Over the past couple of weeks, we’ve been seeing more and more mainstream headlines about inflation fears being on the rise, both in the US and in Europe. Central bankers on both sides of the Atlantic have been doing their best to assuage these concerns, promising that they have everything under control and that the situation will without a doubt normalize soon. Still, all these assurances have failed to convince the markets and many investors are starting to see...

Read More »FX Daily, January 29: Please Stay Seated, the Ride is not Over

Swiss Franc The Euro has risen by 0.16% to 1.0789 EUR/CHF and USD/CHF, January 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Powerful corrective forces continue to grip the market. After a large rally to start the New Year, the correction is punishing. Most Asia Pacific equities markets were off again today to bring the week’s loss to 2.5% to 5.5% throughout the region. Europe’s Dow Jones Stoxx 600 is a...

Read More »Unless the US stops printing money, the dollar will collapse

Interview with Patrick Barron – Part II of II Claudio Grass (CG): This crisis has shaken a lot of industries and core functions of the global economy and international trade. How do you assess its impact on the most important part of the machine, the banking system? Do you see risks there that investors should be worrying about? Patrick Barron (PB): Banks are financial intermediaries. They take deposits and make loans. That has been going on for millennia. What we...

Read More »Unless the US stops printing money, the dollar will collapse

Interview with Patrick Barron – Part II of II Claudio Grass (CG): This crisis has shaken a lot of industries and core functions of the global economy and international trade. How do you assess its impact on the most important part of the machine, the banking system? Do you see risks there that investors should be worrying about? Patrick Barron (PB): Banks are financial intermediaries. They take deposits and make loans. That has been going on for millennia. What we call banking...

Read More »“Unless the US stops printing money, the dollar will collapse.”

Interview with Patrick Barron – Part I of II We’re less than two weeks away from the US election, and yet this sense of utter confusion, bitter political conflict, and economic uncertainty that has been ominously hovering over the nation, as well as the rest of the world, doesn’t seem to have subsided. The country still appears to be in a directionless state, with its economy in serious trouble and its society dangerously fragmented. There seems to be a wide rift in...

Read More »“Unless the US stops printing money, the dollar will collapse.”

Interview with Patrick Barron – Part I of II We’re less than two weeks away from the US election, and yet this sense of utter confusion, bitter political conflict, and economic uncertainty that has been ominously hovering over the nation, as well as the rest of the world, doesn’t seem to have subsided. The country still appears to be in a directionless state, with its economy in serious trouble and its society dangerously fragmented. There seems to be a wide rift in US...

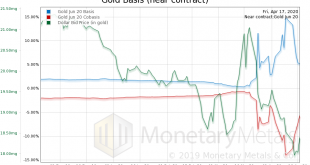

Read More »Crouching Silver, Hidden Oil Market Report 20 Apr

The price of gold has been up steadily for the last 30 days (with a few zigs and zags), now re-attaining the high it achieved prior to the big drop in March. Gold ended the week at $1,662. Alas, it’s not quite the same story in silver, whose price drop was bigger. Now its price blip is smaller. Silver ended the week at $15.19. One does not need to look to the gold-silver ratio, which is currently off the charts, to see that the world has gone mad. Silver, it has long...

Read More »Silver Backwardation Returns, Gold and Silver Market Report 2 March

The big news this week was the drop in the prices of the metals (though we believe that it is the dollar which is going up), $57 and $1.81 respectively. Of course, when the price drops the injured goldbugs come out. We have written the authoritative debunking of the gold and silver price suppression conspiracy here. We provide both the scientific theory and the data. So we won’t say anything more about it today. On 17 Feb, we wrote about the widening bid-ask spread...

Read More »Why Are People Now Selling Their Silver? Report 15 Sep

This week, the prices of the metals fell further, with gold -$18 and silver -$0.73. On May 28, the price of silver hit its nadir, of $14.30. From the last three days of May through Sep 4, the price rose to $19.65. This was a gain of $5.35, or +37%. Congratulations to everyone who bought silver on May 28 and who sold it on Sep 4. To those who believe gold and silver are money (as we do) the rising price of silver may seem right as rain. Why shouldn’t the dollar go...

Read More »“The Eurozone faces the worst combination of economic and systemic risk”

Eurozone faces the worst combination Interview with Alasdair Macleod: The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally. Although these developments...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org