is connected to a network is open to malicious cyber behaviour. All company’s, including digital gold providers, websites, servers and other technologies are vulnerable. There is a great myth about cryptocurrencies that they are more secure than other offerings. In many ways they are but, conversely, there are many ways that they aren’t. Internet shutdowns and cybersecurity attacks compromise our democratic freedoms. Malicious online activity is now about more than getting ahold of your credit card details or just showing off. It is about demonstrating power from one sovereign state to another. As we recently explained in the light of the internet shutdown news, digital assets in general and digital gold is too reliant on online access to be able to offer you the security gold should offer: When our democratic freedoms are threatened it means our financial ones are also at risk. Many savers and investors consider these threats and choose to diversify their portfolios. They spread the risk and hedge their bets against such events. This is a sensible first step, however it can be rendered pointless if your management of your assets is reliant on internet access. Gold has been bought by millions all over the world because of its role in protecting investors during times of war, financial hardship and economic disasters. It is only recently that the idea of cyber warfare and the misuse of this power by governments has become a point of consideration. Gold is as relevant here as it always has been. But it is specifically allocated, segregated physical gold which must be considered. Owning gold coins and bars either in one’s possession or in allocated and segregated storage will protect people and will be accessible and liquid should an internet shutdown be triggered in your country tomorrow. |

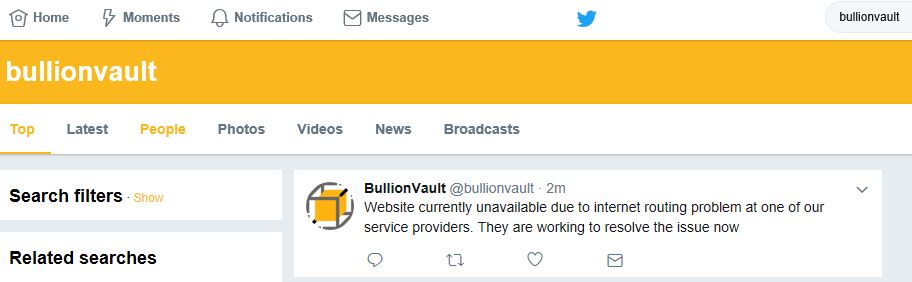

Bullionvault |

Will digital gold serve you as well the real thing?

It was with some interest that we witnessed a flight to physical gold as digital gold bitcoin and its contemporaries fell from their meteoric 2017 rises at the start of 2018.

They have begun to climb once again this week but it has made many aware that gains in these currencies must be secured by something with real value. Many investors agree that the massive price appreciations in cryptocurrencies are unsustainable and they must secure gains. They do this by investing in gold and silver, as we saw with many new clients towards the end of last year and last month.

Those we have spoken to and have assisted are selling a very overvalued asset and putting it into a still undervalued asset. Gold prices remain quite depressed, especially from where they were compared to six or seven years ago, and sentiment is still quite poor.

If you want to benefit from owning gold then own gold. Don’t faff around with something that is purportedly on a blockchain or backed by a pawn shop, a bank or (worse) a central bank.

Ultimately it comes down to investing in and legally owning actual gold coins and bars. Bullion that will serve your wealth in the same way it has served millions of people in years gone by – as an asset that is a form of financial insurance, that cannot be devalued by central banks and will not be confiscated whether through bail-ins or more forceful means.

If using gold, blockchain and bitcoin together means that investors’ portfolios can meet the above criteria then we are on the dawn of something very exciting, but we don’t believe that we are quite there yet. We are in an arguably dangerous period in the adoption bell-curve where learning and education are giving way to misinformation and misunderstanding.

Tags: Ben Judge,Daily Market Update,Featured,Mark Carney,newslettersent