USD/CHF EUR/CHF EUR/CHF and USD/CHF, October 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge USD/JPY [embedded content] USD/JPY with Technical Indicators, October 16(see more posts on USD/JPY, ) - Click to enlarge EUR/USD [embedded content] EUR/USD with Technical Indicators, October 16(see more posts on EUR/USD, ) - Click to enlarge GBP/USD [embedded content]...

Read More »Weekly Technical Analysis: 09/10/2017 – EURJPY, EURAUD, USDCHF, GOLD

USD/CHF EUR/CHF EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge EUR/JPY [embedded content] EUR/JPY with Technical Indicators, October 10(see more posts on EUR/JPY, ) - Click to enlarge EUR/AUD [embedded content] EUR/AUD with Technical Indicators, October 10(see more posts on eur/aud, ) - Click to enlarge USD/CHF [embedded content]...

Read More »Stocks Up and Yields Down – Precious Metals Supply & Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Where the Good Things Go Many gold bugs make an implicit assumption. Gold is good, therefore it will go up. This is tempting but wrong (ignoring that gold does not go anywhere, it’s the dollar that goes down). One error is in thinking that now you have discovered a truth, everyone else will see it quickly. And there is a...

Read More »Weekly Technical Analysis: 02/10/2017 – USDJPY, EURUSD, GBPUSD, USDCAD

USD/CHF EUR/CHF EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge USD/JPY [embedded content] USD/JPY with Technical Indicators, October 2 - Click to enlarge EUR/USD [embedded content] EUR/USD with Technical Indicators, October 2 - Click to enlarge GBP/USD [embedded content] GBP/USD with Technical Indicators, October 2 - Click to...

Read More »Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

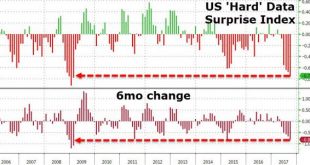

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown – the 4th-longest streak since 1928… So everything is awesome… [embedded content] BUT…US ‘hard’ economic data has not been this weak (and seen the biggest drop) since Feb 2009… US Data Surprise Index, 2006 - 2017 - Click to enlarge Q3 Was a Roller-Coaster… Q3 was the 8th straight quarterly gain in a row for The Dow – the longest streak...

Read More »Weekly Technical Analysis: 25/09/2017 – USDJPY, EURUSD, GBPUSD, NZDUSD

USD/CHF EUR/CHF EUR/CHF and USD/CHF, September 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge EUR/USD [embedded content] USD/JPY [embedded content] GBP/USD [embedded content] NZD/USD [embedded content] Related posts: FX Weekly Review, August 28 – September 02: The end of big euro rise? FX Weekly Review, June 26 – July 01:...

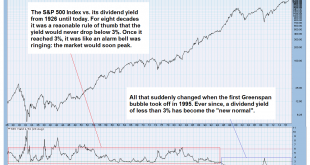

Read More »21st Century Shoe-Shine Boys

Anecdotal Flags are Waved “If a shoeshine boy can predict where this market is going to go, then it’s no place for a man with a lot of money to lose.” – Joseph Kennedy It is actually a true story as far as we know – Joseph Kennedy, by all accounts an extremely shrewd businessman and investor (despite the fact that he had graduated in economics*), really did get his shoes shined on Wall Street one fine morning,...

Read More »FX Weekly Review, September 04 – 09: Draghi Dovish? EUR and USD falling against CHF

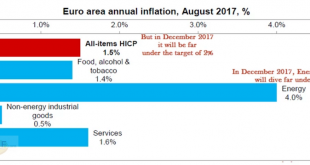

EUR/CHF The euro rose close to CHF 1.15 with the ECB meeting this week. Finally traders realized that the ECB committed not to hike rates for a very long time. The ECB will review and take a first decision on the bond purchasing program this autumn. However, this program will come to an end only when the inflation target of 2% becomes in reach. Strangely the EUR/CHF reacted with losses only on Friday. Where will Euro...

Read More »4 Reasons Why “Gold Has Entered A New Bull Market” – Schroders

– 4 reasons why “gold has entered a new bull market” – Schroders– Market complacency is key to gold bull market say Schroders– Investors are currently pricing in the most benign risk environment in history as seen in the VIX– History shows gold has the potential to perform very well in periods of stock market weakness (see chart)– You should buy insurance when insurers don’t believe that the “risk event” will happen–...

Read More »S&P 500 Index: A Single Day Beats the Entire Week!

Recurring Phenomena Many market participants believe simple phenomena in the stock market are purely random events and cannot recur consistently. Indeed, there is probably no stock market “rule” that will remain valid forever. However, there continue to be certain statistical phenomena in the stock market – even quite simple ones – that have shown a tendency to persist for very long time periods. In today’s report I...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org