Stock Markets EM FX ended the week under pressure. News of the Venezuela debt restructuring was digested well, but sentiment went south as the day wore on. Weakness was concentrated in the weakest links TRY, BRL, RUB, and ZAR, while MXN and COP were dragged along for the ride. We see EM selling pressures persisting into 2018. Stock Markets Emerging Markets, November 04 Source: economist.com - Click to enlarge Czech Republic Czech Republic reports September industrial and construction output, retail sales Monday. Some slowing is expected. It then reports October CPI Thursday, with inflation expected to remain steady at 2.7%. If so, it would still be above the 2% target and supports the case for further

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock Markets

EM FX ended the week under pressure. News of the Venezuela debt restructuring was digested well, but sentiment went south as the day wore on. Weakness was concentrated in the weakest links TRY, BRL, RUB, and ZAR, while MXN and COP were dragged along for the ride. We see EM selling pressures persisting into 2018. |

Stock Markets Emerging Markets, November 04 Source: economist.com - Click to enlarge |

Czech RepublicCzech Republic reports September industrial and construction output, retail sales Monday. Some slowing is expected. It then reports October CPI Thursday, with inflation expected to remain steady at 2.7%. If so, it would still be above the 2% target and supports the case for further tightening after the CNB hiked 25 bp last week. PhilippinesPhilippines reports October CPI Monday, which is expected to rise 3.5% y/y vs. 3.4% in September. If so, inflation would still be in the upper half of the 2-4% target range. Yet the central bank meets Thursday and is expected to keep rates steady at 3%. September trade will be reported Friday. HungaryHungary reports September retail sales Tuesday, which are expected to rise 5.1% y/y vs. 4.7% in August. It then reports September IP (8% y/y WDA expected) and trade (EUR845 mln expected) Wednesday. October CPI will be reported Thursday, with inflation seen easing to 2.3% y/y from 2.5% in September. If so, this would still be in the lower half of the 2-4% target range. TaiwanTaiwan reports October CPI and trade Tuesday. The central bank does not have an explicit inflation target, but low inflation gives it leeway to keep rates on hold well into 2018. Export orders have slowed a bit in recent months, and so exports bear watching. ChileChile reports October trade Tuesday. It then reports October CPI Wednesday, which is expected to rise 1.6% y/y vs. 1.5% in September. If so, inflation would still be in the bottom half of the 2-4% target range. The central bank has signaled that the easing cycle is over. However, low inflation gives it leeway to cut again if the economic outlook worsens. ChinaChina reports October foreign reserves Tuesday, which are expected to tick higher to $3.118 bln. Chine then reports October trade Wednesday, where exports are expected to rise 7% y/y and imports by 16.8% y/y. China then reports October CPI and PPI Thursday. The former is expected to rise 1.7% y/y and the latter by 6.6% y/y. ThailandBank of Thailand meets Wednesday and is expected to keep rates steady at 1.5%. CPI rose only 0.9% y/y in October, still below the 1-4% target range. We see steady rates well into 2018. PolandNational Bank of Poland meets Wednesday and is expected to keep rates steady at 1.5%. CPI rose 2.1% y/y in October, which is still in the bottom half of the 1.5-3.5% target range. Still, with the economy so robust, we do not think the central bank can keep rates steady through 2018, as it plans. RussiaRussia reports October CPI Wednesday, which is expected to rise 2.8% y/y vs. 3.0% in September. The central bank cut rates 25 bp last month, and signaled further cuts ahead. Next policy meeting is December 15and another 25 bp cut to 8.0% is likely. TurkeyTurkey reports September IP Wednesday. The economy is picking up, and high inflation warrants some tightening from the central bank. The lira has responded poorly to the decision to keep rates steady last month, but the central bank is under pressure not to tighten again. The next policy meeting is December 14. MalaysiaBank Negara meets Thursday and is expected to keep rates steady at 3%. Ahead of the decision, Malaysia reports September IP (6.6% y/y expected) and manufacturing sales. Inflation was 4.3% y/y in September. However, the central bank does not have an explicit inflation target and so it can keep policy steady ahead of elections next year. South AfricaSouth Africa reports September manufacturing production Thursday, which is expected to rise 0.5% y/y vs. 1.5% in August. The economy remains weak, but the soft rand may prevent the SARB from cutting at its November 23 policy meeting. A lot can happen between now and then. MexicoBanco de Mexico meets Thursday and is expected to keep rates steady at 7%. Ahead of the decision, Mexico reports October CPI. Recent peso weakness is concerning, and could reverse some of the recent drop in inflation. September IP will be reported Friday. PeruPeru central bank meets Thursday and is expected to cut rates 25 bp to 3.25%. Inflation fell sharply in October to 2% y/y, right on target. However, the sluggish economy warrants further easing. BrazilBrazil reports October IPCA inflation Friday, which is expected at 2.75% y/y vs. 2.54% in September. Inflation has bottomed, which supports COPOM’s signal that is slowing the easing cycle and nearing its end. We look for one last 50 bp cut to 7% on December 6. |

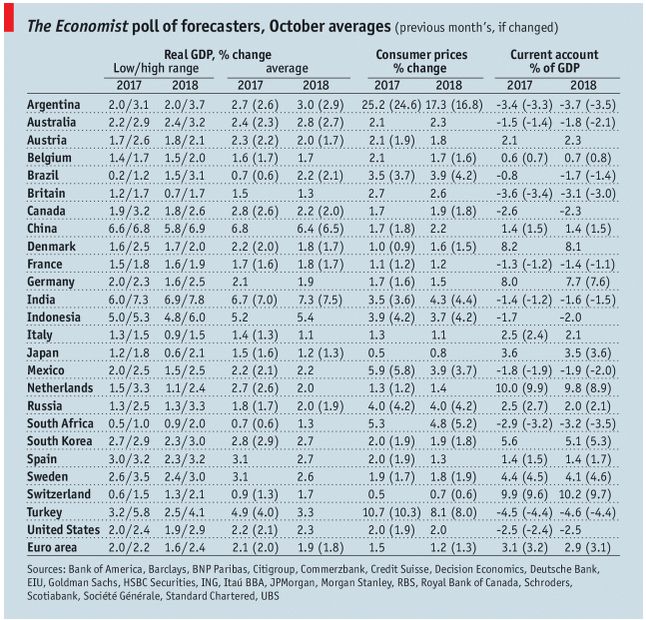

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, October 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin