EUR/CHF Let us remember why the euro has risen from 1.08 to 1.14 between June and August: Hopes that the French president Macron will help the French economy, similarly to the Trump reflation trade. Hopes that the ECB will finish their bond buying program earlier combined with quite good economic data. We are of the opinion that both points may be illusionary. The euro should not rise further. Politicians cannot...

Read More »FX Weekly Review, August 21 – August 26: Dollar Loses its Gains Against CHF

USD/CHF The dollar had some gains versus the franc during the last month, but it lost all during the last days. EUR/CHF The euro is still around 1.14, this is up 2.5% against one month ago. The rising momentum for EUR/CHF, however, seems to be fading. EUR/CHF and USD/CHF, August 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3...

Read More »FX Weekly Review, August 14 – August 19: CHF Recovers after Dovish Draghi Comments

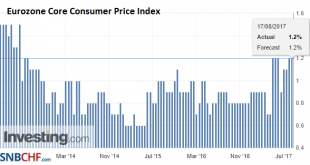

Overview The euro has lost some momentum versus the franc, the main reason is as usual monetary policy: Draghi does not want to talk about an early end of his bond buying programming at Jackson Hole. This had been confirmed by economic data: only 1.2% core inflation compared to a long-term inflation target of 2%. Consequently the Swissie appreciated during the week. Eurozone Core Consumer Price Index (CPI) YoY, Jul...

Read More »Prepare for Another Market Face Pounding

“Better than Goldilocks” “Markets make opinions,” goes the old Wall Street adage. Indeed, this sounds like a nifty thing to say. But what does it really mean? The bears discover Mrs. Locks in their bed and it seems they are less than happy. [PT] Perhaps this means that after a long period of rising stocks prices otherwise intelligent people conceive of clever explanations for why the good times will carry on. ...

Read More »FX Weekly Review, July 31 – August 05: Second Week of Strong CHF Losses

Swiss Franc vs USD and EUR The Swiss Franc entered the second week of stronger losses. While the euro gained 4% last week, the dollar appreciated against the Swiss Franc by 2% during this week. The euro could add another percent in the last days. The EUR/CHF reached 1.1521 after the strong US job figures. Finally, however the euro fell to 1.1451 for two reasons: Profit taking at the end of the week and secondly that...

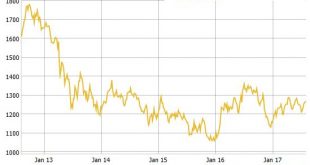

Read More »Gold Consolidates On 2.5percent Gain In July After Dollar Has 5th Monthly Decline

Gold consolidates on 2.5% gain in July as the dollar has fifth monthly decline Trump administration and vicious “civil war” politics casting shadow over America and impacting dollar All eyes on non farm payrolls today for further signs of weakness in U.S. economy Gold recovers from 1.7% decline in June as dollar falls Gold outperforms stocks and benchmark S&P 500 YTD Gold gains 10.8% versus 10.6% gain for S&P...

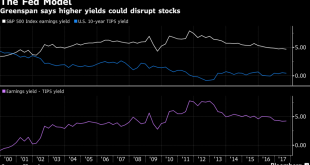

Read More »Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

Former Fed Chairman warns of bond bubble, stagflation “Moving into a … stagflation not seen since the 1970s” This will not be “good for asset prices” 10 Yr Gov bond yields fell from 15.8% in 1981 to 2.3% Interest rates will not stay low, will rise ‘reasonably fast’ “Normal” interest rates in 4%-5% range Inflation will not stay at historically low levels Gold “protects savings” and is “store of value” Gold is the...

Read More »Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

Former Fed Chairman warns of bond bubble, stagflation “Moving into a … stagflation not seen since the 1970s” This will not be “good for asset prices” 10 Yr Gov bond yields fell from 15.8% in 1981 to 2.3% Interest rates will not stay low, will rise ‘reasonably fast’ “Normal” interest rates in 4%-5% range Inflation will not stay at historically low levels Gold “protects savings” and is “store of value” Gold is the...

Read More »FX Weekly Review, July 24 – July 29: Swiss Franc getting crushed

Swiss Franc vs USD and EUR The Swiss franc was the only major foreign currency that fell against the dollar last week. The 2.6% decline was the largest in two years. Stops triggered in the euro-franc cross, reports of direct investment-related franc sales for yen, and conviction that the SNB will lag behind the other central banks is thought to be behind the move. The dollar high in June was near CHF0.9785, and the...

Read More »Great Graphic: Surprise-S&P 500 Outperforming the Dow Jones Stoxx 600

Many asset managers have been bullish European shares this year. European and emerging market equities are among the favorite plays this year. Surveys of fund managers find that the allocation to US equities is among the lowest in nearly a decade. The case against the US is based on overvaluation and being a crowded trade. Many are concerned about too hawkish of a Federal Reserve (policy mistake) or the lack of tax...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org