Interview with Robert Hartmann, Co-Owner ProAurum Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens. That is especially true of precious metals investors. A new gold rush is now underway, with impressive price gains and elevated demand levels that are...

Read More »Hard talk with Václav Klaus: “The people should say NO to all of it.”

As we get deeper into this crisis and we get used to our “new normal”, it’s easy to focus on the daily corona-horror stories in the media or the latest shocking unemployment numbers, and lose track of the bigger picture and of what is really, fundamentally important. Even as the lockdown measures begin to get phased out, the scale of the economic damage is unimaginable and the idea of returning to “business as usual” is no longer tenable. The last couple of months have had a severe...

Read More »Restricted Market Trading Comments

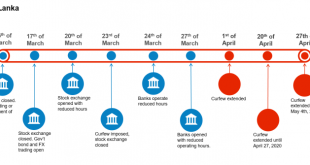

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot As the week commences, a few markets such as Sri Lanka and Philippines are extending their lockdown periods while others such as Nigeria and Kenya continue to experience USD liquidity issues. Please see comments below. Sri Lanka: The Colombo Stock Exchange (CSE) was expected to resume operations on April 27 but, due to an uptick in Covid-19 cases, the exchange remains closed until May 4. Foreign exchange trading is...

Read More »“A crisis must never be misused to extend state power”

Interview with H.S.H. Prince Michael of Liechtenstein In these times of great uncertainty and widespread fear, it is natural for many citizens to turn to their leaders for guidance and reassurance. However, these much-needed qualities of real leadership have proven to be elusive in many countries around the world. Instead of that, in the US and even more so in the EU, we saw a lack of consistency and planning in the face of the corona epidemic, adding to the overall confusion...

Read More »Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot With many markets still under lockdown and some going out on Easter holidays this week, we continue to see amended trading hours. The most notable change has been in India with a reduction in trading hours, while in Nigeria we saw a small amount of liquidity being released by the Central Bank of Nigeria (CBN). Below are our updates for the week. Please get in touch if you would like further information or to discuss...

Read More »Corona crisis: the cost of the response – Part II

Responding to the response This time around, both central banks and governments have gone “all-in” in their response packages and the scale of the support and liquidity provided dwarf the measures that we saw in the 2008 crisis. Of course, the question remains whether this will all be enough to help save the economy from these massive self-inflicted wounds. However, one thing is clear so far and that is the uniformity of the political handling of the economic crisis. All...

Read More »Corona crisis: the cost of the response – Part I

The absolutely unprecedented wave of shutdowns, new restrictions and regulations that the coronavirus epidemic has triggered on a global scale is truly hard to quantify. We’ve simply never seen anything like it before. Never in the history of mankind have countries all over the globe intentionally hit the kill switch on their own economies and simultaneously pulled the brakes on anything even remotely resembling productive activity. Some of the consequences of these radical...

Read More »Is gold still a safe haven?

There have been moments in recent months when many gold owners, myself included, have asked themselves whether gold might have lost its safe haven status, at least in the western world. Was it enough for two generations, who grew up in a paper money system, to forget the history and the 5000-year-old status of gold as real money? And yet, just as these doubts began to arise, reality struck back and decisively dispersed them. A few hours prior to writing this, a surprising number...

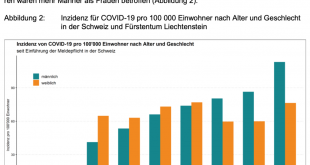

Read More »COVID-19 – Auslegeordnung

In den vergangenen Tagen habe ich mich immer wieder gefragt, “wo besteht eigentlich das Problem?” Zu oft habe ich das Gefühl, dass viele Experten, Medien und Politiker mit den Zahlen ein Durcheinander haben und so mehr zur Verwirrung als zur Klärung beitragen. Deshalb hier der Versuch einer strukturierten Aufschlüsselung. Eine Bitte an alle Leser: Ich suche Quellen (Webseiten, Videos [mit Minutenangabe], Interviews, etc.), welche meine Fragen entweder beantworten...

Read More »Gold-Update from Switzerland

Dear all, There are more and more indications that the physical gold market is running at its limit. The Canadian Mint will not supply Maple Leaf coins for at least the next 3 months, various large refineries are under pressure, while traders are barely keeping up with the order flow. We do not know how the supply will develop in the future. With closed borders, a massive reduction in international transport capacity, slashed work hours and severe operational cuts, I see a real...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org