Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future – Futurist guide to 2028 shows a world of uncertainty and disruption– One scenario suggests cybersecurity attacks will result in bitcoin and blockchain’s dominance of financial systems– Cybersecurity threat will still loom large and wreak havoc. Gold, silver and other real assets will benefit.– Adoption of cryptocurrencies and blockchain will send gold price soaring– Use of cryptocurrencies to take advantage of world systems will see investors turn to safe havens such as gold bullion and coins - Click to enlarge The media is filled with predictions for 2018. Will Trump survive another year? How will Brexit negotiations play out?

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future

– Futurist guide to 2028 shows a world of uncertainty and disruption |

|

| The media is filled with predictions for 2018. Will Trump survive another year? How will Brexit negotiations play out? Can bitcoin recover from its recent fall? What fake news will create the next disruption to the apparent status quo?

No one knows the answers to any of theses questions. If the past year to eighteen months has taught us anything it is that the polls and predictions are almost a waste of time. Arguably it is better to look further into the future and at a range of scenarios so one can consider the opportunities and threats that may lie ahead. Bloomberg has done just this, with their ‘Pessimists Guide to 2028‘. In it the authors consider eight scenarios. Each scenario could very easily begin to take place in 2018, but the full impact will play out over the following decade. The scenarios put forth are: Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Scenario 6 Scenario 7 Scenario 8 Below we bring you the Scenario 3: Bitcoin replaces the banks Each scenario is deserving of attention in its own right but it is the third one which we believe is the most pertinent and arguably realistic. This is the assumption that bitcoin will replace the banks and gold will benefit. Arguably gold would benefit as a result of many of the scenarios put forward. But, given the interest in bitcoin this year it is an important reminder that both bitcoin’s growth and weaknesses will see gold and other real assets shine.

