Days before the ICIJ released this weekend's trove of "Panama Papers" international tax haven data involving Panamaian law firm Mossack Fonseca, Bloomberg conducted an interview on March 29 with the two founding lawyers. In it, it found that even before the full leak was about to be made semi-public (any of the at least 441 US clients are still to be disclosed), the Panama law firm knew that the game was already largely over. As Bloomberg reports, "during a four-hour interview last week,...

Read More »Mossack Fonseca: The Nazi, CIA And Nevada Connections… And Why It’s Now Rothschild’s Turn

For all the media excitement about the disclosed names in the "Panama Papers" leak, in this case represented by the extensive list of Mossack Fonseca clients, this is not a story about which super wealthy individuals did everything in their power, both legal and illegal, to avoid taxes, preserve their financial anonymity, and generally preserve their wealth. After all, that's what they do, and it should not come as a surprise that they will always do that, especially following last year's...

Read More »U.S. Futures Slide, Crude Under $39 As Dollar Rallies For Fifth Day

Following yesterday's dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below $39 earlier in the session, and leading to weakness across virtually all...

Read More »USA: The New Switzerland?

Hold your real assets outside of the banking system in a private international facility --> http://www.321gold.com/info/053015_sprott.html USA: The New Switzerland? Written by Jeff Thomas (CLICK FOR ORIGINAL) At one time, tax havens took great pride in calling themselves just that, since low-tax jurisdictions provide people with freedom from oppressive taxation. But, in recent decades, the...

Read More »The Global Run On Physical Cash Has Begun: Why It Pays To Panic First

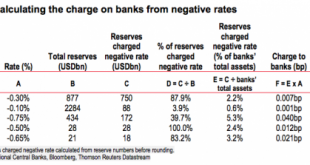

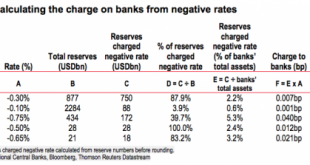

Back in August 2012, when negative interest rates were still merely viewed as sheer monetary lunacy instead of pervasive global monetary reality that has pushed over $6 trillion in global bonds into negative yield territory, the NY Fed mused hypothetically about negative rates and wrote "Be Careful What You Wish For" saying that "if rates go negative, the U.S. Treasury Department’s Bureau of Engraving and Printing will likely be called upon to print a lot more currency as individuals and...

Read More »HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for...

Read More »HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for...

Read More »HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org