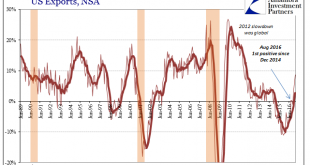

US trade statistics dramatically improved in January 2017, though questions remain as to interpreting by how much. On the export side, US exports of goods rose 8.7% year-over-year (NSA). While that was the highest growth rate since 2012, there is part symmetry to account for some of it. Exports in the latter half of 2015 and for that first month of 2016 were contracting at double digit rates, the base effects of the...

Read More »Economic Dissonance, Too

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony. But that may only be true because “accommodation” doesn’t ever achieve what it aims to....

Read More »Why Aren’t Oil Prices $50 Ahead?

Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even...

Read More »U.S. CPI after the energy push

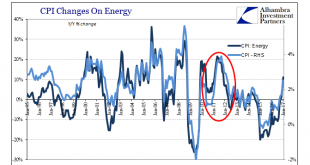

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise...

Read More »Financial markets looking for a second wind

Published: 17th March 2016 Download issue: Financial markets search for a second wind Equity markets in developed economies rebounded in February, after spending December and January in an attitude of crisis. We think that this is just a tactical rebound, rather than a return to the bull market that prevailed on equity markets from 2009 to 2014. The fundamentals that limit the upside for equities have not changed; meanwhile, the limits of central bank policy are becoming increasingly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org