The latest data releases seem to confirm our view that Chinese growth is decelerating, but our GDP forecast of 6.8% growth for 2017 remains unchanged.The latest data on China’s economic activity point to a slowdown in China’s growth momentum in the third quarter, after the positive surprise of the first half of the year. We expect growth to continue to moderate for the rest of 2017 and into 2018, but the pace of deceleration may be fairly modest. We have thus decided to keep our GDP forecast of 6.8% for 2017 unchanged for the time being.Our own calculation shows that for the month of August, the growth in FAI declined to 3.8% y-o-y from 6.5% in July. In our view, the deceleration in infrastructure investment was the main contributor to the slowdown in FAI in August The moderation in

Topics:

Dong Chen considers the following as important: China growth forecast, China growth momentum, China H2 GDP, Chinses exports, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The latest data releases seem to confirm our view that Chinese growth is decelerating, but our GDP forecast of 6.8% growth for 2017 remains unchanged.

The latest data on China’s economic activity point to a slowdown in China’s growth momentum in the third quarter, after the positive surprise of the first half of the year. We expect growth to continue to moderate for the rest of 2017 and into 2018, but the pace of deceleration may be fairly modest. We have thus decided to keep our GDP forecast of 6.8% for 2017 unchanged for the time being.

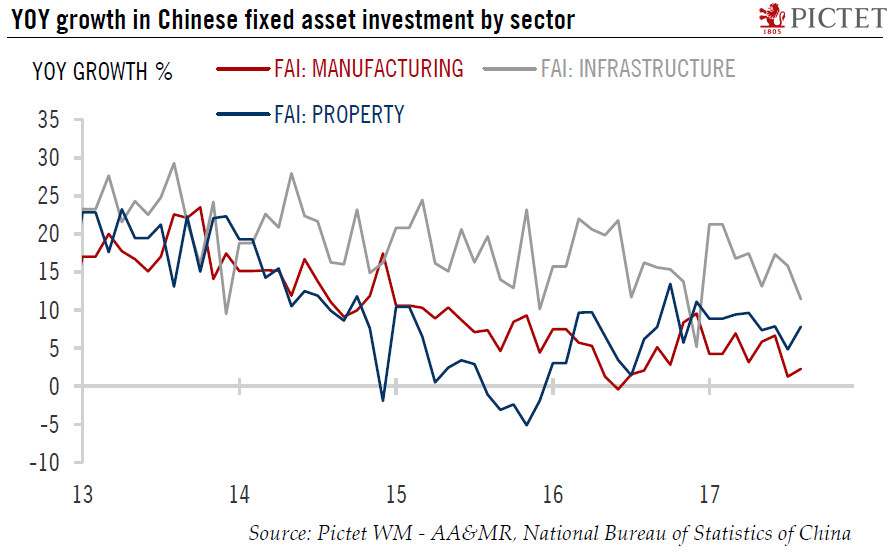

Our own calculation shows that for the month of August, the growth in FAI declined to 3.8% y-o-y from 6.5% in July. In our view, the deceleration in infrastructure investment was the main contributor to the slowdown in FAI in August The moderation in infrastructure investment is consistent with the slower pace of fiscal spending, front loaded to the start of the year.

Investment in the manufacturing and property sectors, which are the two other major components of Chinese FAI, showed minor improvement in August from the previous month, although growth was still lower than in the first half of the year (see chart).

Property investment has been much more resilient than we had earlier expected. Looking ahead, we expect housing sales to continue to trend downwards, and the growth in property investment to moderate further in the rest of 2017. However, a major correction in property investment seems unlikely.

On the external front, growth in Chinese exports continued to moderate in August. While the current global economic environment is still supportive, we believe the rebound in Chinese exports probably peaked in Q2. The recent appreciation of the Renminbi may weigh on Chinese exports going forward.

Meanwhile, Chinese consumers are resilient, and online shopping, especially for services, is growing at much faster rates than retail sales as a whole. The strong demand for SUVs and for online services suggests that the trend for the Chinese middle class to upscale their consumption is well underway.