Summary: Tensions on the Korean peninsula are still rising. Hong Kong boosted its 2017 growth forecast. S&P affirmed Israel’s A+ rating but moved the outlook from stable to positive. The corruption investigation against Israeli Prime Minister Netanyahu has intensified. South Africa’s parliament voted down the no confidence motion against President Zuma. Argentina officials are taking steps to support the peso. Banco de Mexico has ended its tightening cycle. Stock Markets In the EM equity space as measured by MSCI, Peru (+1.8%), Czech Republic (+0.7%), and Hungary (+0.5%) have outperformed this week, while India (-3.9%), Korea (-3.5%), and Hong Kong (-2.1%) have underperformed. To put this in better context, MSCI

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary:

Stock MarketsIn the EM equity space as measured by MSCI, Peru (+1.8%), Czech Republic (+0.7%), and Hungary (+0.5%) have outperformed this week, while India (-3.9%), Korea (-3.5%), and Hong Kong (-2.1%) have underperformed. To put this in better context, MSCI EM fell -2.3% this week while MSCI DM fell -1.5%. In the EM local currency bond space, Colombia (10-year yield -13 bp), Czech Republic (-6 bp), and Singapore (-5 bp) have outperformed this week, while Brazil (10-year yield +26 bp), Turkey (+15 bp), and Chile (+8 bp) have underperformed. To put this in better context, the 10-year UST yield fell 5 bp to 2.21%. In the EM FX space, ILS (+1.3% vs. USD), CNY (+1.0% vs. USD), and CLP (+0.4% vs. USD) have outperformed this week, while KRW (-1.6% vs. USD), PHP (-1.5% vs. USD), and BRL (-1.2% vs. USD) have underperformed. |

Stock Markets Emerging Markets, August 9nd Source: economist.com - Click to enlarge |

KoreaTensions on the Korean peninsula are still rising. Rather than taking a step back, President Trump has intensified his rhetoric. Pyongyang has threatened to launch four missiles into waters near Guam, which could come just days before long-planned US-South Korea joint military exercises from August 21-31. Hong KongHong Kong boosted its 2017 growth forecast. The government raised its forecast to between 3-4%, up from the 2-3% range seen in May. The move came after Hong Kong posted stronger than expected GDP growth of 3.8% y/y in Q2. IsraelS&P moved the outlook on Israel’s A+ rating from stable to positive. S&P sees growth averaging 3.2% over next four years, while the balance of payments performance is expected to stay strong. S&P noted that the positive outlook reflects potential for a better than expected fiscal performance over the next two years. The corruption investigation against Israeli Prime Minister Netanyahu has intensified. His former chief-of-staff Ari Harow has agreed to testify against him in a plea deal in an unrelated offense. Netanyahu has denied all allegations but Harow’s plea deal opens up a whole new front. South AfricaSouth Africa’s parliament voted down the no confidence motion against President Zuma. However, the 198-177 vote (with 9 abstentions) was very, very close. With over two dozen ANC lawmakers voting against Zuma, the vote suggests a bruising battle ahead for the ANC leadership this December. Bottom line: we think the rand will continue to underperform. ArgentinaArgentina officials are taking steps to support the peso. The central bank has started selling more dollars. Furthermore, requests from individuals seeking to buy more than $10,000 are reportedly being rejected by local banks. Peso weakness has picked up ahead of this weekend’s primary elections, where former President Fernandez is expected to do well in her quest for a senate seat. MexicoBanco de Mexico has likely ended its tightening cycle. After hiking at seven straight meetings, rates were kept steady for the first time since last August. The statement strikes us as being on the dovish side, saying that inflation has likely peaked and will turn lower in H2. It added that the current policy rate is consistent with moving inflation back to the 3% target. |

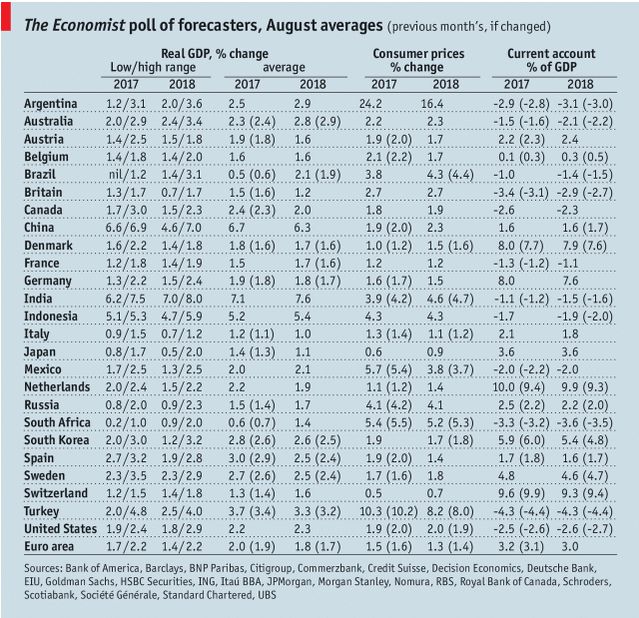

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, August 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin