– “Things have been going up for too long…” – Goldman Sachs’ CEO – Lloyd Blankfein, Goldman CEO “unnerved by market” (see video) – Bitcoin bubble is no outlier says Bank of America Merrill Lynch– Bubbles are everywhere including London property– trillion of monetary stimulus has pushed investors to take more risks– We are now in a new era of bigger booms and bigger busts – BAML– “Seeing signs of bubbles in more and more parts of the capital market” – Deutsche Banks’ John Cryan – Global debt bubble and China very vulnerable too – warns Steve Keen – Bubbles, bubbles everywhere … lots of potential pins … got gold?Editor: Mark O’Byrne [embedded content] The B word is something which is almost whispered in financial

Topics:

Jan Skoyles considers the following as important: Barnaby Martin, Daily Market Update, Featured, Gold, GoldCore, Hans Lorenzen, John Cryan, Kim Jong-un, Lloyd Blankfein, Merrill Lynch, newslettersent, Robert Shiller, Steve Keen

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| – “Things have been going up for too long…” – Goldman Sachs’ CEO – Lloyd Blankfein, Goldman CEO “unnerved by market” (see video) – Bitcoin bubble is no outlier says Bank of America Merrill Lynch – Bubbles are everywhere including London property – $14 trillion of monetary stimulus has pushed investors to take more risks – We are now in a new era of bigger booms and bigger busts – BAML – “Seeing signs of bubbles in more and more parts of the capital market” – Deutsche Banks’ John Cryan – Global debt bubble and China very vulnerable too – warns Steve Keen – Bubbles, bubbles everywhere … lots of potential pins … got gold?Editor: Mark O’Byrne |

|

| The B word is something which is almost whispered in financial circles. To acknowledge there might be a bubble somewhere is like admitting the proverbial elephant is in the room.

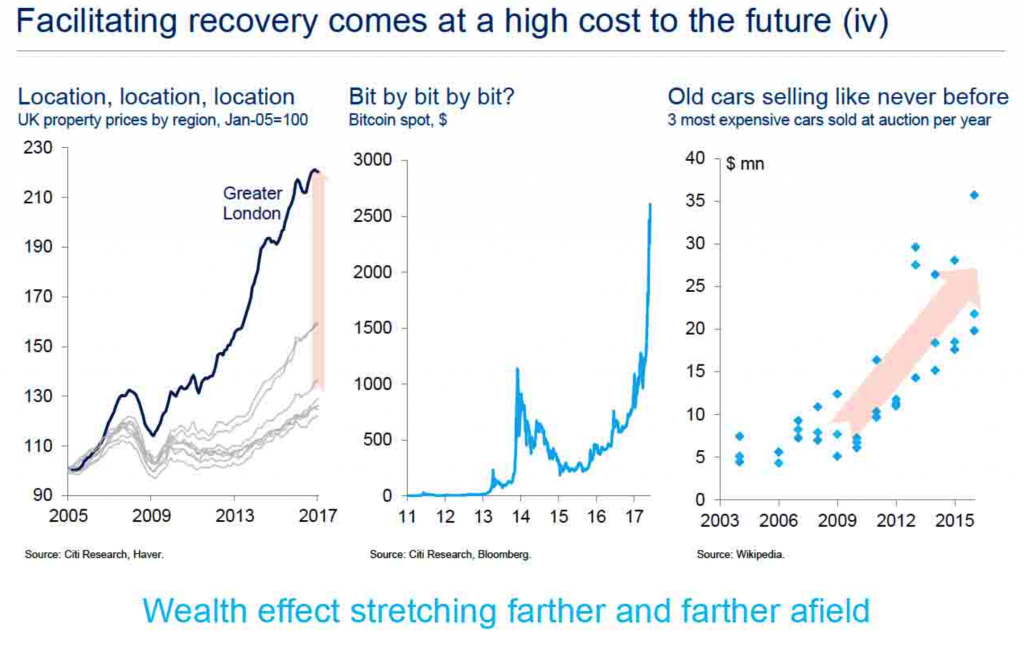

But, like many taboo words, it seems the mainstream are coming around to the idea that it is ok to mention the word ‘bubble’ and express their concerns about the possibility of at least one existing. This week Goldman Sachs’ Lloyd Blankfein, Deutsche Banks’ CEO John Cryan and strategists at Bank of America Merrill Lynch have separately expressed concerns that there are signs of bubbles in the markets – from the obvious bitcoin bubble to the less obvious bubble in London and other property markets and bubbles in many stock and bond markets. The most obvious one is bitcoin. Bitcoin is up 380% this year whilst the combined market cap of cryptocurrencies is up by 800%. However these are by no means anomalies according to analysts at BAML. Cryan and Blankfein agree, thanks to central bank money printing and low interest rates, they too are expressing their concerns over the state of markets. “When yields on corporate bonds are lower than dividends on stocks? That unnerves me … “ |

Wealth effect stretching farther and farther afield |

| There’s no bubble here

Professor Robert Shiller has been calling a bubble in bitcoin for a couple of years, for him it is the latest sign of ‘Irrational Exuberance’.

