As it prepares to announce a partial shrinkage of its balance sheet this week, the question is how firmly the Fed signals the next rate hike.The Fed is widely expected to announce a partial shrinkage of its balance sheet at its 20 September meeting, in line with the guidance it provided in June.We also expect Yellen to point to the possibility of another rate hike soon (while remaining vague about the exact timing), dependent on further improvements in inflation. This should be backed by the end-2017 median dot on Fed members’ ‘dot chart’ staying at 1.375%. We think the Fed will see the recent hurricanes that struck the southern coasts of the US as constituting only a blip in economic activity.The end-2018 median forecast could stay at 2.125%, but some Fed officials will probably reduce

Topics:

Thomas Costerg considers the following as important: Fed balance sheet reduction, Fed dot chart, Fed September meeting, Macroview, US Fed rate forecast

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

As it prepares to announce a partial shrinkage of its balance sheet this week, the question is how firmly the Fed signals the next rate hike.

The Fed is widely expected to announce a partial shrinkage of its balance sheet at its 20 September meeting, in line with the guidance it provided in June.

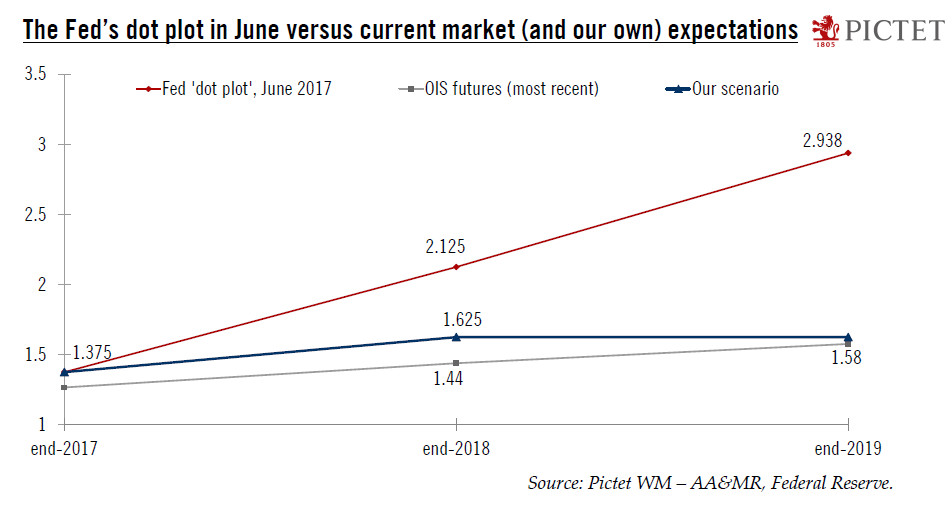

We also expect Yellen to point to the possibility of another rate hike soon (while remaining vague about the exact timing), dependent on further improvements in inflation. This should be backed by the end-2017 median dot on Fed members’ ‘dot chart’ staying at 1.375%. We think the Fed will see the recent hurricanes that struck the southern coasts of the US as constituting only a blip in economic activity.

The end-2018 median forecast could stay at 2.125%, but some Fed officials will probably reduce their expectations for the terminal rate of the rate-tightening cycle. We think the median terminal rate on the Fed’s ‘dot chart’ could drop to 2.75% from 2.94%.

We remain comfortable with our December rate hike call, even though, as of 18 September, the Fed funds future markets was still pricing in only a 47% chance of a rate hike on 13 December, according to Bloomberg data. Our scenario remains that the Fed will hike once more after that, in March 2018. Beyond that, however, the outlook gets muddier. We expect a pause in hikes, as fiscal policy could disappoint and we think the Fed’s dots are too optimistic, especially beyond 2018.