Just after sunrise on April 19, 1775, a large contingent of British military troops arrived to the town of Lexington, Massachusetts. They were under orders to search for and confiscate all weapons and munitions from the colonials– something the British army had done countless times before. In many ways it was a routine operation. And yet, that morning, roughly 80 local militiamen stood blocking their path. Paul Revere had ridden through Lexington only hours before to warn residents of the...

Read More »Switzerland: You know negative interest rates are bad when…

Switzerland is famous for being punctual. The trains. The buses. The meticulously crafted, hand polished luxury watches. The Swiss are so culturally punctual that they even tend to pay their taxes well in advance of the filing deadline. So it was quite a shock to hear this morning that the Swiss canton of Zug is asking its citizens to delay paying their taxes for as long as possible. Why? Negative interest rates. The cantonal government doesn’t want to take in a pile of cash, only to end...

Read More »Gold And Negative Interest Rates

The Inflation Illusion We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates. We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have...

Read More »Interest Rates: How Low Can They Go?

When Denmark introduced negative interest rates in 2012, it was a pioneer. But the policy has become such an accepted part of central banks’ toolbox in the years since that financial pundits hardly batted an eyelash when Hungary became the world’s sixth central bank to introduce negative rates in March 2016. As the practice becomes more widespread, the question of how low interest rates can go has become increasingly relevant for investors. While every country (or region, in the case...

Read More »Germany’s AFD leader Frauke Peter wants ‘more Switzerland for Germany’

Frauke Petry, leader of the Alternative for Germany (AFD) Frauke Petry, leader of the Alternative for Germany (AfD), believes Germany “needs more Switzerland … more democracy” and that Switzerland is some way ahead of her country when it comes to a “culture of democracy”. Petry, who in January suggested German police should be allowed to shoot refugees trying to enter Germany, was a guest speaker at the general meeting of the Campaign for an Independent and Neutral Switzerland (CINS, in...

Read More »Switzerland Readies Military In Preparation For A New Wave Of Migrants

According to The BBC, the most asylum claims in 2015 occurred in Germany, which saw >500,000... With the main route (reportedly shut down) being from Turkey to Greece, and up through the Balkans... With Syrians making up the bulk of migrants trying to enter Europe. But now, in response to Balkan countries closing down traditional migrant routes to Europe, Switzerland's military is taking steps to prepare for a potential new wave of immigrants in case it becomes part of a new route....

Read More »The Shocking Reason For FATCA… And What Comes Next

Politicians around the world are working hard to build this emerging prison planet. But it’s still possible to escape. We recently released a video to show you how. Click here to watch it now. If you’ve never heard of the Foreign Account Tax Compliance Act (FATCA), you’re not alone. Few people have, and even fewer fully grasp the terrible things it foreshadows. FATCA is a U.S. law that forces every financial institution in the world to give the IRS information about its American...

Read More »Malaysia CDS Spike After Abu Dhabi Puts Scandal-Ridden 1MDB In Default, Funds hidden in Switzerland

Over the better part of the past year, we’ve documented the curious case of 1MDB, Malaysia’s government investment fund founded in 2009. It’s a long and exceptionally convoluted story that doesn’t exactly lend itself to a concise summary but suffice to say that the development bank was something of a black box right from the beginning and in 2013, some $680 million allegedly tied to 1MDB ended up in Malaysian PM Najib Razak’s personal bank account just prior to an election. There are any...

Read More »Panama Papers Names Revealed: Multiple Connections to Clinton Foundation, Marc Rich

There has been much confusion, at time quite angry, how in the aftermath of the Soros-funded Panama Papers revelations few, if any, prominent U.S. name emerged as a result of the biggest offshore tax leak in history. Now, thanks to McClatchy more U.S. names are finally being revealed and it will probably come as little surprise that many of the newly revealed names have connection to both Bill and Hillary Clinton. Connections to Bill and Hillary Clinton As McClatchy writes, donors to...

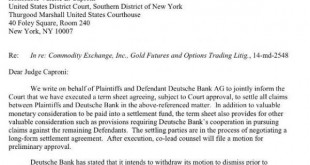

Read More »Billion Dollar Lawsuits Filed Following Deutsche Bank’s Admission Of Gold, Silver Rigging

Barely a day had passed since the historic admission of gold and silver price rigging by Deutsche bank, which as we reported on Thursday was settled with not only "valuable monetary consideration", but Deutsche's "cooperation in pursuing claims" against other members of the cartel, i.e., exposing the manipulation of other cartel members, and the class action lawsuits have begun. Overnight, two class action lawsuits seeking $1 billion in damages on behalf of Canadian gold and silver...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org