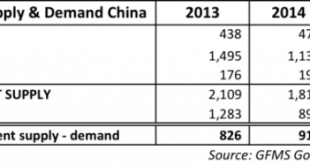

Submitted by Koos Jansen of BullionStar In the Gold Survey 2016 report by GFMS that covers the global gold market for calendar year 2015 Chinese gold consumption was assessed at 867 tonnes. As Chinese wholesale demand, measured by withdrawals from Shanghai Gold Exchange designated vaults, accounted for 2,596 tonnes in 2015 the difference reached an extraordinary peak for the year. In an attempt to explain the 1,729...

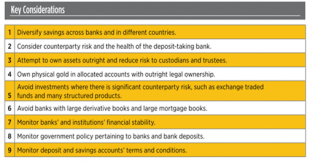

Read More »Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland’s largest insurance companies, have been moving cash out of Irish bank deposits and into bonds. Revelations regarding deposit bail-in risks came in the wake of warnings of a new property crash centred on the housing market in Ireland. The former deputy governor of the Central Bank warned in an op-ed in a...

Read More »Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland's largest insurance companies, have been moving cash out of Irish bank deposits and into bonds. Revelations regarding deposit bail-in risks came in the wake of warnings of a new property crash centred on the housing market in Ireland. The former deputy governor of the Central Bank warned in an op-ed in a leading international financial publication, Project...

Read More »Negative Consumer Financing Rates in Germany, Soon More Negative in Switzerland?

Negative Consumer Financing Rates in Germany Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one’s means. Curiously, it was just a month ago when an...

Read More »Silver Kangaroo Coins – Sales Surge To Over 10 Million

Silver kangaroo coins have seen sales surge to over 10 million coins which is double the expected demand for the year. Silver Kangaroo Coins 1 oz (2016) Introduced to the market less than 11 months ago in September 2015 at a launch attended by GoldCore, sales of the new release Perth Mint’s 2016 Australian Kangaroo 1 ounce silver bullion coin were anticipated to reach 5 million coins in their introductory first year. Yet sales of the silver coins have already surged to a...

Read More »Silver Kangaroo Coins – Sales Surge To Over 10 Million

Silver kangaroo coins have seen sales surge to over 10 million coins which is double the expected demand for the year. Silver Kangaroo Coins 1 oz (2016) Introduced to the market less than 11 months ago in September 2015 at a launch attended by GoldCore, sales of the new release Perth Mint’s 2016 Australian Kangaroo 1 ounce silver bullion coin were anticipated to reach 5 million coins in their introductory first year....

Read More »Trump, Clinton, “Ugliest” Election Coming – Gold’s “Summer Doldrums” Prior To Resumption of Bull Market

The Trump and Clinton election is set to be one of the "ugliest" and "messiest" U.S. elections ever, astute gold analyst Frank Holmes warned this week. He believes this is a reason to own gold and will be one of the factors that will see a resumption of gold's bull market after the summer doldrums which we explore below. Republican presidential candidate Donald Trump delivers a speech at the Republican National Convention on July 21, 2016 (Photo by John Moore/Getty Images) Gold...

Read More »“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed...

Read More »Germany Sells First Ever Negative-Yielding 10Y Treasury, Corporate Bonds

Negative for 10 Years Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon. As it turned out the issue was historic in another way as well: with the prevailing 10Y bond trading well in negative yield territory, it was largely expected that today’s bond auction would likewise issue at a negative yield, and...

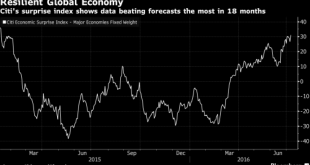

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org