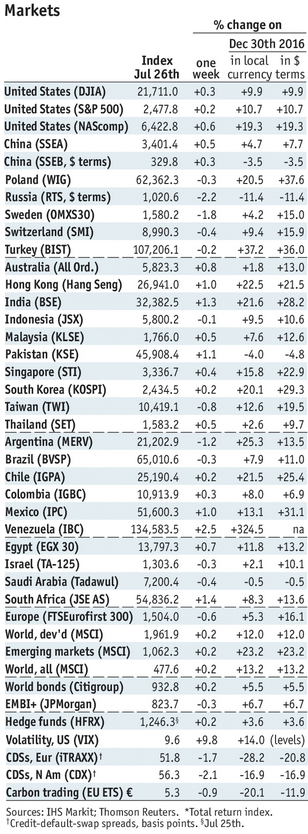

Stock Markets EM FX was mixed last week, as markets await fresh drivers. Jobs report this Friday could provide greater clarity with regards to Fed policy. BOE and RBA meet but aren’t expected to change policy. Data is likely to reinforce the notion that inflation remains low in EM, allowing those central banks to remain dovish. Czech National Bank is the main exception, as it may start the tightening cycle this week. Stock Markets Emerging Markets, July 29 - Click to enlarge China China reports official July PMI readings Monday, with manufacturing expected at 51.5 vs. 51.7 in June. Caixin manufacturing PMI will come out a day later, and is expected to remain steady at 50.4. CNY was one of the best EM

Topics:

Win Thin considers the following as important: emerging markets, Featured, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Stock MarketsEM FX was mixed last week, as markets await fresh drivers. Jobs report this Friday could provide greater clarity with regards to Fed policy. BOE and RBA meet but aren’t expected to change policy. Data is likely to reinforce the notion that inflation remains low in EM, allowing those central banks to remain dovish. Czech National Bank is the main exception, as it may start the tightening cycle this week. |

Stock Markets Emerging Markets, July 29 |

ChinaChina reports official July PMI readings Monday, with manufacturing expected at 51.5 vs. 51.7 in June. Caixin manufacturing PMI will come out a day later, and is expected to remain steady at 50.4. CNY was one of the best EM currencies last week, and suggests limited market concerns about the mainland economy. South AfricaSouth Africa reports June money and credit growth and trade Monday. M3 and credit growth are both expected to slow modestly from May. SARB started the easing cycle this month with a 25 bp cut to 6.75%, and is likely to continue with a 25 bp cut to 6.5% at the next meeting on September 21. TurkeyTurkey reports June trade Monday. The central bank releases its quarterly inflation report Tuesday. Turkey then reports July CPI Thursday, which is expected to rise 9.9% y/y vs. 10.9% in June. If so, this would still be above the 3-7% target range. The bank kept rates steady last week, and is likely to do the same at the next meeting on September 14. PolandPoland reports July CPI Monday, and is expected 1.6% y/y vs. 1.5% in June. If so, it would remain at the bottom of the 1.5-3.5% target range. The central bank has signaled an intent to keep rates steady into 2018 (or even 2019, as some officials suggest). We see no change at the next policy meeting on September 6. MexicoMexico reports Q2 GDP Monday, which is expected to rise 1.9% y/y vs. 2.8% in Q1. Momentum is slowing in the economy, though higher oil prices will help in Q3. We believe Banco de Mexico is on hold for now. Next policy meeting is August 10, no change is expected then. KoreaKorea reports July CPI and trade Tuesday. CPI is expected to rise 2.1% y/y vs. 1.9% in June, while exports are expected to rise 18.4% y/y and imports 15.7% y/y. If so, it reports June current account data Thursday. ThailandThailand reports July CPI Tuesday, which is expected to rise 0.25% y/y vs. -0.05% in June. Inflation remains well below the 1-4% target range, and seems likely to stay there. We think Bank of Thailand is on hold for the time being. Next policy meeting is August 16, rates are likely to remain at 1.5%. IndonesiaIndonesia reports July CPI Tuesday, which is expected to rise 3.94% y/y vs. 4.37% in June. If so, this would be back in the bottom of the 3-5% target range. We think Bank Indonesia is on hold for the time being. Next policy meeting is August 22, rates are likely to remain at 1.5%. PeruPeru reports July CPI Tuesday, which is expected to rise 2.85% y/y vs. 2.73% in June. If so, it would remain in the 1-3% target range. The central bank started the easing cycle with a 25 bp cut to 4% in May, stood pat in June, and then cut 25 bp again in July to 3.75%. While the easing cycle is likely to continue, the bank may stand pat at its August 10 meeting before cutting at the September 14 meeting. BrazilBrazil reports June IP and July trade Tuesday. IP is expected to rise 1.3% y/y vs. 4.0% in May. COPOM minutes will also be released. It cut rates 100 bp to 9.25%, as expected, but issued a more dovish than expected statement. As such, the market is starting to price in a 100 bp cut at the September 6 meeting vs. 75 bp previously. HungaryHungary central bank releases its minutes Wednesday. Hungary then reports June retail sales Thursday, which are expected to rise 4.5% y/y vs. 5.5% in May. It then reports June IP Friday, which is expected to rise 7.2% WDA vs. 6.2% in May. The economy remains firm, but low inflation could lead the central bank to ease again at its September meeting. IndiaReserve Bank of India meets Wednesday and is expected to cut rates 25 bp. However, the market is split, with about a third of the analysts polled by Bloomberg looking for no change. CPI rose 1.5% y/y in June, below the 2-6% target range. Czech RepublicCzech National Bank meets Thursday and is expected to hike rates 20 bp to 0.25%. However, the market is split. Of the 21 analysts polled by Bloomberg, 11 see a 20 bp hike and 10 see no change. We lean toward no hike now, but think it is very likely at the next meeting on September 27. June retail sales will be reported Friday, which are expected to rise 5.5% y/y vs. 5.3% in May. PhilippinesThe Philippines reports July CPI Friday, which is expected to rise 2.9% y/y vs. 2.8% in June. If so, this would still be in the bottom half of the 2-4% target range. The next policy meeting is August 10, and rates are likely to be kept steady at 3.0%. ColombiaColombia reports July CPI Saturday, which is expected to rise 3.57% y/y vs. 3.99% in June. If so, it would be the lowest rate since October 2014 and would move further into the 2-4% target range. The central bank just cut rates 25 bp to 5.5% last week. We think the easing cycle will continue into Q4, with another 25 bp cut to 5.25% likely at the August 31 meeting. |

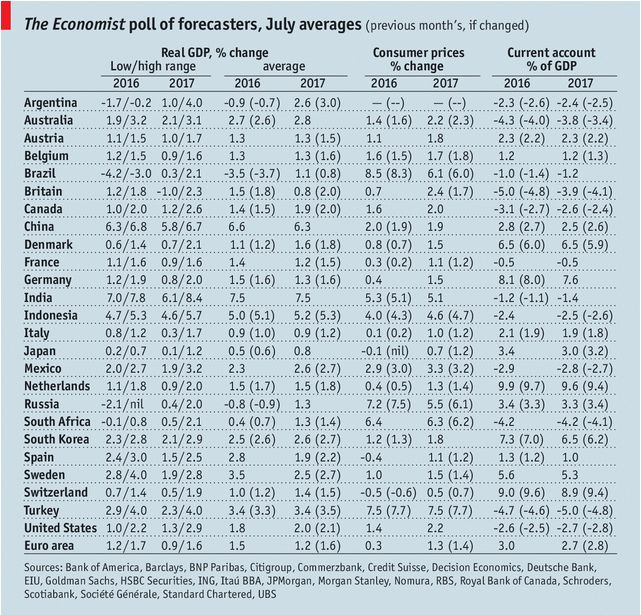

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, July 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newslettersent