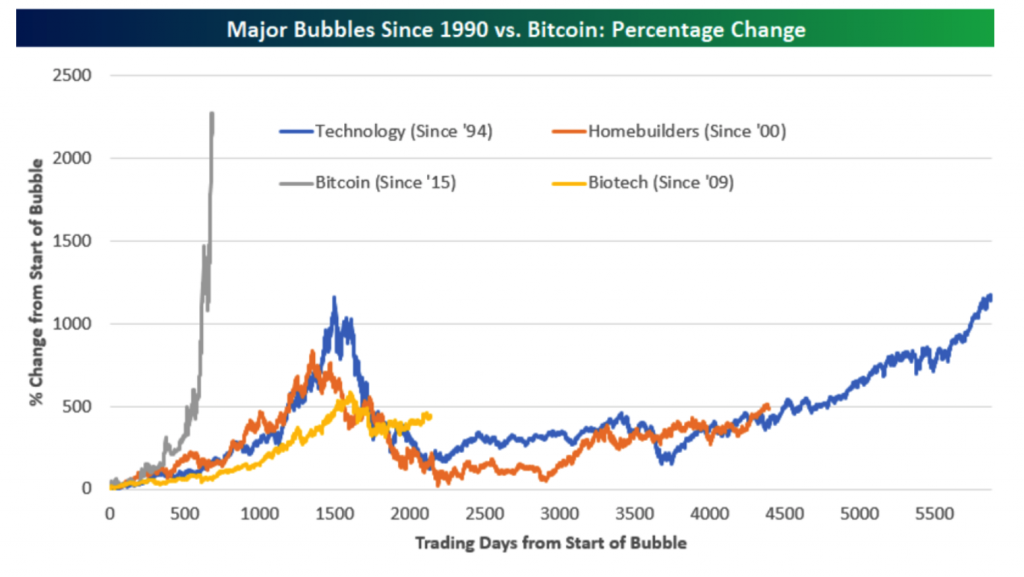

The bitcoin community was not best pleased when the man who is credited with being able to spot speculative manias decided to single out the cryptocurrency as the latest one. In response CoinTelegraph wrote an article entitled ‘Bitcoin So High Above the Bubbles They Can’t Be Seen’. The author claims that bitcoin is failing to follow the pattern of other bubbles.

The bitcoin crowd are doing exactly what so many tend to do when a market is massively outperforming – they build a narrative from it and begin to fuel the belief that the price can only go up. A BBC Capital article on the bitcoin phenomenon quotes a small bitcoin investor as saying ‘“I don’t know how far it’s going to grow,” he explains, “but if something is growing at hundreds of per cent, that’s a pretty valuable return.” Note ‘I don’t know how far it’s going to grow…’ The investor is convinced this can only go one way. For now we can perhaps assure ourselves that unlike in some other markets few investors will have gone all in or driven themselves into debt (as per the housing market). |

Major Bubbles Since 1990 and Bitcoin Change |

A happy, bubbly narrativeBubbles are created when investor enthusiasm and optimism are at excessive levels. In a 2010 interview with the Financial Crisis Inquiry Commission (FCIC) Warren Buffett explained that this happens because investors originally invest based on a sound premise, which is then the only focus for the investment strategy and they end up blinkered. Simply put investors begin to invest based on a sound premise, for example house prices are going to go up because money is losing its value and there is a more demand than supply. Investors are convinced that as house prices are climbing they must buy now. This goes on and on based on the original premise. Investors ignore other developments such as house price climbs are now outstripping inflation. We are seeing a similar thing in bitcoin. The housing example is no more pertinent right now than in Australia which is basically a $1.7 trillion house of cards. According to LF Economics, Australian housing speculators are able to use unrealized gains in properties as a ‘cash substitute’ for down payments on other investment properties. ‘Profitability is therefore predicated on ever-rising house prices…“[Many] international wholesale lenders … may find out the hard way that they have invested into nothing more than a $1.7 trillion ‘piss in a fancy bottle scam’,” |

Gold Futures Jan - Aug 2017(see more posts on Gold, ) |

Homebuyers forget the original premise and and become blinkered by the price action – which is that house prices are going up and up. Because it has been relatively easy and cheap to borrow money to finance purchases on these properties homebuyers suddenly see themselves as investors and decide to buy more than one house, because ‘it’s only going to go up’.

This is where we are with so many asset classes right now, including bitcoin, property, vintage cars and equities.

Debt and bubble junkies

But what gets the narrative going in the first place? In the last ten years it has been the generosity of central banks in their infinite money printing and low interest rate policies.

“Post the financial crisis, the largesse of central banks appears to be inducing quicker and steeper price gains in assets compared to the case historically,” analysts at BAML wrote “Speculative behavior in assets is cropping up more frequently and in more places than just credit markets.”

