Summary Reuters reported that China may loosen controls on outbound capital flows (QDLP). Samsung chief Lee was set free in an unexpected court reversal. Romania central bank hiked rates by 25 bp and raised its inflation forecasts for the next two years. South Africa President Zuma appears to be on the way out. Ecuador voters approved a referendum that reinstates term limits for the president. Venezuela central bank restarted FX auctions for the first time since August and devalued the bolivar by more than 80%. Stock Markets In the EM equity space as measured by MSCI, Egypt (-1.0%), Indonesia (-1.5%), and UAE (-1.7%) have outperformed this week, while China (-10.0%), Hong Kong (-7.5%), and Taiwan (-7.4%) have

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

Stock MarketsIn the EM equity space as measured by MSCI, Egypt (-1.0%), Indonesia (-1.5%), and UAE (-1.7%) have outperformed this week, while China (-10.0%), Hong Kong (-7.5%), and Taiwan (-7.4%) have underperformed. To put this in better context, MSCI EM fell -6.9% this week while MSCI DM fell -5.8%. In the EM local currency bond space, Hungary (10-year yield -22 bp), India (-10 bp), and Czech Republic (-6 bp) have outperformed this week, while Turkey (10-year yield +26 bp), Peru (+8 bp), and Mexico (+6 bp) have underperformed. To put this in better context, the 10-year UST yield rose 1 bp to 2.85%. In the EM FX space, PHP (+0.3% vs. USD), PKR (+0.1% vs. USD), and ZAR (+0.1% vs. USD) have outperformed this week, while RUB (-3.1% vs. USD), ARS (-2.8% vs. USD), and ILS (-2.1% vs. USD) have underperformed. |

Stock Markets Emerging Markets, February 07 Source: economist.com - Click to enlarge |

ChinaReuters reported that China may loosen controls on outbound capital flows (QDLP). Foreign fund managers with newly awarded quotas would be able to raise money in China for investment overseas under the QDLP scheme for the first time since late 2015. These licenses were granted to a dozen global money managers, according to the report. Samsung chief Lee was set free in an unexpected High Court reversal. Lee had appealed his 5-year jail sentence on corruption charges, which the court cut in half to 2 ½ years and then suspended it. Instead, Lee will be on probation for four years. The prosecution plans to appeal this latest ruling to the Supreme Court. RomaniaRomania central bank hiked rates by 25 bp and raised its inflation forecasts for the next two years. The bank sees inflation accelerating to 3.5% this year, up from its previous forecast of 3.2%. CPI rose 3.3% y/y in December, near the top of the 1.5-3.5% target range. The bank added that inflation should peak in H1 2018 at around 5% before slowing to 3.1% at the end of 2019. South AfricaSouth Africa President Zuma appears to be on the way out. The state of the union address was delayed as ANC officials negotiate a deal on Zuma’s exit so that Ramaphosa can deliver the speech as President. Top ANC leaders have also pulled out of events commemorating what would have been Nelson Mandela’s 100th birthday. Local press reports that Zuma will announce his decision to step down next week. EcuadorEcuador voters approved a referendum that reinstates term limits for the president. Preliminary count shows 64.3% voted to bar former President Rafael Correa from running for another term. Correa’s strategy to have his protégé and current President Moreno serve as a placeholder until the 2021 election seems to have backfired. VenezuelaVenezuela central bank restarted FX auctions for the first time since August and devalued the bolivar by more than 80%. One USD bought 25,000 bolivars at the auction vs. 3,345 bolivars at the last so-called Dicom sale last August. Still, even this new rate is much stronger than the black market rate, which is around 225,000 bolivars per USD. |

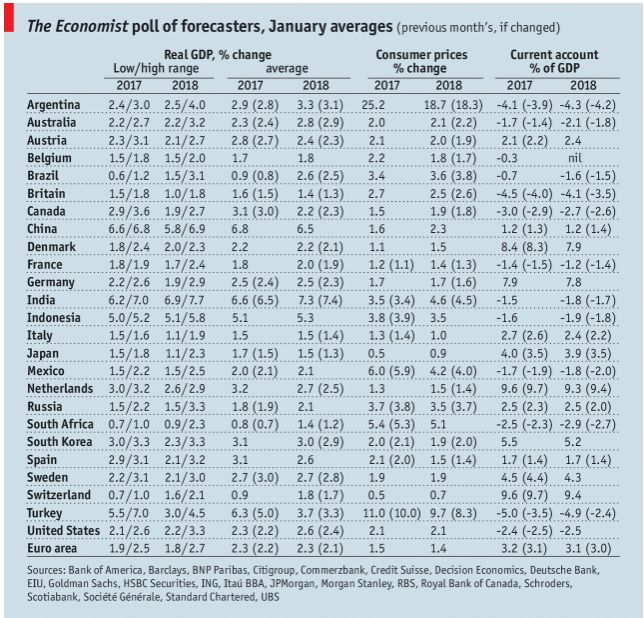

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2018 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin