Summary:

Summary South Korea proposed resuming military and humanitarian exchanges with North Korea. The European Union may sanction Poland over its controversial judicial overhaul. Turkish Prime Minister Yildirim announced a cabinet shuffle after meeting with President Erdogan. Turkey’s worsening relations with Germany will come with economic costs. South African Reserve Bank surprised markets by starting the easing cycle with a 25 bp cut to 7.0%. Brazil will raise fuel taxes and freeze spending in an effort to meet its fiscal targets S&P raised the outlook on Mexico’s BBB+ rating from negative to stable. Stock Markets In the EM equity space as measured by MSCI, South Africa (+1.8%), Chile (+1.6%), and China (+1.5%) have

Topics:

Win Thin considers the following as important: emerging markets, Featured, Mehmet Simsek, newsletter, win-thin

This could be interesting, too:

Summary South Korea proposed resuming military and humanitarian exchanges with North Korea. The European Union may sanction Poland over its controversial judicial overhaul. Turkish Prime Minister Yildirim announced a cabinet shuffle after meeting with President Erdogan. Turkey’s worsening relations with Germany will come with economic costs. South African Reserve Bank surprised markets by starting the easing cycle with a 25 bp cut to 7.0%. Brazil will raise fuel taxes and freeze spending in an effort to meet its fiscal targets S&P raised the outlook on Mexico’s BBB+ rating from negative to stable. Stock Markets In the EM equity space as measured by MSCI, South Africa (+1.8%), Chile (+1.6%), and China (+1.5%) have

Topics:

Win Thin considers the following as important: emerging markets, Featured, Mehmet Simsek, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

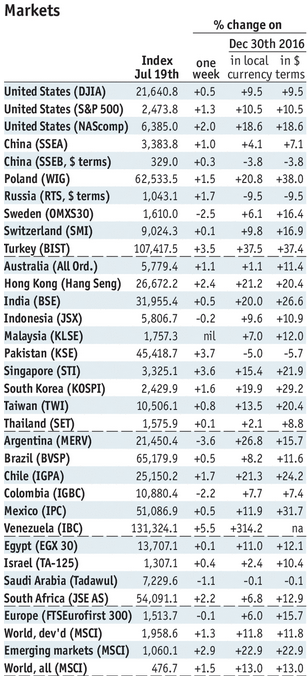

Stock MarketsIn the EM equity space as measured by MSCI, South Africa (+1.8%), Chile (+1.6%), and China (+1.5%) have outperformed this week, while Indonesia (-1.8%), Russia (-1.5%), and Colombia (-1.5%) have underperformed. To put this in better context, MSCI EM rose 1.2% this week while MSCI DM rose 0.5%.

In the EM local currency bond space, Brazil (10-year yield -23 bp), South Africa (-17 bp), and Russia (-10 bp) have outperformed this week, while Chile (10-year yield +10 bp), Colombia (+4 bp), and China (+4 bp) have underperformed. To put this in better context, the 10-year UST yield fell 10 bp to 2.33%.

In the EM FX space, BRL (+1.9% vs. USD), KRW (+1.3% vs. USD), and THB (+0.9% vs. USD) have outperformed this week, while ARS (-3.0% vs. USD), PLN (-1.4% vs. EUR), and ILS (-0.4% vs. USD) have underperformed.

|

Stock Markets Emerging Markets, July 22 |

South KoreaSouth Korea proposed resuming military and humanitarian exchanges with North Korea. President Moon Jae-in promised a different approach to North-South relations from the hardline approach taken by his predecessor Park Geun-eh. The announcement came after North Korea signaled a willingness to engage. Moon has already suspended the controversial missile shield, so we may see some further thawing of relations.

PolandThe European Union may sanction Poland over its controversial judicial overhaul. The European Commission confirmed it is close to starting a procedure that could eventually lead to a loss of Poland’s EU voting rights under Article 7 of the EU treaty. The judicial revamp would force all Supreme Court judges to retire and would give the government more say over new picks for the judiciary.

TurkeyTurkish Prime Minister Yildirim announced a cabinet shuffle after meeting with President Erdogan. Mehmet Simsek, who has responsibility for economic issues, was the only Deputy Prime Minister to keep his position. As such, we see little in the way of policy implications as Erdogan is still calling the shots.

Turkey’s worsening relations with Germany will come with economic costs. The latest flare-up comes after Turkey arrested a German human rights activist for being part of a terrorist organization. German Foreign Minister Gabriel announced a “re-orientation” of German policy toward Turkey and warned German companies against doing business there and issued revised guidelines for travelers. German business groups warned of a “significant drop” in sales to Turkey.

South AfricaSouth African Reserve Bank surprised markets by starting the easing cycle with a 25 bp cut to 7.0%. No change was expected. This is its first rate cut since July 2012. Now that the door has been opened, further cuts are likely at the September 21 and November 23 meetings.

BrazilBrazil will raise fuel taxes and freeze spending in an effort to meet its fiscal targets. The government expects to raise BRL10.4 bln ($3.3 bln) from the fuel tax, and plans to freeze spending by BRL5.9 bln. Extraordinary measures are needed as the recovery continues to lag expectations.

MexicoS&P raised the outlook on Mexico’s BBB+ rating from negative to stable. The agency said that it doesn’t expect significant worsening of the country’s debt load. It noted that “We believe that the prompt reaction of Mexican government authorities to recent negative shocks, such as the depreciation of the currency in late 2016, will diminish the recently rapid pace of debt accumulation and help stabilize the government’s debt burden.”

|

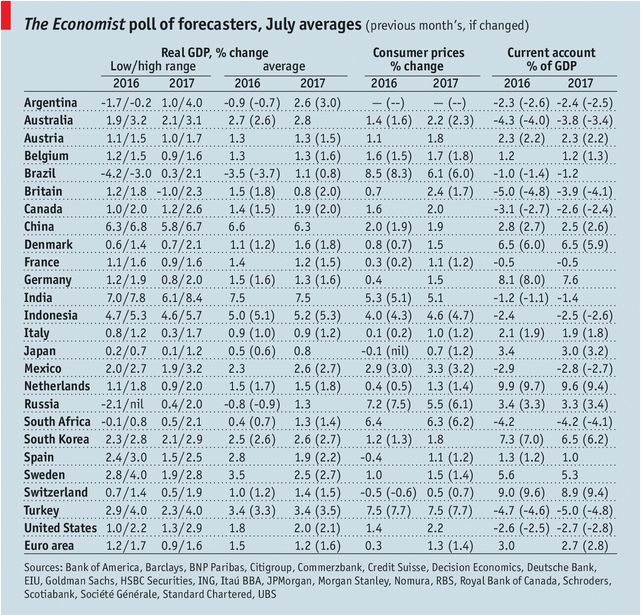

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, July 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,Mehmet Simsek,newsletter,win-thin