|

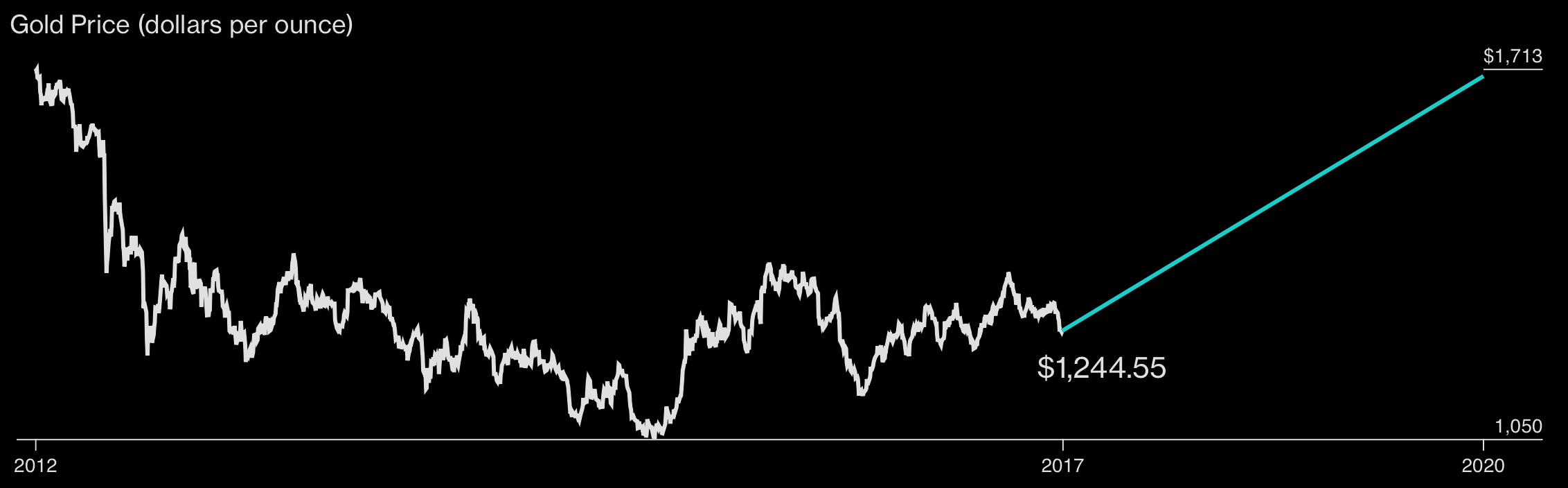

Gold Price, 2012 - 2017(see more posts on gold price, ) |

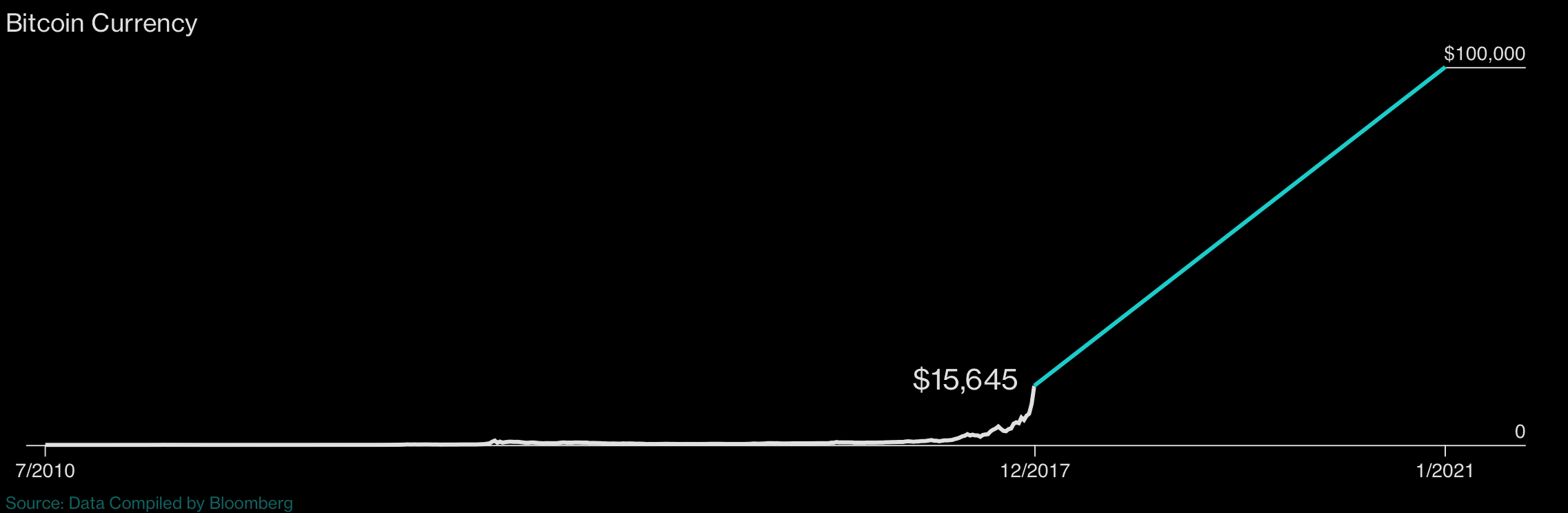

| 2021 China’s Alibaba adopts its own cryptocurrency for use inside its vast e-commerce network, establishing the mass-market viability of digital money. Following Venezuela’s lead, Greece and a few African countries adopt bitcoin, which hits $100,000. |

Bitcoin Currency, Jul 2010 - Dec 2017 |

In light of this scenario’s end, Bloomberg offers Nightberg’s advice for the investor:

Bloomberg’s analysis and Nightberg’s conclusion bring up a fear which is not just for the future but is a very real one today: cybersecurity attacks. the scenario begins because of a cybersecurity attack and it this issue is still not resolved ten years into the future. Cyber attacks are not something which can be overcome by cybersecurity. Like any form of attack there will be new approaches and strategies. The year of 2017 has been a very serious wake-up call as to how cyber power can flip the status quo on its head. Consider the apparent meddling by Russia in Western politics or North Korea’s (occasionally successful) attempts to steal bitcoin. The invisible threat is very much on our doorstep. This Christmas weekend HMS St Albans was forced to shadow a Russian warship in the North Sea. According to reports the warship was showing interest in ‘areas of national interest’. What is there apart from oil? The UK’s communication cables. Air Chief Marshal Sir Stuart Peach, the chief of the UK’s defence staff, has recently expressed concerns over the security of the cables. Should they be cut (or service disrupted) then the damage would “immediately and potentially catastrophically” hit the economy. Prepare for uncertainty, not the rise of bitcoin |

|

| This weekend’s posturing by the Russians or Bloomberg’s scenario planning should serve as a timely reminder as to what can and will survive such times. Physical gold cannot be made to disappear at the touch of a few buttons or by the cutting of cables. Should there be a global cyberattack on the financial system, the primary wealth would no longer be primarily digital (bitcoin, cash, stocks and bonds etc).

