Swiss Franc The Euro has fallen by 0.06% to 1.1279 CHF. EUR/CHF and USD/CHF, August 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The second largest drop in US equities this year has spilled over to drag global markets lower. The MSCI Asia Pacific Index fell nearly 0.5%, snapping a four-day advance and cutting this week’s gain in half. The Dow Jones Stoxx did not...

Read More »FX Weekly Preview: Synthetic FX View — Macro and Prices

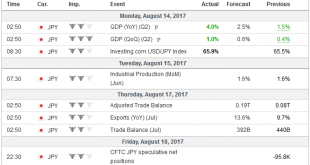

Summary: Economic data due out are unlikely to change macro views. Swiss franc’s price action suggests some return to “normalcy” despite rhetoric remaining elevated. Sterling’s 3.25 cent drop against the dollar looks over. An escalation of threatening rhetoric by the United States and North Korea emerged as the key driver last week. The US was unable to build on the success it enjoyed at the UN on August 5...

Read More »FX Daily, August 10: Tensions Remain Elevated, Dollar Firms

Swiss Franc The euro has depreciated by 0.13% to 1.1312CHF. EUR/CHF and USD/CHF, August 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The net impact is to lift the US dollar, yen and gold. The geopolitical tensions saw more profit-taking in equities. Debt markets are little changed, but the US Treasuries area a little firmer. We suspect that like yesterday, North...

Read More »FX Daily, May 26: Anxiety Levels Rise Ahead of Weekend

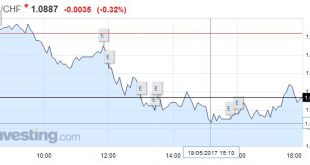

Swiss Franc The Euro has fallen by 0.01% to 1.0902 CHF. EUR/CHF - Euro Swiss Franc, May 26(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The markets are unsettled. It is not so much in the magnitude of moves as the breadth of the move. The nearly 1% rally in gold is a tell, but also the inability of equity market to follow the lead of the US markets, where the S&P 500 and NASDAQ set new records. US...

Read More »Great Graphic: OIl and the S&P 500

The first Great Graphic (created on Bloomberg) here shows the rolling 60-day correlation of the level of the S&P and the level of oil since the beginning of last year. In early 2016, the correlation was almost perfect, but steadily fell and spend a good part of the second half of the year negatively correlated. Late in the year, the correlation began recovering, and February reached almost 0.8. However, a month...

Read More »FX Daily, May 25: Euro Strength more than Dollar Weakness

Swiss Franc The Euro has fallen by 0.14% to 1.0903 CHF. EUR/CHF - Euro Swiss Franc, May 25(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Pound to Swiss Franc exchange rates have seen a choppy day of trading but almost no net movement whatsoever, with the percentage difference on buying Swiss Franc rates since the opening bell at a paltry 0.01%. Why the quiet market? We are at the back end of the month...

Read More »FX Daily, May 18: Some Respite from US Politics as Sterling Surges Through $1.30

Swiss Franc EUR/CHF - Euro Swiss Franc, May 18(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Yesterday’s dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI’s investigation into Russia’s attempt to influence the US election appears to have acted a circuit breaker of sorts. It is not sufficient to boost confidence that the Trump...

Read More »FX Weekly Preview: Dollar Drivers

Summary: US retail sales and CPI should help bolster confidence that the Fed was right about the transitory nature of Q1 slowdown. Bank of England meets; Forbes will likely continue with her dissent, but likely failed to convince her other colleagues of the merit of an immediate rate hike. French politics are center stage, but German state election and South Korea’s national election are also important....

Read More »What is the Bank of Japan to Do?

Summary: Policy is on hold. There is several areas which the BOJ can adjust its forecast or forward guidance. BOJ is more likely to err on the side of caution. The Bank of Japan is unlikely to change policy. Its current policy of targeting 10-year bond yields and expanding the balance sheet by JPY80 trillion is aimed at boosting core inflation to 2%. However, the risk is that BOJ Governor Kuroda surprises the...

Read More »FX Weekly Preview: What to Watch in the Week Ahead

Many observers misunderstood US President Trump’s “American First” rhetoric. Trump’s earlier writings show that this is not a reference to the 1940s effort to keep the US out of WWII, with its isolationist tint. Rather, Trump’s use goes back to the original use by President Harding in the 1920s. It was a rejection of the Wilsonian multilateralism (e.g. League of Nations) and a robust defense of unilateralism. That...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org