Earlier in the summer Citi’s Hans Lorenzen said the effect of the central banks’ ‘largesse’ was that “the wealth effect is stretching farther and farther afield.”

BAML’s analysts are also seeing this spread of the bubble effect across a number of markets, not just in credit markets where there is an unprecedented buying spree. ‘Asset bubbles seem to be becoming more “bubbly” as time goes by…’

Unlike our bitcoin friends, BAML sees a key issue with the current trajectory of the crypto’s price:

For instance, the increase in Japanese equities was pronounced between mid-1982 and the end of 1989, with share prices rising around 440% over the period. But Bitcoin, for instance, has risen roughly 2000% since just mid-2015. And other, recent, in-vogue indices seem to be surging higher as well.

Not to mention the Nasdaq index has soared over 18 % this year while the S&P 500 and Dow Jones indexes are each around 10% higher – building on the already large gains seen in recent years. Throughout the year U.S. bond yields at the 10-year and 30-year maturities have also fallen.

As Deutsche Bank’s John Cryan pointed out much of this inflation in the market place is thanks to the prolonger period of low-interest rates and cheap monetary policy. He called for the ECB to put an end to their current monetary policy and it is now causing “ever greater upheaval.”

“We are now seeing signs of bubbles in more and more parts of the capital market where we wouldn’t have expected them…I welcome the recent announcement by the Federal Reserve and now also from the ECB that they intend to gradually bring their loose monetary policy to an end.”

Is no one else worried about this?

Cryan pointed out that today volatility is markedly cheap given what is going on in both financial markets and the wider geopolitical space.

“The interesting thing about the markets today is that obviously they pay some regard to these hotspots but they don’t seem to be paying too much regard because we see very high asset prices in almost all asset categories…”

In Professor Steve Keen’s book Can We Avoid Another Financial Crisis?, he argues that many countries have become debt junkies.

“They face the junkie’s dilemma, a choice between going ‘cold turkey’ now, or continuing to shoot up on credit and experience a bigger bust later.”

Is it all about to go ‘pop’?

BAML strategist Barnaby Martin thinks not. Currently the market has a benign view on rates and this will most likely only be altered by an ‘inflationary shock’ which will see the major flows into the credit cycle fall back. Or the ECB swiftly stops with its current QE programme.

The latter may come sooner than we think, today the ECB is expected to give some indication on its plans regarding bond purchases, but in reality it probably won’t make much difference.

As Martin writes, this party isn’t coming to an end just yet:

“the end of the credit party will likely require a big inflationary “shock” in Europe, and one strong enough to reset market expectations over the pace of rate hikes. Safe to say that this seems a long way off to us.”

As a result, helped by falling political uncertainty (note European policy uncertainty is now lower than US policy uncertainty – the first time since mid-2012) and the renewed rise in negative yielding assets (note record number of European countries now with negative yielding debt), we see credit spreads heading tighter into year-end.

China swoops in from the left-field

How might all this end? Who knows. The last time interest-rates were this low for as long was during the 1930s and that ended with the Second World War.

It might be through trying to avoid World War III that the financial collapse is finally triggered. Currently Trump is relying heavily on China to cool things down with Kim Jong-Un of maniacal despot fame.

In Keen’s latest book China is one of the countries he believes is a debt junkie. The country’s credit-driven expansion has accounted for more than half of global growth since 2008. Why? Because it dealt with the collapse of the Western credit bubble in 2008 by fuelling a bubble of its own.

Today Chinese banks have $35tn of assets on their balance sheets – a fourfold increase since 2008. In the last decade private debt as a proportion of the country’s annual economic output (GDP) has increased from 120% to 210%.

Its financial system could almost be a mirror to those seen in the US and UK in the run up to the financial crisis. It has a large shadow banking system and special investment vehicles that take assets off balance sheets.

How does this relate to Trump, North Korea and the next financial crisis? Trump needs China on side when dealing with Kim Jong-Un. However, last week Beijing said that in the event of war between the two nuclear powers it would sit on the sidelines.

Trump now has to decide how to handle China as the country clearly has its limits in how much it will help. The most obvious option would be to impose economic sanctions for example, slapping tariffs on steel imports. It could also put China in a negative light in terms of its dealings in markets such as going back to Trump’s old rhetoric branding the country as a currency manipulator or accusing it of facilitating illegal piracy businesses.

Should sanctions be imposed then a trade war would inevitably erupt. This eruption would firmly put a pin in China’s bubble and ripples would be sent out across the world.

Bubbles, bubbles everywhere … lots of potential pins … got gold?

Tags: Barnaby Martin,Daily Market Update,Featured,Gold,Hans Lorenzen,John Cryan,Kim Jong-un,Lloyd Blankfein,Merrill Lynch,newslettersent,Robert Shiller,Steve Keen