Gold and silver allocated and segregated bullion is important because of both its tangible nature and its role as a safe haven in times of geopolitical upset. Bitcoin, or any other cryptocurrency, cannot be considered safe when cyberattacks are a daily reality. They are also new and still untrusted by the majority of the system. When seeking to diversify your portfolio in order to protect from uncertain scenarios you should consider the risks posed to digital gold providers who do not allow clients to interact and trade on the phone and are solely reliant for pricing and liquidity from online portals and online trading platforms. Those who have outright legal ownership of physical gold and silver coins and bars outside the banking system will be far better prepared for cybersecurity attacks and uncertain times. You can read more on the other seven scenarios here. Whilst reading them it is worth reminding oneself of how easily the world can change and how uncertain we are as to whether they may or may not happen. |

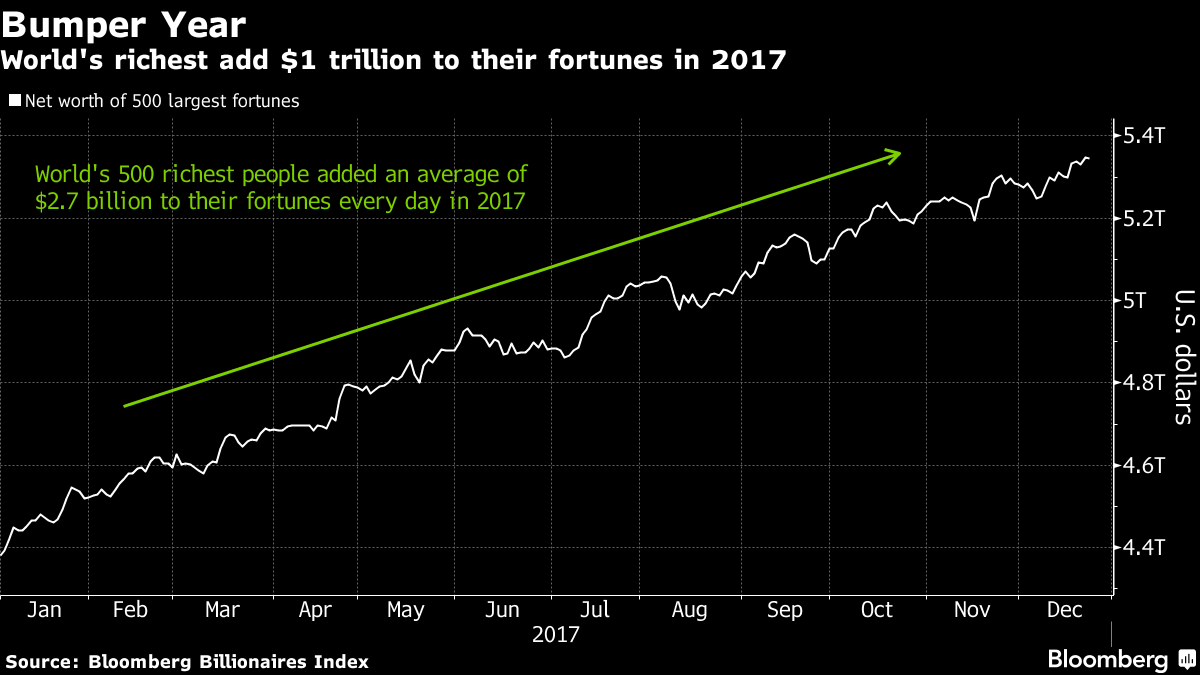

Net Worts of 500 Largest Fortunes, Jan - Dec 2017 |

Tags: Daily Market Update,Featured,newsletter